7 Hidden Costs of Poor Lease Management

Last Updated on May 22, 2025 by

How much are you really spending on lease management? If you’re not sure, you’re not alone. According to a recent Forbes article, over 70% of organizations admit they are not completely confident in their understanding of the total costs associated with their lease portfolios.

For commercial tenants, leases typically represent the 2nd largest expense after payroll. Yet the systems managing these critical financial obligations often remain trapped in legacy software, spreadsheets, shared drives, and the institutional knowledge of a few key team members. This approach isn’t just outdated, it’s quietly eroding your bottom line through a series of hidden costs that compound across your portfolio.

In this post, we’ll uncover these invisible profit-drainers and show how modern lease management approaches are helping forward-thinking real estate leaders transform this cost center into a strategic advantage.

What Is Lease Management?

Commercial lease management encompasses the people, processes, and technologies that oversee the entire lifecycle of a commercial lease from negotiation and lease execution to ongoing lease administration and eventual termination or renewal.

For multi-location businesses, effective lease management isn’t just administrative housekeeping; it’s a core operational function that directly impacts financial performance, compliance requirements, and strategic growth opportunities. Commercial and retail lease agreements introduce layers of complexity: percentage rent calculations, CAM (Common Area Maintenance) reconciliations, co-tenancy clauses, exclusivity rights, assignment provisions, and complicated renewal option structures.

Without robust lease administration systems to manage these elements, even the most experienced real estate teams leave money on the table, often without realizing it.

7 Hidden Costs Lurking in Your Lease Portfolio

Missed Renewal Dates & Option Windows

Every lease contains critical deadlines that, when missed, can have severe financial consequences. Option periods typically require 6-12 months’ advance notice, and missing these windows forces tenants into unfavorable renewal negotiations or, worse, losing high-performing locations.

Missing a lease renewal window can put even flagship locations at risk and cause a loss in revenue, spike in legal fees, and an increase in occupancy costs. This rang true for Ark Restaurant Group, which operates the Bryant Park Grill in New York City. When their lease expired on April 30, 2025, the landlord awarded the prime space to another operator: celebrity chef Jean-Georges. Ark Restaurants disputed the decision and refused to vacate, leading to legal action and the threat of eviction. It’s a high-profile reminder that without clear renewal tracking and proactive lease management, even iconic locations can be lost. Westside Spirit

Inaccurate CAM Reconciliations

Landlords make mistakes in CAM calculations more often than you might think. A recent BOMA study found that over 60% of CAM reconciliations contain errors, with the average overcharge exceeding $2.50 per square foot. For a 5,000 sq ft location, that’s $12,500 annually that could be recaptured through proper audit procedures.

These errors multiply across portfolios, quietly bleeding profits location by location. Without systematic review processes, most go undetected, becoming a silent profit drain that grows with each location.

Unfavorable Lease Terms Going Unnoticed

Co-tenancy violations, exclusivity infringements, and assignment restrictions often trigger rent reductions or other financial remedies, but only if you’re aware they exist and actively monitor for violations. Without centralized visibility into these provisions, retail tenants routinely miss opportunities to exercise their rights, paying full rent when reductions are contractually available.

A notable example comes from Jo-Ann Stores. In 2018, two anchor tenants, Sports Chalet and Toys “R” Us, vacated the Elk Grove Promenade in California, dropping the shopping center’s occupancy below 60%. Jo-Ann had a co-tenancy clause in its lease that allowed for reduced rent under these conditions. Because they were actively tracking the provision, Jo-Ann promptly invoked the clause and began paying a significantly lower “substitute rent.”

The landlord sued, seeking approximately $638,000 in back rent. But the courts, including the California Supreme Court, upheld the lease terms, validating Jo-Ann’s right to reduce rent based on the co-tenancy trigger. GlobeSt

The takeaway? When lease provisions are properly tracked and enforced, tenants can unlock meaningful savings and avoid paying more than they owe.

Manual Lease Tracking & Spreadsheets

The hidden cost here isn’t just the administrative burden, it’s the compounding risk of human error. When critical dates, rent steps, and other obligations live in spreadsheets, mistakes become inevitable.

The labor cost alone is significant! Many retail organizations with a lease portfolio of 20 leases dedicate 15-20 hours monthly to manual lease administration and accounting tasks that modern systems automate. Beyond efficiency losses, errors in tracking can lead to missed payments, incorrect accounting, and compliance issues, each with its own financial penalties.

