Avoiding Common Lease Administration Mistakes

Last Updated on June 5, 2025 by Morgan Beard

Even the most experienced real estate teams can make costly lease administration mistakes but with the right tools and processes, you can avoid them. In fact, simple errors like putting a decimal point in the wrong place can result in tenants paying much less than their fair share of recoveries, forcing landlords to cover the difference at significant cost.

The Bottom Line: Lease administration errors are surprisingly common and expensive, but entirely preventable with proper systems and processes.

The High-Stakes Reality of Commercial Lease Management

Lease administration has evolved into one of the most complex operational challenges facing commercial real estate professionals today. With multiple locations, intricate clauses, amendments, and renewal options to track, even small oversights can spiral into significant financial losses, legal disputes, or compliance headaches.

The stakes have never been higher. The global lease management software market is experiencing explosive growth, valued at $800 Million in 2024 and expected to reach $3 Billion by 2033, growing at a compound annual growth rate of 15.6% according to Business Research Insights. This growth reflects the urgent need for sophisticated lease administration solutions as organizations grapple with increasingly complex portfolios.

Why Lease Administration Mistakes Happen

Understanding the root causes of lease administration errors is the first step toward prevention. The complexity isn’t accidental, it’s structural.

Portfolio Complexity Creates Chaos

Today’s commercial real estate portfolios are more complex than ever. Organizations manage multiple locations with varying lease structures, from triple net leases to modified gross arrangements. Each lease contains dozens of clauses, amendments, and renewal options that must be monitored continuously. CAM charges alone can account for up to 15% of total lease costs, making accurate tracking essential for budget management.

Siloed Information Systems

Legal teams track contract terms in one system, finance manages payments in another, and real estate teams handle renewals in spreadsheets. This fragmentation creates dangerous blind spots. When critical information lives in disconnected systems, important details slip through the cracks.

Manual Process Dependency

Despite technological advances, many organizations still rely heavily on manual processes for lease administration. Spreadsheets remain surprisingly common, creating vulnerabilities around version control, data entry errors, and human oversight. Manual lease administration processes can be time-consuming and inefficient, requiring significant manpower and resources.

Human Error Amplification

With complex lease portfolios managed manually, human error becomes inevitable. From data entry mistakes to overlooked obligations, these errors compound over time, creating significant operational and financial risks.

The Most Common Lease Administration Mistakes

Based on extensive industry analysis, certain mistakes appear repeatedly across organizations of all sizes. Here are the most costly ones:

1. Missing Critical Dates

The Mistake: Failing to automate tracking of renewal deadlines, rent escalation dates, and termination windows.

The Consequence: Organizations routinely lose strategic locations or pay inflated rates because they missed critical notification deadlines. Timing confusion around rent schedules, whether based on calendar months or anniversary dates, can create disagreements between tenants and landlords about what’s due when, affecting property cash flow and balance sheets.

Real-World Impact: Missing a renewal notification by even one day can force organizations to accept unfavorable terms or lose prime locations entirely.

2. Overlooking Clause Obligations

The Mistake: Failing to monitor co-tenancy requirements, exclusivity rights, or sublease provisions.

The Consequence: Unmonitored clauses can result in lease disputes, lost leverage during negotiations, or unexpected financial obligations or savings potential. Many leases contain dozens of specialized clauses that require ongoing attention.

3. Inaccurate Financial Reporting

The Mistake: Failing to properly account for rent escalations, CAM charges, or ASC 842 compliance requirements.

The Consequence: The recognition of operating leases on the balance sheet affects financial ratios such as debt to equity, leverage ratios, and return on assets, which may affect a company’s creditworthiness and borrowing rates. Non-compliance with accounting standards creates audit risks and compliance failures.

4. Fragmented Communication

The Mistake: Different departments working in silos without unified data access.

The Consequence: Many organizations fail to establish clear communication channels and workflows between finance, legal, real estate, and facilities management, which usually leads to incomplete data and lease records, resulting in reporting errors, compliance risks, and missed cost-savings.

5. Relying on Spreadsheets for Complex Portfolios

The Mistake: Managing multi-location portfolios with spreadsheets instead of dedicated software.

The Consequence: Spreadsheets create version control nightmares, limit collaboration, and increase error rates exponentially as portfolios grow. They simply weren’t designed for the complexity of modern commercial lease management.

How to Avoid These Mistakes

The good news? These mistakes are entirely preventable with the right approach and tools.

Implement Centralized Lease Management

Create a single source of truth for all lease data. Specialized software for lease administration tasks and ASC 842 lease accounting helps automate lease data collection, lease classification, and lease accounting calculations, reducing manual effort and improving accuracy while providing centralized lease management.

Centralization eliminates the dangerous information silos that plague many organizations. When all stakeholders work from the same data set, errors decrease dramatically.

