Lessee vs. Lessor Accounting Differences

Last Updated on October 25, 2024 by Morgan Beard

If you own or operate a business that leases property or equipment, you’re probably already familiar with the concept of lease accounting. However, with the implementation of the new lease accounting standard, ASC 842, both lessees and lessors face changes in how they recognize and report leases. In this blog post, we’ll explore the differences between lessee vs. lessor accounting under ASC 842, as well as the key accounting differences between operating and finance leases.

What is a Lessee?

A lessee is a tenant. Or an individual or organization that enters into a lease agreement to rent an asset from the owner, known as the lessor. The lessee is responsible for paying the agreed-upon rent to the lessor for the use of the asset. The lessee is also responsible for maintaining the asset and returning it to the lessor in good condition at the end of the lease term. Lessees may include businesses that lease equipment, vehicles, buildings, or other assets.

What is a Lessor?

In contrast, a lessor is the Landlord. Also known as an individual or organization that owns an asset and leases it to a lessee for a specified period. The lessor is responsible for ensuring that the asset is maintained in good condition and for providing the lessee with the necessary support during the lease term. The lessor receives regular payments from the lessee for the use of the asset. Lessors may include equipment or vehicle rental companies, real estate companies, or other businesses that lease assets.

What is ASC 842?

ASC 842 is the new lease accounting standard issued by the Financial Accounting Standards Board (FASB) that replaced ASC 840. The purpose of ASC 842 is to provide a more transparent and accurate view of a company’s lease obligations and assets.

One of the main changes brought by ASC 842 is the requirement for lessees to recognize all leases on their balance sheet. This includes the recognition of lease assets and liabilities and the measurement of lease payments. ASC 842 also requires lessors to classify leases as either operating or finance leases and recognize lease revenue and interest income differently based on the type of lease.

The implementation of ASC 842 has significant implications for both lessees and lessors. Lessees must ensure that all leases are recognized on their balance sheet and comply with the new lease accounting standard. Lessors must classify leases correctly and recognize lease revenue and interest income differently based on the type of lease.

