CAM Charges: Lease Negotiation Tips

Last Updated on July 28, 2025 by

When negotiating a commercial lease, Common Area Maintenance (CAM) charges are one of the most critical components to evaluate. These recurring costs can significantly impact your rent, long-term budget, and real estate lease strategy. For commercial tenants, understanding CAM lease language is essential for avoiding inflated pass-throughs and gaining transparency into shared operating costs.

In today’s commercial real estate landscape—where budgets are scrutinized and operating efficiency matters—optimizing CAM terms is essential for controlling expenses, projecting annual increases, and maintaining financial stability.

What are CAM Charges?

Common Area Maintenance charges represent the area maintenance charges associated with shared facilities in a commercial property. These may include parking lot maintenance, landscaping costs, janitorial services, HVAC upkeep, utility costs, security services, lighting, and repairs to common restrooms, elevators, hallways, and other shared areas. All of these fall under the umbrella of common area expenses.

CAM charges are typically passed through to tenants using the Pro Rata Share method. Your tenant’s share is calculated based on your leased square footage divided by the total leasable area (or total leasable space) of the building. These charges are standard in retail leases, office buildings, and industrial spaces, especially when structured as triple net leases (NNN leases).

In addition to property insurance, real estate taxes, and base rent, tenants are also responsible for their portion of CAM expenses. CAM costs are often estimated and billed on an annual basis, followed by a year-end reconciliation to compare estimated versus actual expenses. Some leases may include Fixed CAM charges, where tenants pay a fixed amount or fixed percentage monthly—this simplifies forecasting but can mask inefficiencies or inflated charges.

How to Calculate CAM Charges?

Each tenant’s share of common area maintenance charges are determined by multiplying their portion of expenses by the anticipated annual CAM fee. This is calculated as follows:

Pro-Rata Share (%) = Tenant’s Rentable Square Footage (RSF) ÷ Total Leasable Area (GLA)

CAM clauses can often include a range of jargon with the goal of increasing the maintenance costs incurred by the tenant. In addition, CAM charges can vary widely, depending on the property and the specific terms outlined in the lease agreement. It’s essential to carefully review the lease agreement’s CAM provision to understand how these charges are calculated, what expenses are included, and any limitations or exclusions. To gain a deeper understanding of CAM check out our blog post titled: CAM Charges: A Guide to Common Area Maintenance. Now let’s dive into CAM Charges Negotiation Tips.

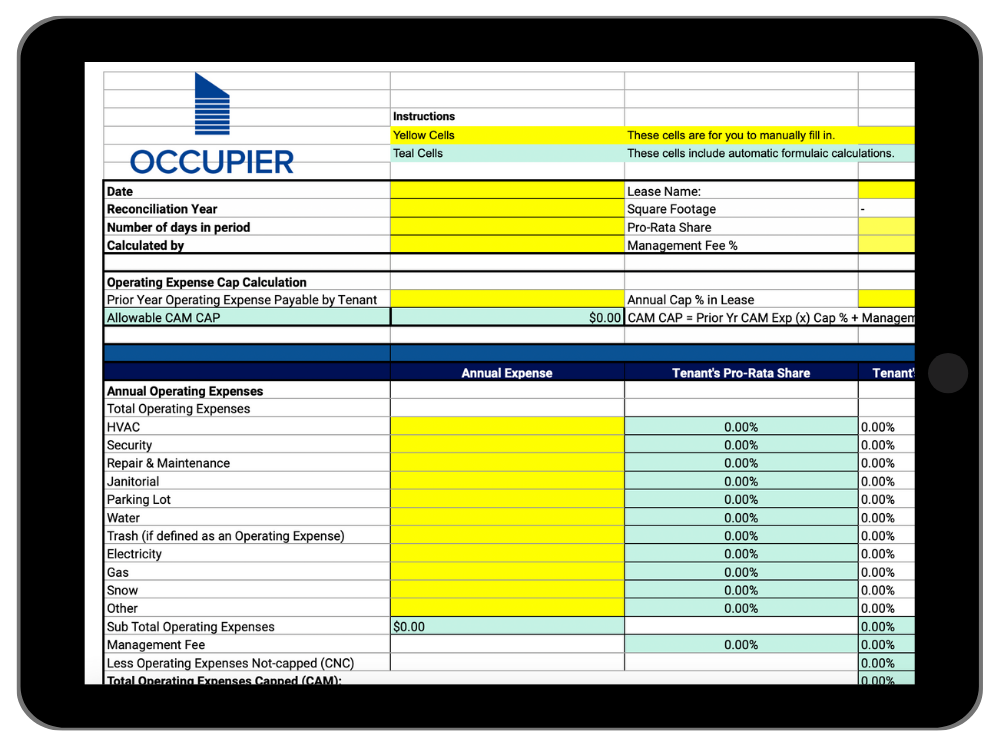

CAM Reconciliation Template

Key Tips for Negotiating CAM Charges

Review Lease Agreement Thoroughly:

