Wharton Smith Implements Occupier for Equipment Lease Accounting

Last Updated on June 5, 2024 by Amanda Lee

When auditors informed Wharton Smith of the new ASC 842 compliance requirements, time was short with deadlines fast approaching.

Transitioning to comply with ASC 842 represented a sizable change. So, they selected Occupier for their lease management software due to the unmatched 2-week implementation timeline.

Challenge: Time-Sensitive Audit Needs

Wharton Smith is a construction company that manages 300+ equipment leases and 30+ real estate leases through manual tracking in Excel sheets. When their auditors informed them of the new ASC 842 compliance requirements, they knew significant changes were needed to update their lease accounting process and meet the looming deadline.

After reviewing options including two legacy lease accounting software providers, Wharton Smith selected Occupier due to the unmatched 2-week implementation timeline. VP of Finance Stephanie shared, “We were expecting our audit to be late and anticipating those ripple effects of being behind schedule. Occupier’s 2-week implementation timeline is what sold us when competitors quoted 1 month or longer.”

Solution: Smooth ASC 842 Transition and Painless Audit Process

The accelerated onboarding allowed Wharton Smith to generate the new ASC 842 compliant lease accounting entries and provide auditors the reports they needed, all before the pressed deadlines. “We gave Occupier a bonus for how quickly they implemented it,” said Aaron Jacobson, Assistant Controller. “They met our tight deadline that we needed to finish by June 1st for our audit.”

For the audit, providing necessary documentation was shockingly easy. Jacobson simply pulled ASC 842 compliant reports from Occupier and sent them directly to auditors. Rather than sifting through mountains of paperwork, auditors could easily analyze leases through Occupier’s centralized system and customized reporting. This saved immense time and headaches for the Wharton Smith finance team during the already stressful audit.

“I was expecting 2 days of calls with auditors picking through details. But I sent the Occupier reports and the auditors said it provided everything needed immediately.”

Benefits of Occupier

Wharton Smith needed a solution fast, and one that satiated the rigorous needs of ASC 842 compliance while aligning stakeholders in accounting, finance, and operations.

- Fast and flexible implementation to meet tight deadlines: Occupier can implement their software in as little as 2 weeks, accelerating ASC 842 compliance even on short timeframes.

- Automates ASC 842 compliance including calculations and reporting: Occupier handles all the complex ASC 842 calculations and generates the necessary journal entries and financial reports.

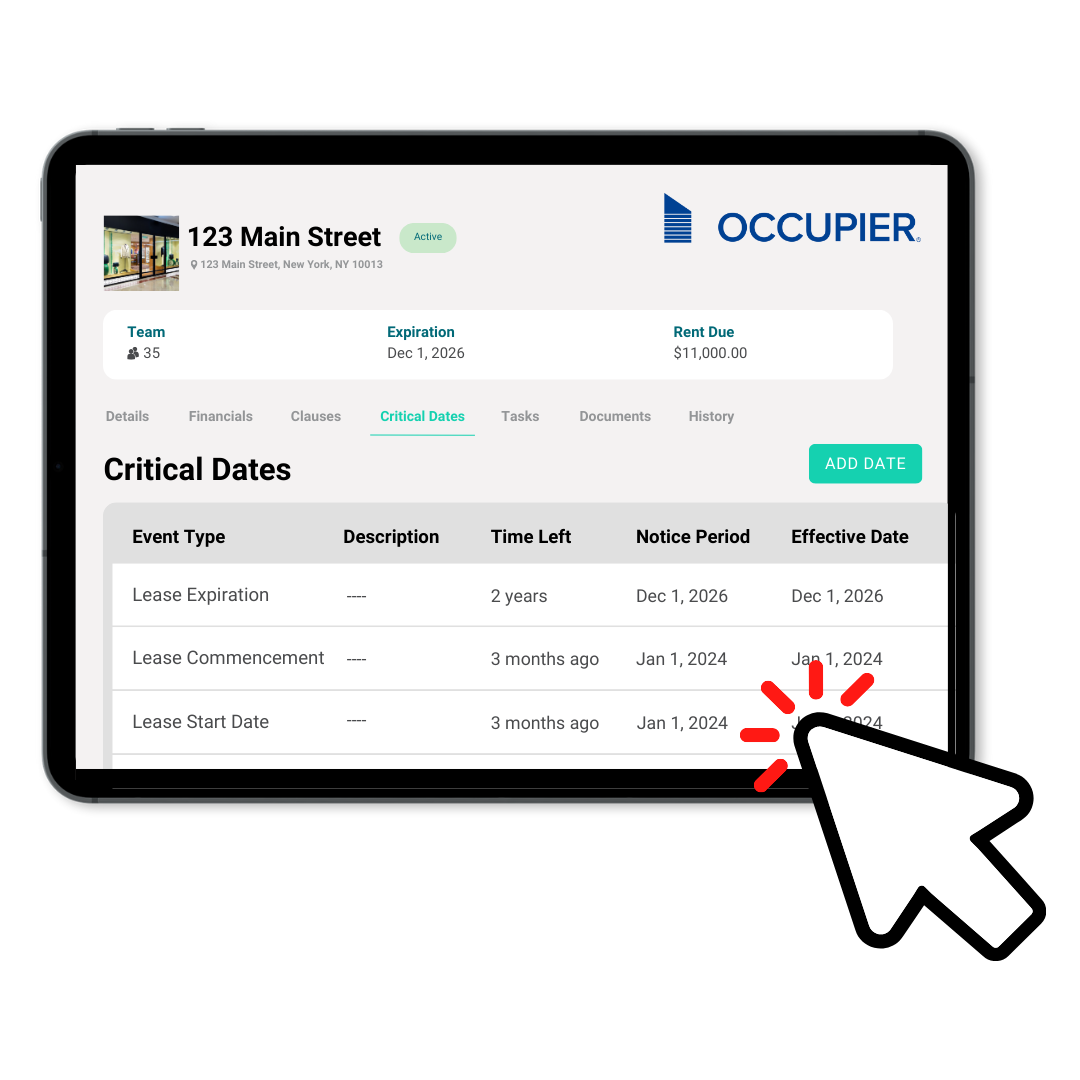

- Centralized lease details and collaboration: The software consolidates lease data from disparate sources into one single source of truth, improving collaboration.

- Smooth audits with customizable reports: Users can easily pull reports with all data needed for auditors, eliminating tedious audit prep.

- Greater visibility into lease finances: By correlating lease payments to underlying assets and liabilities, Occupier adds context for the AP team beyond invoices.

- Proactive support and training for long-term success: Occupier’s responsive customer success team provides ongoing training and guidance for continued lease accounting success.

Occupier’s attentiveness to client needs, whether through fast implementation or ongoing support, provides confidence that Wharton Smith selected the right partner. As Aaron summarized, “You can tell Occupier is willing to reach out and make sure customers are taken care of — we appreciate that.”

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.