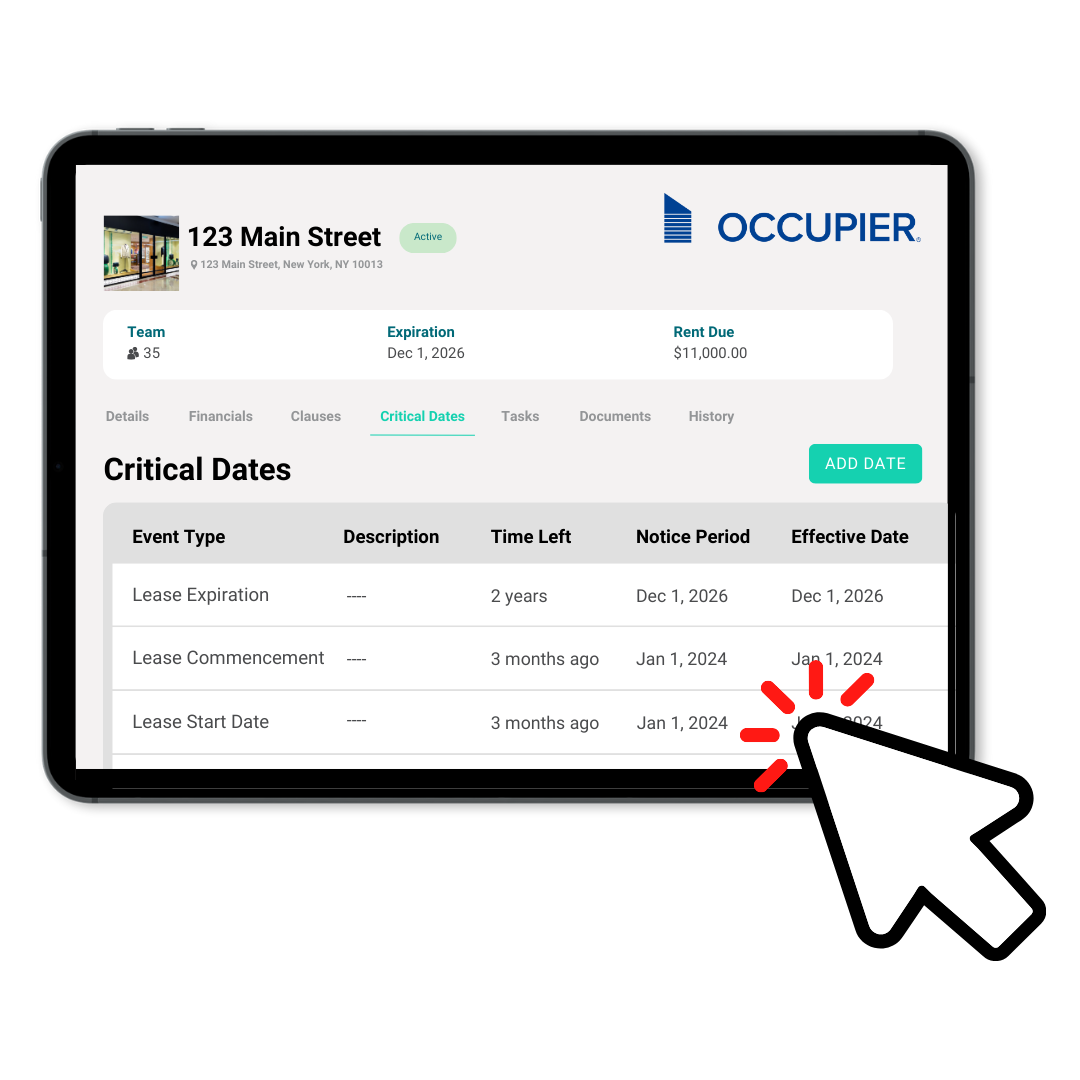

However, the adoption of ASC 842 also provides an opportunity for businesses to improve their lease management processes and gain greater visibility into their lease portfolio. By maintaining accurate lease data and leveraging lease accounting software, businesses can ensure compliance with the new standard and gain insights into their lease obligations and assets.

Lessor vs Lessee Accounting

Lessee Accounting under ASC 842

Under ASC 842, lessees are required to recognize all leases on their balance sheets, including both operating and finance leases. This means that lessees must measure the lease liability and recognize a right-of-use asset for all leases with terms greater than 12 months. The lease liability should be measured as the present value of lease payments over the lease term, using the lessee’s incremental borrowing rate. Meanwhile, the right-of-use asset should be recognized as the lease liability plus any initial direct costs, lease payments made before the lease commencement date, and any lease incentives received.

In terms of expense recognition, there are differences between operating and finance leases. For operating leases, lessees should recognize lease expenses on a straight-line basis over the lease term. For finance leases, lessees should recognize both interest expense and amortization expense on the right-of-use asset over the lease term.

Lessor Accounting under ASC 842

Under ASC 842, lessors must classify leases as either operating or finance leases. The classification is based on whether the lease transfers substantially all the risks and rewards of ownership to the lessee. For operating leases, lessors should recognize lease revenue on a straight-line basis over the lease term, while for finance leases, lessors should recognize both lease revenue and interest income over the lease term.

In addition to recognizing lease revenue, lessors should also recognize a lease receivable and a deferred inflow of resources. The lease receivable represents the lessor’s right to receive lease payments from the lessee, while the deferred inflow of resources represents the amount of lease payments received before the lessor has fulfilled all of its obligations under the lease.

Key Differences between Lessee vs. Lessor Accounting

The key differences between lessee and lessor accounting under ASC 842 include the following:

- Recognition of lease assets and liabilities: Lessees are required to recognize lease liabilities and right-of-use assets for all leases, while lessors do not recognize lease liabilities.

- Expense and revenue recognition: Lessees recognize lease expense on a straight-line basis for operating leases and both interest and amortization expense for finance leases, while lessors recognize lease revenue on a straight-line basis for operating leases and both lease revenue and interest income for finance leases.

- Discount rates: Lessees use their incremental borrowing rate to calculate the present value of lease payments, while lessors use the implicit rate of return in the lease or their incremental borrowing rate, whichever is lower.

- Sales-type leases: In a sales-type lease, the lessor is considered to have sold the leased property to the lessee and is therefore required to recognize a gain or loss on the sale. Lessees recognize both a lease liability and a right-of-use asset for sales-type leases.

In conclusion, understanding the differences in accounting treatment between lessees and lessors is crucial for both parties, and compliance with ASC 842 is essential to avoid financial penalties. It’s important to remember that ASC 842 applies to all leases with terms greater than 12 months, so businesses of all sizes and industries may be impacted. For those who need more information on ASC 842 and lease accounting, resources are available from accounting firms,lease accounting software providers, and industry associations.

As a lessee or lessor, you may also want to consider the impact of ASC 842 on your financial statements and ratios. For example, the inclusion of lease liabilities on the balance sheet may affect debt-to-equity ratios and other financial metrics.

Overall, while the changes brought by ASC 842 may seem daunting, they are intended to provide a more transparent and accurate view of a company’s lease obligations and assets. By understanding the key differences in treatment between lessees vs lessor accounting , you can be better equipped to navigate these changes and ensure compliance with the new lease accounting standard.

In summary, the implementation of ASC 842 has significant implications for both lessees and lessors. Lessees must recognize all leases on their balance sheet, measure the lease liability and recognize a right-of-use asset, and recognize lease expense differently based on the type of lease. Lessors must classify leases as either operating or finance leases and recognize lease revenue and interest income differently based on the type of lease. The key differences in accounting treatment between lessees and lessors under ASC 842 include recognition of lease assets and liabilities, expense and revenue recognition, discount rates, and sales-type leases. It’s important for businesses to understand these differences and ensure compliance with the new lease accounting standard to avoid financial penalties and maintain accurate financial reporting.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.