Before entering into any lease agreement, thoroughly review the CAM provision. Pay attention to how expenses are defined, how the proportional share is calculated, and any limitations or exclusions. This will provide clarity on what expenses you may be responsible for and help identify potential areas for negotiation.

Engage in Pre-Negotiation Research:

Gaining a comprehensive understanding of the property, industry standards, and CAM charges in similar properties will strengthen your negotiating position. Research similar properties in the area and compare their CAM charges to ensure you are paying a fair share. Asking your neighbors and similar organizations about their CAM changes:

CAM Charges Negotiation Questions to Ask Neighbors

- What are your annual CAM charges?

- Were you able to negotiate a cap or ceiling on the annual CAM charges?

- What is included in your CAM charges?

- Did you negotiate an audit right in your lease?

- What is your annual CAM charge escalation rate?

- Has the CAM reconciliation process been smooth with this landlord?

Seek Professional Advice

Consider engaging the services of a commercial real estate attorney and a tenant-rep broker as commercial lease negotiation advisors. They can provide valuable insights, analyze lease agreements, and help identify potential negotiation points that align with your business goals.

Negotiate a Cap or Cap Exclusions:

Consider negotiating a cap on annual CAM charge increases or exclusions for specific extraordinary expenses. This will provide budget certainty and protect against significant year-over-year increases.

Consider Alternatives to Pass-Through:

Explore alternatives to pass-through CAM charges. For example, negotiate a gross lease structure where the landlord assumes responsibility for common area expenses. This can provide greater control over your budget and simplify expense management.

Review Audit Rights:

Negotiate the right to audit the landlord’s CAM charge calculations periodically. This ensures transparency and accuracy in the assessment of expenses and prevents potential overcharging. Lease Administration Audits are an excellent annual practice for commercial tenants to deploy. Oftentimes you’ll find cost savings and charge overages. Watch our webinar on Lease Administration Audits: CAM, OPEX, TAX to learn more tips on this.

Areas of Potential Disputes

During lease negotiations, it’s essential to be aware of common areas where disputes may arise regarding CAM charges. By proactively addressing these areas, you can minimize future conflicts and uncertainties. Some potential areas of dispute include:

Inaccurate Expense Allocation:

Ensure that expenses are allocated fairly and accurately, taking into account each tenant’s proportionate share based on square footage. Review the lease agreement for any discrepancies or ambiguous language.

Capital Expenditures vs. Repairs:

Distinguish between capital expenditures and repairs. Capital expenditures, such as major renovations or improvements, are typically the landlord’s responsibility. Repairs, on the other hand, are usually passed through as CAM charges. Clarify these distinctions in the lease agreement prior to signing in order to avoid disputes down the line.

Unreasonable Administrative Fees:

Some landlords may include substantial administrative fees within the CAM charges. Review these fees carefully and negotiate their removal or reduction if they seem excessive or unrelated to the actual management of the property.

Disputed Common Area Calculations:

Disputes regarding the calculation of common areas and the allocation of CAM charges can arise. Ensure that the lease agreement clearly defines the calculation methodology and what constitutes common areas.

How to Maximize Your Negotiating Power

To maximize your negotiating power when it comes to CAM charges, consider the following strategies:

- Leverage Market Research: Conduct thorough market research to understand the prevailing CAM charges in similar properties within the area. This knowledge will provide you with valuable leverage during negotiations and help ensure you are paying a fair share.

- Highlight Your Value as a Tenant: Emphasize your value as a tenant and the positive impact your business brings to the property. Demonstrating your significance may encourage the landlord to provide more favorable CAM charge terms.

- Propose Cost-Sharing Arrangements: Negotiate cost-sharing arrangements with the landlord for major capital improvements or upgrades to the common areas. By sharing the financial burden, you can mitigate the impact on your CAM charges.

- Consider Long-Term Leases: Long-term lease agreements provide stability for both tenants and landlords. Consider negotiating longer lease terms in exchange for more favorable CAM charge terms. Landlords may be more willing to accommodate such requests for extended commitments.

