How to Calculate your Lease Amortization Schedules – Excel Template

Last Updated on May 22, 2025 by Amanda Lee

What is Lease Amortization?

Lease amortization is the process of paying down an operating or finance leased asset over time. We use a lease amortization schedule to amortize projected payments on a straight-line lease expense basis towards the principle of the lease throughout the lease term. Understanding how to calculate your lease amortization schedules is fundamental to creating your journal entries under ASC 842.

In its essence an amortization is a reduction in value of an intangible asset. Lease amortization is the process of taking the intangible asset within a lease agreement and reducing its value based on the historical cost, economic lifetime value, as well as the residual value. So the total debt towards the asset is reduced or amortized each month.

How to Calculate Your Lease Amortization

Under ASC 842, operating leases and financial leases have different amortization calculations. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types.

If you are recording an operating lease, the lessee is responsible for making periodic payments in exchange for using the leased asset. The remaining lease liability must also include the interest expense. You’ll know that you have an operating lease if the estimated economic life of the asset is less than 75% and the net present value (NPV) is at least 90% of the lease’s total value.

What if the recorded lease is a finance lease? A finance lease is defined as an agreement in which ownership is transferred to the lessee, who is now responsible for the maintenance of the leased asset, including insurance and taxes, at the end of the lease term.

How does our Lease Amortization Schedule work?

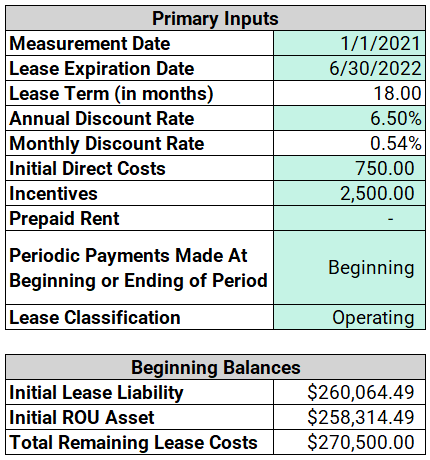

In our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards:

- Measurement Date – The measurement date should be the lease commencement date or the ASC 842 effective date.

- Lease Expiration Date – The lease expiration date is the last date of the lease.

- Lease Term (in months) – ‘This is a calculated field to determine how many months the lease term is. This impacts how the ROU Asset is amortized/reduced.

- Annual Discount Rate – ‘This is the annual incremental borrowing rate for this lease.

- Monthly Discount Rate – ‘This is a calculated field to determine the monthly incremental borrowing rate.

- Initial Direct Costs – ‘Incremental costs of a lease that would not have been incurred had the lease not been executed. Example: Broker commissions on executed lease.

- Incentives – ‘A lease agreement may include incentives to encourage a lessee to sign the lease. Example: Tenant improvement allowance.

- Prepaid Rent – ‘Any prepaid rent paid to the Lessor prior to the lease commencement date.

- Periodic Payments (beginning or end of month) – ‘This field determines if payments are made at the beginning or end of a period. This impacts how interest expense and the PV of lease payments is calculated. This should be completed as one of the following:

- Beginning – The beginning liability balance for your amortization schedule.

- Ending – The ending balance for the Lease Liability and ROU Asset should be zero as of the Lease Expiration Date.

- Lease Classification – This field dictates how the ROU asset is amortized/reduced throughout the lease term and the expense recognition pattern of the lease. This should be completed as one of the following:

- Operating – Lessee is given the right to use the leased asset; is not recorded on a balance sheet

- Finance – Lessee is given the right to use the leased asset, and risk is transferred from lessor to lessee; asset is recorded on a balance sheet

Initial Lease Liability equals present value or remaining lease payments at the discount rate. When determining your discount rate, it is highly recommended that you consult with an auditor.

Initial ROU Asset equals lease liabilities – lease Incentives Received + Initial Direct Costs + Prepaid Lease Payments.

The Total Remaining Lease Costs equals Total Lease Payments + Unamortized Initial Direct Costs – Lease Incentives – Prior Period Lease Costs. It is utilized to recognize the straight line lease expense for operating leases. Knowing these inputs is foundational to kickstarting the process of how to calculate your lease amortization schedules.

Check out our Lease Amortization Schedule Excel Template here:

Occupier has built out the necessary components of the lease amortization schedule for easy data input and accurate, fast calculations. In this table, you are to record information about your lease to create the lease amortization schedule, including the measurement date or the date your lease is active, the commencement date, the lease term, and the classification identifying whether it is an operating lease or finance lease, and many more data inputs to help calculate the amortization schedule.

Next, we have the Beginning Balances table, this shows the initial lease liability, initial Right-Of- Use Asset, and Total remaining lease cost. Occupier’s Lease Amortization Schedule also supplies a journal entry structure to understand the recorded monthly costs of the lease.

