Lease Audit: What is a Roll Forward Report?

Last Updated on February 28, 2024 by Morgan Beard

The Roll Forward Report is a common audit request that provides auditors with a clear picture of how account balances have changed over a specific period. It serves as a reconciliation that shows the movement in account balances from the end of the last audit period to the current period under review.

Ensuring the accuracy and reliability of financial statements is crucial. Auditors need to examine account balances and transactions to verify their validity and identify any potential errors or discrepancies. The Roll Forward report is a tool that helps auditors in this process. The Roll Forward report can be used for most assets and liabilities accounts.

What is a Roll Forward report?

A Roll Forward report is a summary of the changes that have occurred in account balances during a specific period. It typically includes information such as the beginning balance, additions, subtractions, and ending balance for each account. This report allows auditors to track the movement of account balances and identify any inconsistencies or anomalies. Read all about our best practices and tips on roll forward reporting here.

Why do Auditors Request Roll Forward Reports

The Roll Forward is a common audit request because it provides auditors with a clear picture of how account balances have changed over a specific period. In addition, since they validated prior year balances during their previous audit, this gives them a map to how they should test the changes in the balance from last year to this year. By detailing the change in the balance based on the transaction type, for instance for Right of Use (“ROU”) Assets, new leases, terminated leases, and asset amortizations helps quantify the population and build the sample size needed to gain comfort over the year end balance.

Verification of Transactions:

Auditors need to ensure that transactions are accurately recorded and reflected in the financial statements. By examining the Roll Forward, they can trace individual transactions and see how they contribute to changes in account balances.

Detection of Errors or Fraud:

Discrepancies in account balances could indicate errors or potential fraudulent activity. The Roll Forward, especially when performed on a lease level basis, helps auditors identify irregularities by comparing expected changes in account balances to actual changes.The Roll Forward report allows auditors to perform analytical procedures to assess the reasonableness of account balances and detect any potential misstatements. By comparing the Roll Forward report to other documents and records, auditors can identify any discrepancies and take appropriate corrective actions.

Completeness and Accuracy:

Auditors assess whether all relevant transactions have been recorded and whether the financial statements are accurate. The Roll Forward helps in this assessment by providing a comprehensive overview of changes in account balances.

Disclosure Requirements:

Certain financial reporting standards require specific disclosures regarding changes in account balances. The Roll Forward assists in fulfilling these disclosure requirements by presenting a detailed breakdown of changes in balances.

Enhanced Audit Trail:

By examining the Roll Forward, auditors can follow the audit trail from one period to the next, ensuring consistency and reliability in financial reporting. To read more on the importance of creating a lease audit trail, read our blog, how to build a lease audit trail.

Preparing a Roll Forward Report

A comprehensive roll forward report typically comprises several key elements that collectively paint a detailed picture of how account balances evolve over time. From opening balances to adjustments and closing balances, each component plays a crucial role in facilitating auditors’ assessments and ensuring the accuracy and completeness of financial statements