- Collaborate with Other Tenants: If the property has multiple tenants, consider collaborating with them to collectively negotiate CAM charges. Working together can strengthen your position and provide more leverage for beneficial terms.

Take Control of Your CAM Terms

CAM charges can significantly influence your monthly rent, operating expenses, and ability to project future growth. Tenants who take a proactive, strategic approach to CAM negotiation gain more than just savings—they gain greater visibility, stronger control of their commercial real estate lease, and improved tenant satisfaction over time.

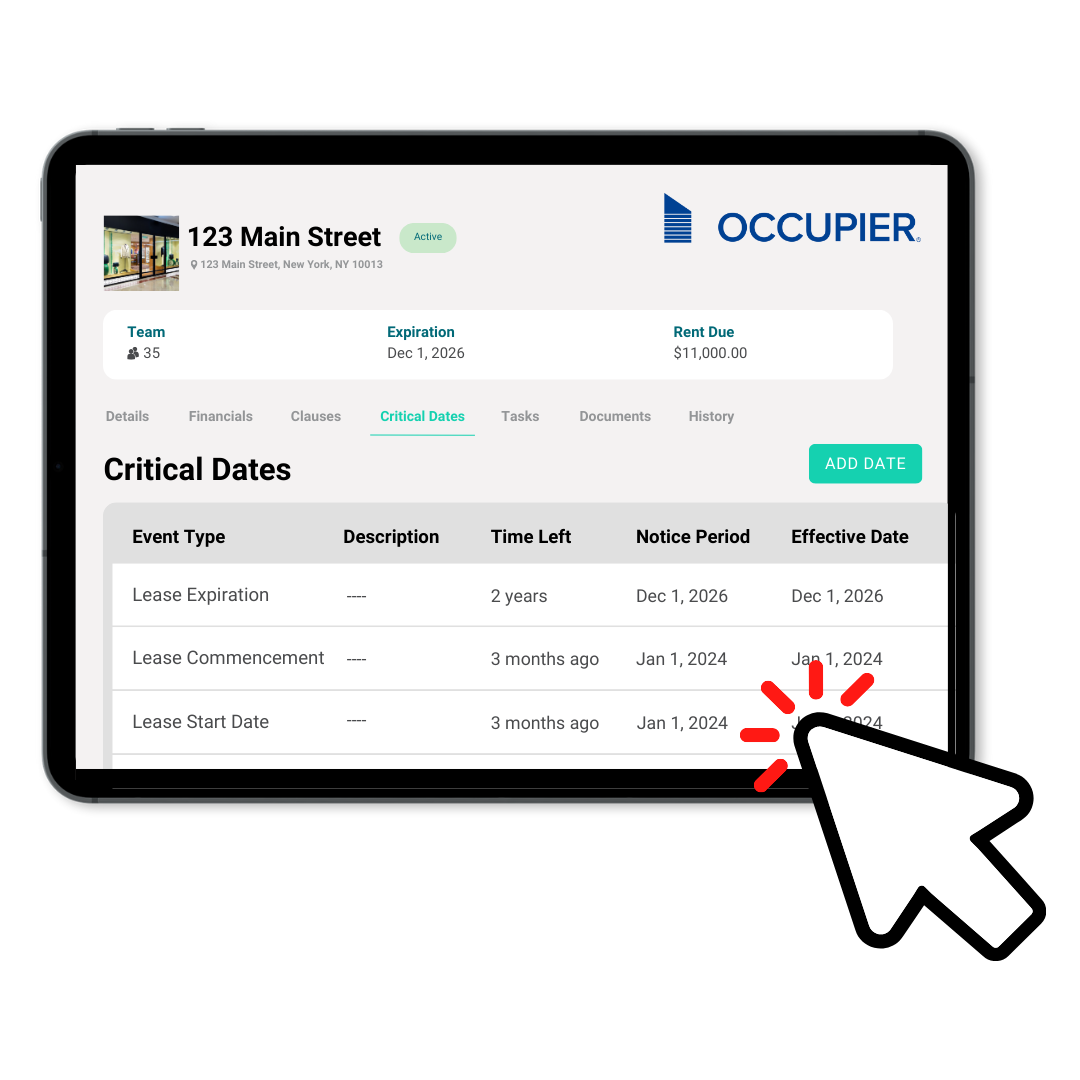

Occupier Lease Administration Software helps commercial tenants like you centralize lease data, manage CAM language and obligations, and ensure that your team is equipped to track every cost with clarity. If you’re managing multiple leases or preparing for a major lease renewal, now is the time to bring structure to your leasing operations.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.