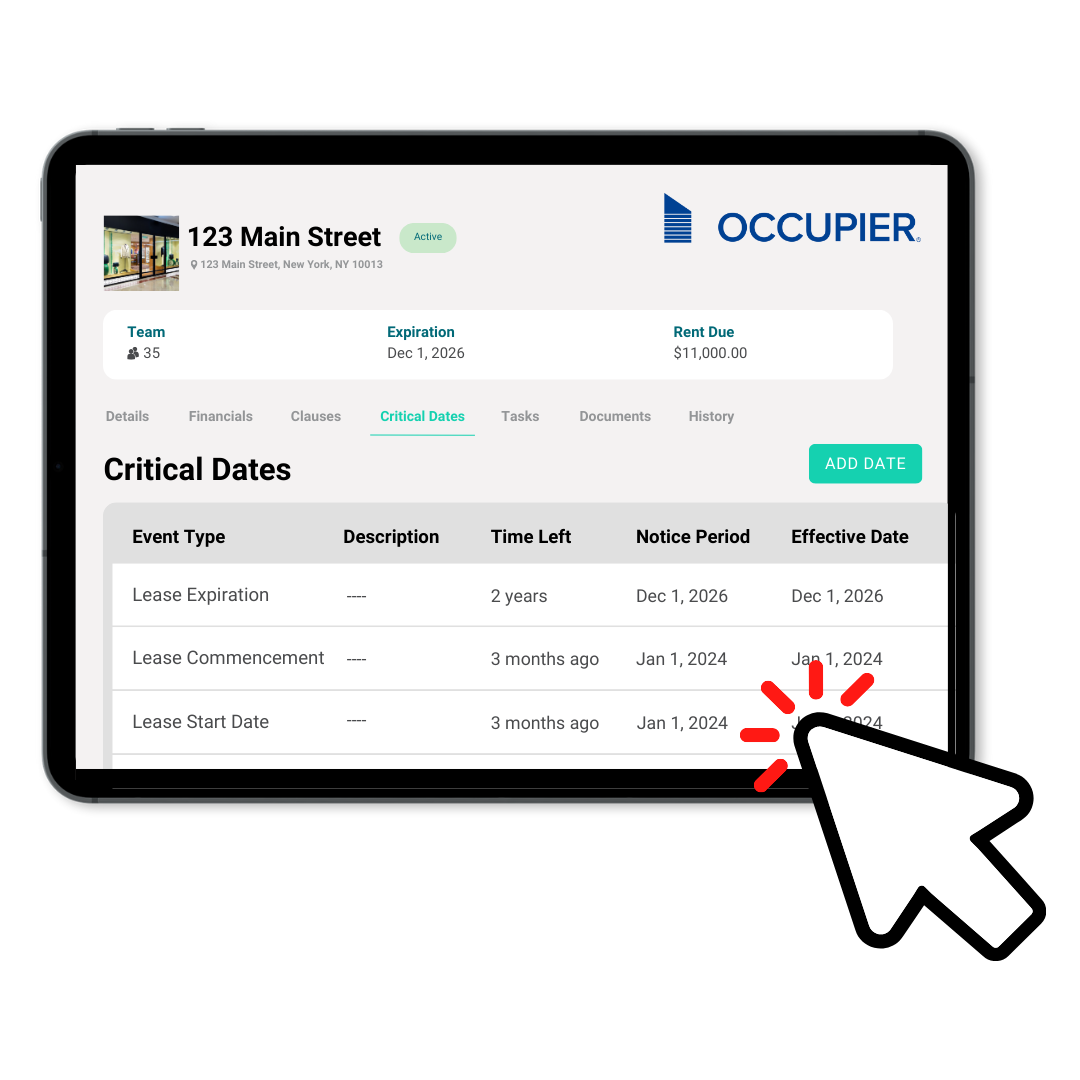

Set Up Automated Alerts & Notifications

Automate critical date tracking to ensure nothing falls through the cracks. Modern leasing software can monitor hundreds of dates simultaneously, sending alerts well in advance of deadlines. This eliminates the manual calendar management that leads to missed opportunities.

Track Clause Obligations Intelligently

Implement systematic clause monitoring to ensure compliance with co-tenancy, exclusivity, and other specialized requirements. Smart systems can track complex obligations across entire portfolios, providing visibility that manual processes simply cannot match.

Foster Cross-Functional Collaboration

Enable seamless collaboration between finance, legal, and real estate teams. Having a centralized lease management system enables seamless collaboration, providing easy access to lease documents, communication history, and task assignments, promoting transparency and simplifying communication among all parties involved.

Prioritize Data Accuracy and Compliance

Leverage specialized software that supports ASC 842 compliance and other regulatory requirements. Companies can stay audit-ready all year long and manage every modification while maintaining compliance for day 2 and beyond, even as leases and regulatory requirements evolve.

How Technology Transforms Lease Administration

Modern leasing software offers transformative capabilities that manual processes simply cannot match:

Automated Error Detection: Lease accounting software should be able to catch errors that misalign with company rules, such as creating amortization schedules for leases shorter than company policy allows, and alert users immediately.

Compliance Automation: Software solutions automatically incorporate regulatory updates, ensuring ongoing compliance without manual intervention.

Real-Time Collaboration: Multiple stakeholders can access the same data simultaneously, eliminating version control issues and communication gaps.

Predictive Analytics: Advanced systems provide insights into lease performance, helping organizations make more informed decisions about renewals and negotiations.

The Business Case for Modern Lease Administration

Organizations that invest in proper lease administration see immediate and ongoing benefits:

- Risk Reduction: Automated systems eliminate the human errors that create financial and legal exposure

- Cost Savings: Better visibility into lease obligations enables more strategic negotiations and cost management

- Compliance Assurance: Automated compliance reduces audit risks and regulatory penalties

- Operational Efficiency: Teams spend less time on manual tasks and more time on strategic activities

Effective lease administrators use advanced tools such as lease management software to centralize data and improve reporting accuracy, assisting in storing essential documentation, performing financial analysis for balance sheets, and providing insights throughout the lease lifecycle.

Looking Forward: The Future of Lease Administration

As commercial real estate continues to evolve, lease administration will only become more complex. Organizations that invest in proper systems and processes now will be better positioned for future growth and changes in the regulatory environment.

The shift toward centralized, automated lease management isn’t just a trend… It’s a necessity for organizations serious about managing their real estate portfolios effectively.

The key takeaway: Don’t wait for a costly mistake to force change. Proactive investment in proper lease administration systems pays dividends in reduced risk, improved compliance, and better financial performance.

The organizations thriving in today’s complex commercial real estate environment are those that have moved beyond manual processes to embrace integrated, automated lease management solutions.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.