Practical Examples of Roll Forward Reporting

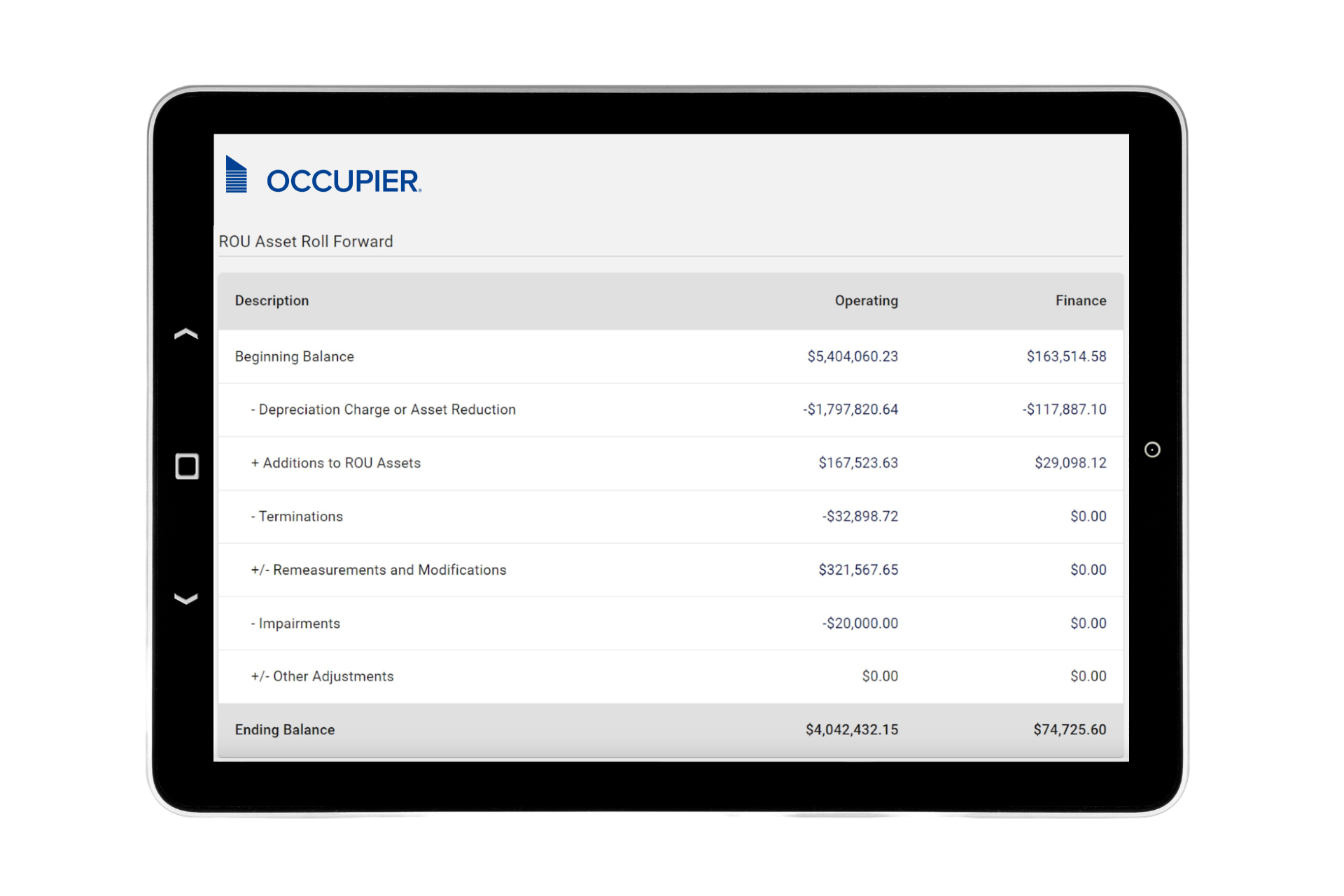

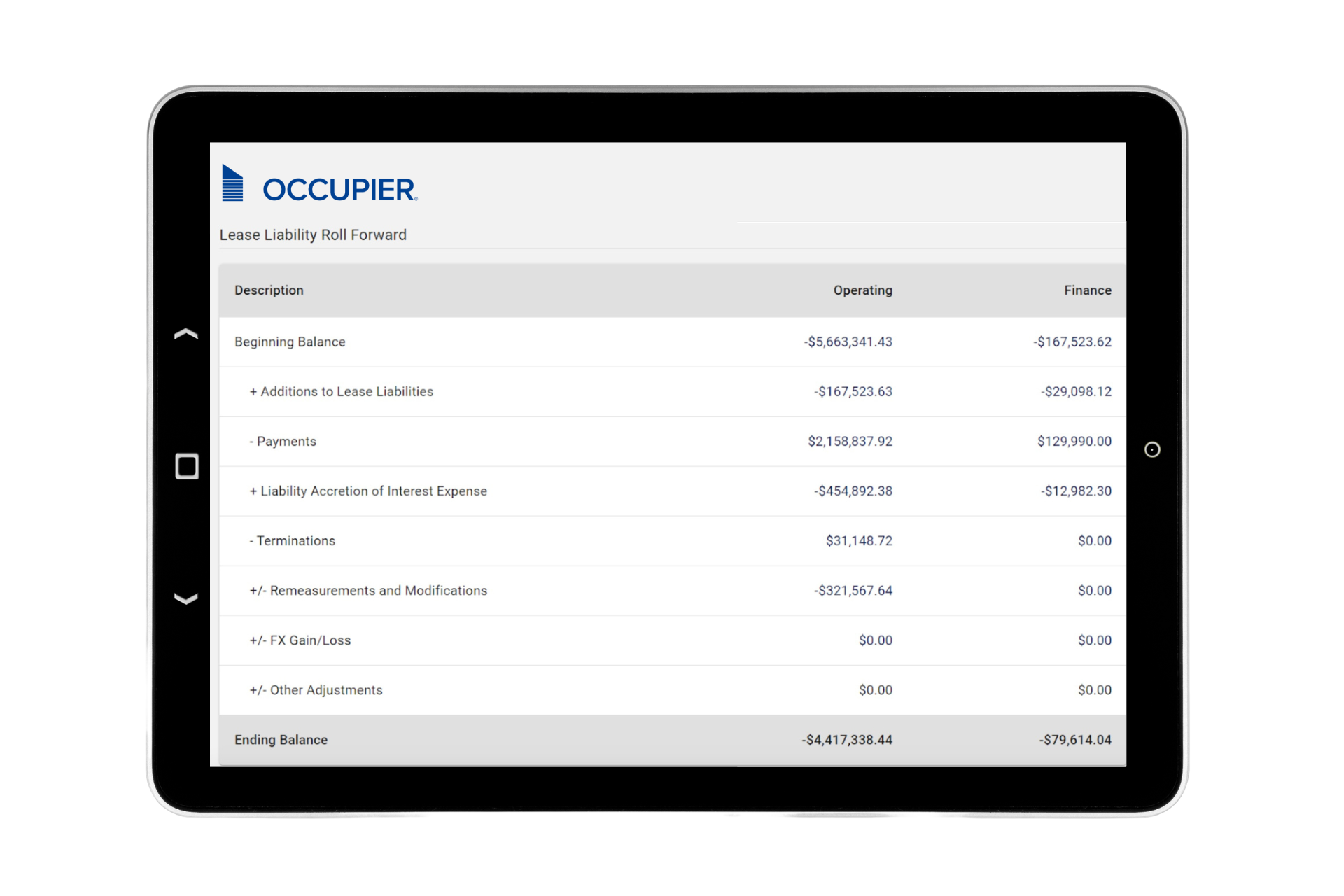

For Leases, examples of Roll Forwards at a portfolio level are captured below:

Right of Use Asset Roll Forward Report

Lease Liability Roll Forward Report

Below is a description of the transaction types for the Roll Forwards represented above:

- Beginning Balance: This is the beginning period balance. If under an audit for calendar year 2023, the beginning balance would be the account balance as of 1/1/2023.

- Additions: This captures any new additions to the lease portfolio. This captures the commencement date journal entry amounts for the ROU Asset and the Lease Liability.

- Payments: This represents any lease payments made during the period, which results in a reduction in the lease liability.

- Depreciation Charge/ Asset Reduction: This measures the monthly credits to the ROU Asset made during the life of the lease. For finance leases, this is a depreciation charge versus for operating leases it is a ROU Asset reduction.

- Liability Accretion/Interest Expense: This measures the monthly credits to the Lease Liability made during the life of the lease. For finance leases, this is an interest expense versus for operating leases it is a liability accretion.

- Remeasurements and Modifications: Throughout the year, it is common for leases to undergo a remeasurement event. This measures the modification entries impact to the Lease Liability and ROU Asset resulting from that remeasurement event.

- FX Gain/Loss:This represents any changes in the FX from the start of the period to the end of period that impacted the lease balances.

- Impairments: This captures any impairments made during the period, reducing the ROU Asset Balance.

- Other Adjustments: If for any reason there were other adjustments made to the ROU Asset or Liabilities, this transaction would capture that adjustment.

- Ending Balance: The ending balance is the summation of all the Beginning Balance + all transactions above.

The Roll Forward report is a great tool to have in preparation for your audit report.

Lease Accounting Resources

Check out our resource hub. We have the templates, spreadsheets, and calculators to help you manage entire lease lifecycle.