Scaling Your QSR Franchise While Retaining Capital

Last Updated on February 20, 2025 by Morgan Beard

Expanding a quick-service restaurant (QSR) franchise is an exciting yet capital-intensive endeavor. Whether you’re a franchisee looking to grow within your existing territory or an operator planning a multi-unit expansion, managing capital efficiently is key. With real estate costs, lease obligations, and operational expenses, scaling can quickly drain financial resources. However, with the right strategies—such as leveraging smart lease agreements, exploring alternative financing, and optimizing site selection—you can grow sustainably while preserving capital.

Smart Site Selection: Expanding Strategically

Location, Location, Location

Finding the right location is critical for a successful QSR expansion. Instead of focusing solely on high-rent, high-traffic areas, consider emerging markets where competition is lower but demand is rising. Leveraging data analytics and real estate software can help identify prime locations based on foot traffic, demographic trends, and competitor proximity.

Leasing vs. Buying: Which is Better for Growth?

Owning real estate can be a long-term investment, but leasing provides flexibility and lower upfront costs—allowing you to scale faster. Negotiating lease terms that align with your growth strategy, such as rent escalations and tenant improvement allowances, can help optimize cash flow. Read more about lease management best practices.

The Role of Market Research

Before committing to a new location, conducting thorough market research is essential. Consider local customer demographics, competitor presence, and potential for growth. Utilizing professional real estate brokers and digital mapping tools can provide insights that improve decision-making and mitigate risks associated with expansion.

Financing Your Growth Without Draining Capital

Alternative Funding Options for Franchisees

Traditional bank loans aren’t the only option for financing expansion. Franchise-specific lending programs, SBA loans, and private investors can provide capital without putting all your cash reserves at risk. Additionally, sale-leaseback arrangements allow you to unlock capital from owned properties to reinvest in new locations.

Partnering with Multi-Unit Developers

Working with real estate investment firms or preferred developers can ease financial burdens. These partners often finance and build locations, leasing them back to you, reducing upfront costs and accelerating growth without significant capital expenditures.

Bootstrapping vs. External Investment

Depending on your risk appetite, you may opt to bootstrap your expansion by reinvesting profits. However, for faster scaling, external investment through franchise financing or venture capital may be a viable route. Balancing the cost of capital with long-term sustainability should be a key consideration in your expansion strategy.