Delayed New Location Openings

The gap between lease execution and store opening represents pure expense without offsetting revenue. While some delays are unavoidable, many stem from inefficient lease management processes: slow document routing, delayed construction allowance disbursements, or permit applications that stall because lease exhibits weren’t properly cataloged.

Every week of delay for a new location costs thousands in unproductive rent, while simultaneously delaying the revenue stream. For retailers opening dozens of locations annually, these delays can silently consume millions in capital.

Lack of Lease Portfolio Visibility

Without comprehensive data on your portfolio’s performance, real estate decisions default to gut instinct rather than analytics. This visibility gap prevents optimization across locations, markets, and landlords.

Strategic decisions about expansion, contraction, and relocation require data-driven insights. Without them, organizations miss opportunities to leverage successful location patterns, negotiate better terms with repeat landlords, or exit underperforming markets before they drain resources.

Lease Compliance & Accounting Errors

Since ASC 842 implementation, lease accounting has grown significantly more complex. Inaccurate lease data now directly impacts financial statements, creating audit risks and potential restatements. Beyond accounting standards, regulatory compliance creates additional exposure all tied to lease obligations and amendments.

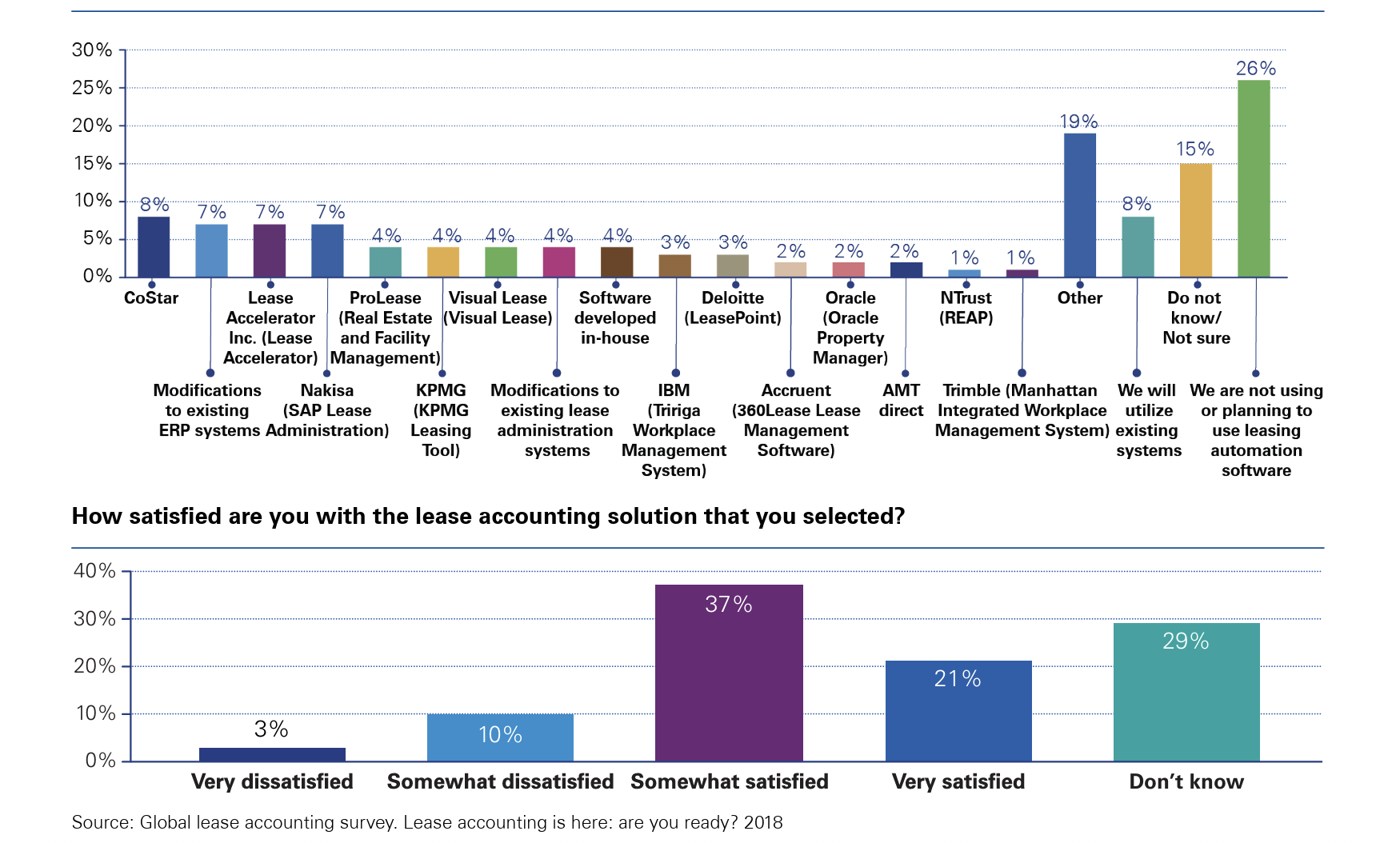

In a 2019 Global Lease Accounting Survey conducted by KPMG, they found that 37% of lease accountants were only “somewhat satisfied” with their leasing software tech stack.