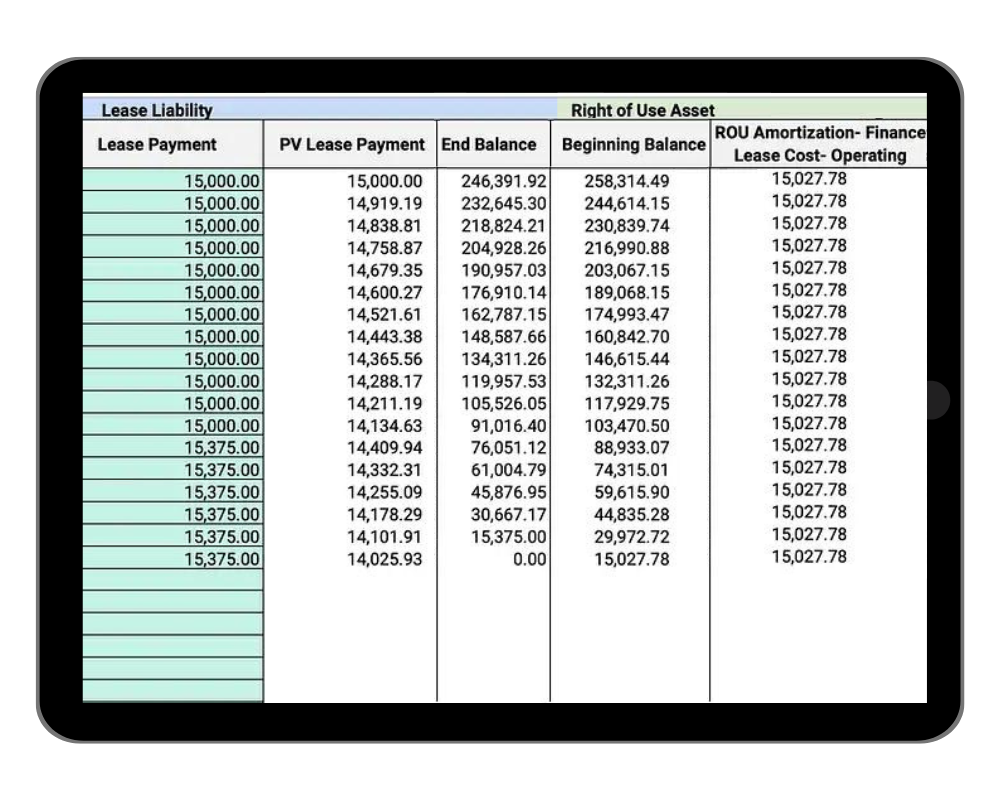

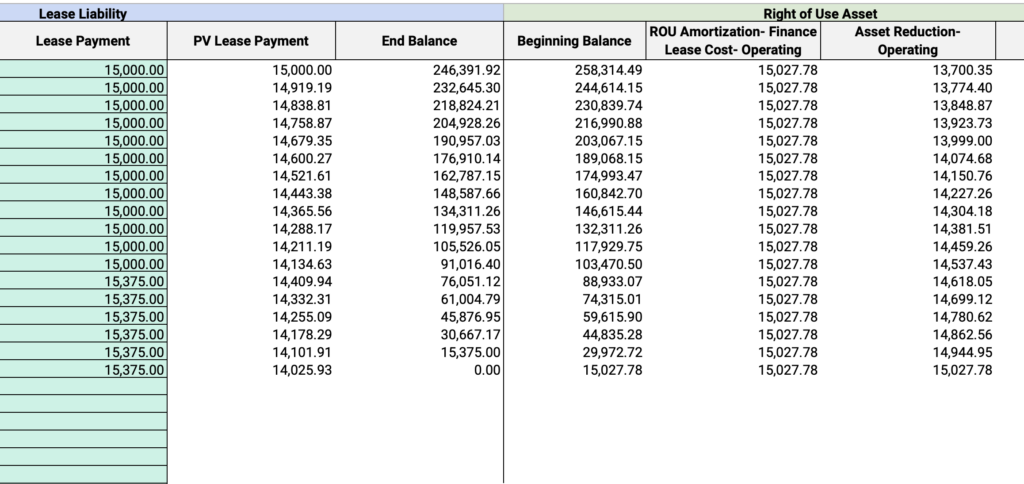

Moving on to the Lease Amortization Schedule itself. In this table, you can find the date/period of the lease payments, the lease liability, the Right-of-Use asset inputs, and current/non-current liabilities.

The date and time section shows the periods starting at zero, and the dates of payments. The lease liability section shows the beginning and ending balance, the liability accretion, the base rent lease payments, and the present value (PV) lease payments. The Right-of-Use Asset section shows the beginning and ending balance, ROU Amortization, and the asset reduction.

As the process of leasing becomes more popular in companies, there needs to be an accurate and efficient way to keep track of all payments. The Lease Amortization schedule is a necessity for understanding what kind of lease you have, the interest that is being accrued, and knowing when the lease term ends.

See how Occupier can help you take control of your real estate portfolio and unlock opportunities within your business’s lease lifecycle.

Lease Accounting Resources

Check out our resource hub. We have the templates, spreadsheets, and calculators to help you manage entire lease lifecycle.