Leveraging Lease Management Software to Maintain Financial Health

Keeping Lease Costs in Check

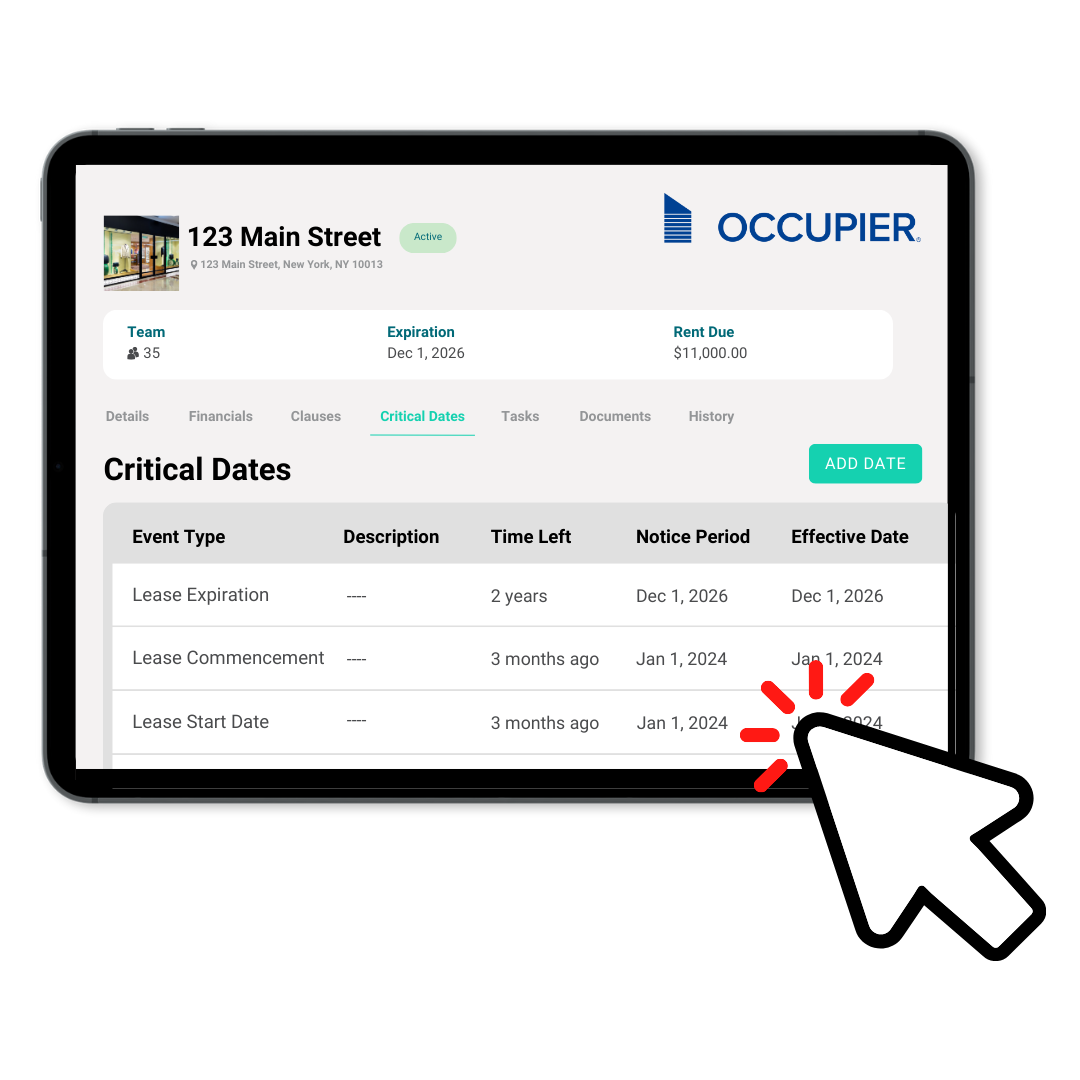

Without a structured approach, lease expenses can spiral, impacting profitability. Utilizing lease management software, such as Occupier, ensures that all lease obligations, renewal deadlines, and expense reconciliations are tracked, preventing costly oversights.

Data-Driven Decision Making

Having a digital lease portfolio helps franchisees analyze trends across locations, benchmark performance, and make data-driven site selection decisions. This approach ensures each expansion move is financially sound.

Managing Lease Renewals and Negotiations

One often overlooked aspect of a franchise growth strategy is lease renewal management. Ensuring that lease renewals align with long-term profitability while negotiating favorable terms such as renewal caps and maintenance responsibilities, can save substantial capital over time.

Operational Efficiencies for Cost Management

Optimizing Supply Chain Management

Efficient supply chain management can significantly impact cost savings when scaling. Establishing relationships with regional suppliers, investing in centralized procurement, and leveraging technology for inventory tracking can improve margins and ensure smooth operations as you expand.

Investing in Staff Training and Retention

A well-trained workforce reduces turnover costs and enhances operational consistency across multiple locations. Investing in training programs and retention strategies will not only improve employee satisfaction but also contribute to better customer service, boosting revenue and profitability.

Franchise Growth Strategy

Scaling a QSR franchise requires a strategic approach to real estate, financing, and lease management. By making informed site selection decisions, exploring alternative funding sources, and leveraging technology to optimize lease expenses, franchisees can expand without draining their capital reserves. Additionally, prioritizing operational efficiencies and workforce development will set the foundation for long-term success. Ready to take control of your lease portfolio? Learn how Occupier can help.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.