That was five years ago—before hybrid work, inflationary rent escalations, and aggressive portfolio rightsizing became the norm. If your tech stack was underwhelming, then it’s likely falling short today.

The financial impact here extends beyond compliance costs, potential legal expenses, and the opportunity cost of diverting resources to emergency accounting compliance projects.Implementing a modern lease management strategy isn’t just about compliance. It’s about risk mitigation, cost containment, and cross-functional visibility.

How Hidden Lease Costs Compound at Scale

Consider this potential scenario for a 100-location portfolio:

| Hidden Cost Category | Per-Location Impact | Portfolio-Wide Annual Impact |

|---|---|---|

| Missed Renewal Options | $15,000 | $300,000 (assuming 20% of portfolio) |

| CAM Overcharges | $8,500 | $170,000 (assuming 20% of portfolio) |

| Unfavorable Lease Terms | $12,000 | $600,000 (assuming 50% of portfolio) |

| Manual Processes | $7,200 | $720,000 |

| Opening Delays | $14,000 | $350,000 (assuming 25 new locations) |

| Lack of Portfolio Visibility | $10,000 | $1,000,000 |

| Compliance & Accounting Errors | $9,000 | $450,000 (assuming 50% of portfolio) |

| TOTAL | $3,590,000 |

Retail margins are thin. Leases are often your second-largest expense. Letting these inefficiencies go unchecked? That’s a silent profit killer and one that compounds with every new location you add.

“The opportunity cost of not having Occupier is far too great. The real ROI is in not missing an option. It keeps us in control of our lease dates and due diligence timelines.”

Without a centralized system, you’re exposed to:

- Missed critical dates that trigger automatic lease renewals or penalties

- Inaccurate financial reporting that can snowball into failed audits

- Siloed workflows that delay decision-making across accounting, real estate, and legal

- Limited portfolio insights, making it harder to negotiate lease terms or execute on location strategy

Occupier puts your team back in control. With a platform built for today’s modern lease lifecycle—from deal to administration and disclosure—you can shift from being reactive to staying proactive in your portfolio decision-making.

In-House vs. Outsourced Lease Administration: Which Costs More in the Long Run?

Many real estate leaders are weighing whether to manage leases in-house or outsource. Each lease management model has its tradeoffs, but the wrong one can lead to hidden costs. While outsourcing might seem efficient, it often creates knowledge gaps and reduces strategic control over one of your largest expense categories.

The modern approach combines the best of both: in-house strategic oversight powered by specialized software that automates the administrative burden while maintaining institutional knowledge and control.

Comparing In-House vs. Outsourced Lease Administration

| Factor | In-House Lease Administration | Outsourced Lease Administration |

|---|---|---|

| Initial Cost | Higher (staff + systems) | Lower (predictable fees) |

| Long-term Cost | Lower with proper systems | Increases as portfolio scales |

| Knowledge Retention | High & Transferable | Low to Moderate |

| Strategic Control | Complete | Limited |

| Scalability | High (with technology) | Moderate |

| Team Alignment | Seamless | Often disconnected |

| Response Time | Immediate | Variable |

| Data Ownership | Complete | Partial/Shared |

What Great Lease Management Looks Like

Modern lease management transforms this business function from an administrative burden to a strategic advantage:

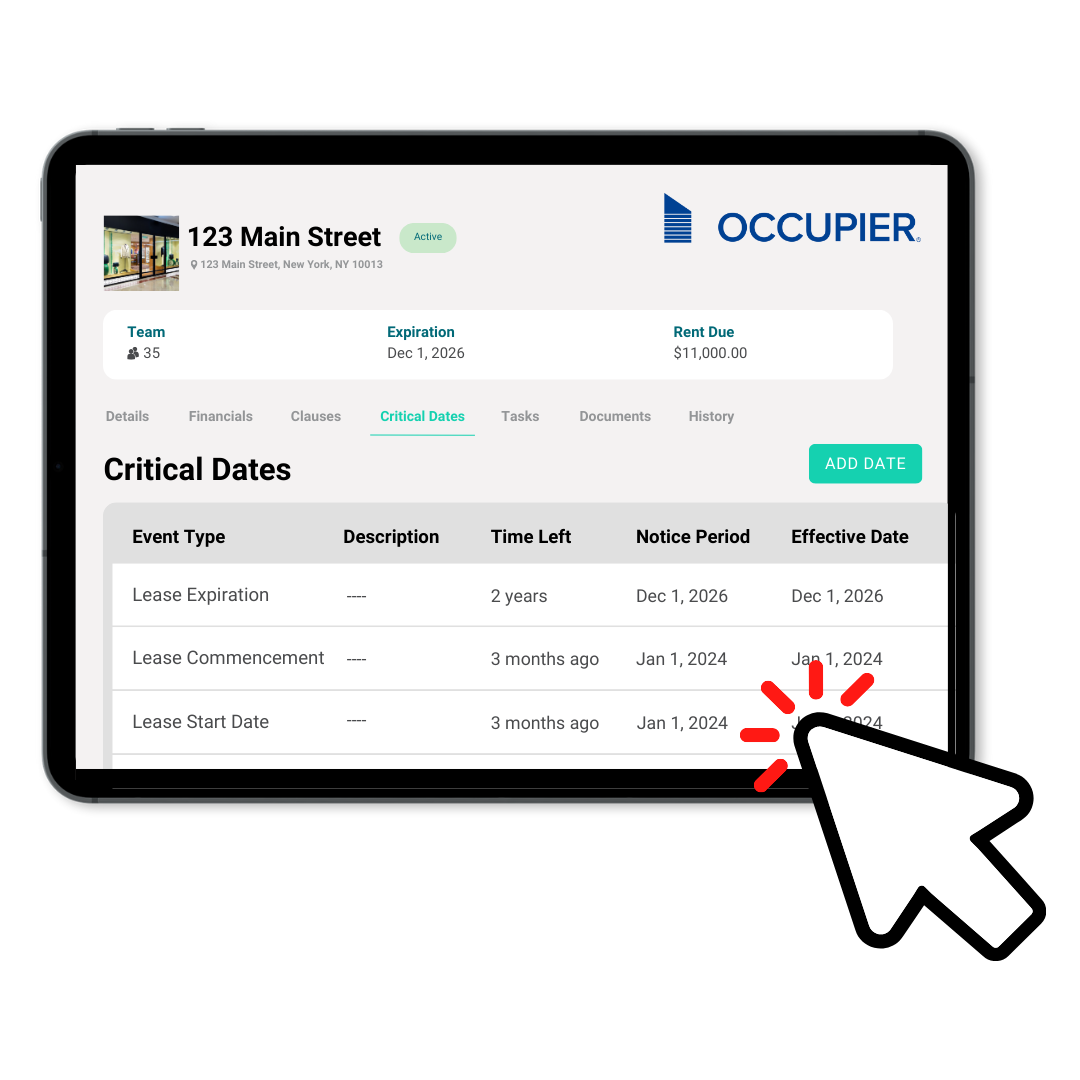

- Proactive alerts eliminate missed deadlines with automated notifications for options, renewals, and other time-sensitive events

- Digital lease repositories provide secure, searchable access to all documents and amendments

- Analytics dashboards surface portfolio-wide insights and benchmark performance across locations

- Cross-functional collaboration tools connect real estate decisions with finance, legal, and operations teams

- Audit-ready systems maintain compliance documentation and calculation transparency

The most significant shift for organizations that upgrade their approach is moving from reactive to proactive management, anticipating deadlines and opportunities rather than scrambling to address them after they occur.

How to Take Action

Ready to recapture those hidden costs? Here’s how to begin:

- Conduct an internal audit of your lease portfolio management processes, focusing on the seven cost areas outlined above

- Invest in modern lease management software like Occupier that centralizes information, automates critical functions, and provides portfolio-wide visibility

- Consolidate your lease data into a single source of truth that all stakeholders can access

- Establish clear processes for regular review of CAM charges, co-tenancy requirements, and other variable lease elements

- Align cross-functional teams around the lease lifecycle to ensure finance, legal, and operations all share the same information

The retail landscape continues to evolve rapidly, and agile portfolio management has become a competitive advantage. Organizations that transform their lease management approach aren’t just avoiding hidden costs, they’re positioning themselves to make faster, more informed real estate decisions in an increasingly dynamic market.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.