Mastering CAM Reconciliation: Guide to Streamline Your Expense

Last Updated on May 23, 2025 by Amanda Lee

As a commercial tenant, one of the most complex lease management processes is common area maintenance (CAM) reconciliation. CAM charges cover the costs of maintaining shared spaces like lobbies, parking lots, and restrooms. While these expenses are typically estimated at the start of the year, there are inevitable discrepancies between what you paid and what you actually owe your Landlord.

Properly reconciling CAM charges is crucial for avoiding overpayments and ensuring you only pay your fair share of operating expenses. However, the reconciliation process can be painstakingly difficult without the right processes and technology in place. This comprehensive guide will help you master CAM reconciliation to streamline your financial operations.

What is CAM Reconciliation?

CAM reconciliation is when your landlord evaluates the monthly estimated CAM payments against the actual operating expenses for the year. This process results in either the tenant being reimbursed for overpayments or having to pay any shortfall.

As part of the reconciliation, landlords will provide an itemized breakdown of all shared expenses, payments made, and remaining balance. Diligently tracking your common area maintenance charges across all commercial property leases is tedious yet crucial to ensure your business is not being overcharged.

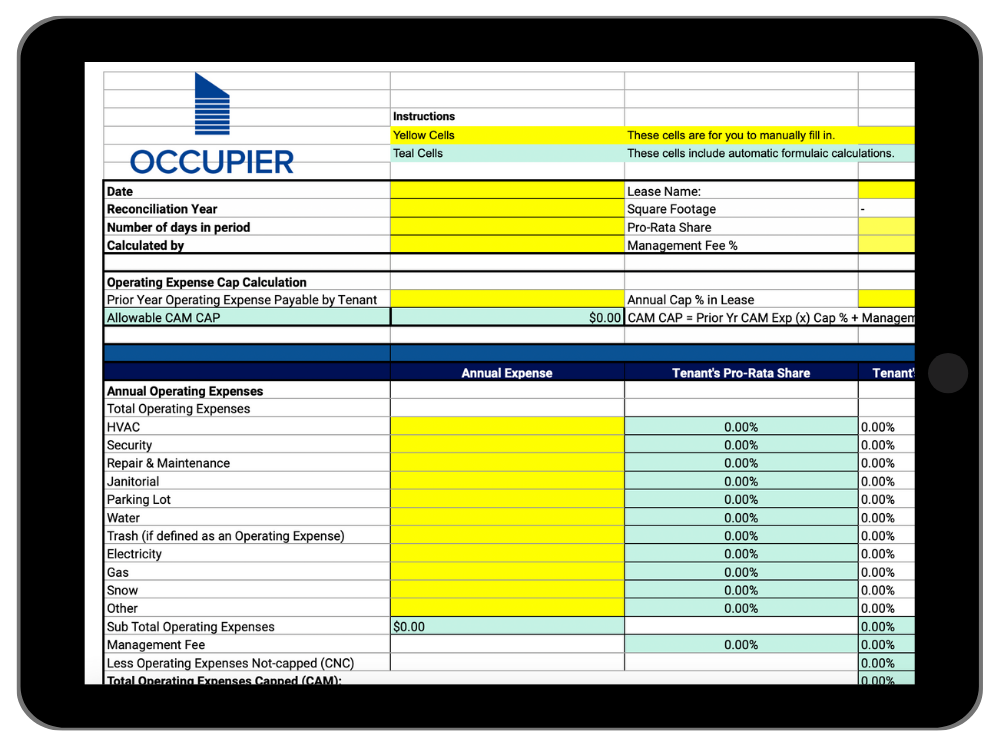

CAM Reconciliation Template

Understanding CAM Expense Categories

To accurately review the reconciliation statement, you need to understand the different categories of CAM expenses. There are generally two main types:

Controllable Expenses

Controllable CAM expenses are costs that the Landlord has the ability to manage and minimize through competitive sourcing or negotiating with vendors. These “operating expenses” often have embedded caps that limit how much of an increase tenants are responsible for year-over-year. Common controllable expenses include:

- Landscaping and grounds maintenance

- Janitorial and cleaning services

- Repair and maintenance for common areas

- Security and parking attendants

- Administrative staff salaries

- Marketing and promotions

- Capital improvements and equipment replacements

As these services are typically procured in a competitive market, the Landlord can shop around and leverage their negotiating power to keep costs reasonable for tenants.

Non-Controllable Expenses

Non-controllable CAM expenses, on the other hand, are unavoidable costs over which the landlord has virtually no control. As such, these “non-operating expenses” usually do not have statutory caps or limits written into the lease. Examples include:

- Utilities (water, sewer, gas, electric)

- Property taxes and assessments

- Property Insurance

- Snow and trash removal

- Government mandates or fees

Since the Landlord cannot negotiate these costs, any increases incurred are typically passed through to tenants based on their pro rata share of expenses. Reviewing non-controllable costs is still important to validate calculations.

During the reconciliation review, you’ll want to ensure each line item expense is properly categorized as controllable or non-controllable based on your specific lease terms. Mis-classifications can lead to overcharges if controllable costs exceed the capped amount. Understanding this distinction is key to paying only your fair share of operating expenses.

Lease Audit: CAM, OPEX & TAX

Allocating your expenses as operating or capital expenditures can have a significant impact on your CAM charges. In the webinar linked here, Occupier Co-Founder and Leasing Expert, Denise Hinkle dive into real estate industry lease audit and annual processes to deploy in to help you with tracking potential incorrect allocation of expense as well as dispute resolution mechanisms,

Why is CAM Reconciliation Important?

Proper CAM reconciliation is vital for both tenants and landlords. For landlords, it ensures they recoup any shortfalls from estimated expenses over the year. For tenants, it’s an opportunity to get reimbursed for overpayments and verify each charge complies with the lease terms.

The reconciliation process also provides transparency into your operating costs and ensures you only pay your pro rata share based on leased square footage. Any discrepancies can then be audited and addressed.

Common Challenges in CAM Reconciliation

Despite its importance, CAM reconciliation is notoriously difficult to get right due to the complexity involved:

- Unique lease terms around expense inclusions, exclusions, caps, etc.

- Properly calculating pro rata tenant’s shares and gross-up clauses

- Accounting for mid-year changes like relocations, expansions, co-tenancy

- Identifying erroneous charges or duplicate expenses

Manually reviewing every line item and cross-checking it against the lease language is extremely time-consuming and prone to errors. Tenant-specific exclusions enable a tenant to subtract certain tenant contributions from their total, which adds additional calculations.

Best Practices to Streamline Your CAM Reconciliation

To maximize savings and efficiency, follow these best practices:

- Deeply understand your lease: Review expense pass-throughs, caps, audit rights and reconciliation timing requirements.

- Implement a lease accounting software: Automate the labor-intensive validation of each charge against your lease abstracts.

- Promptly reconcile statements: Record receipt dates and review charges annually to identify discrepancies early.

- Benchmark your costs: Monitor your CAM expenses across your full portfolio to identify outliers and negotiation opportunities.

- Leverage historical data: Apply learnings from prior reconciliations to negotiate improved lease terms.

By following these steps, you can turn an overwhelming manual process into a seamless part of your financial operations.

CAM Reconciliation Made Easy with Occupier

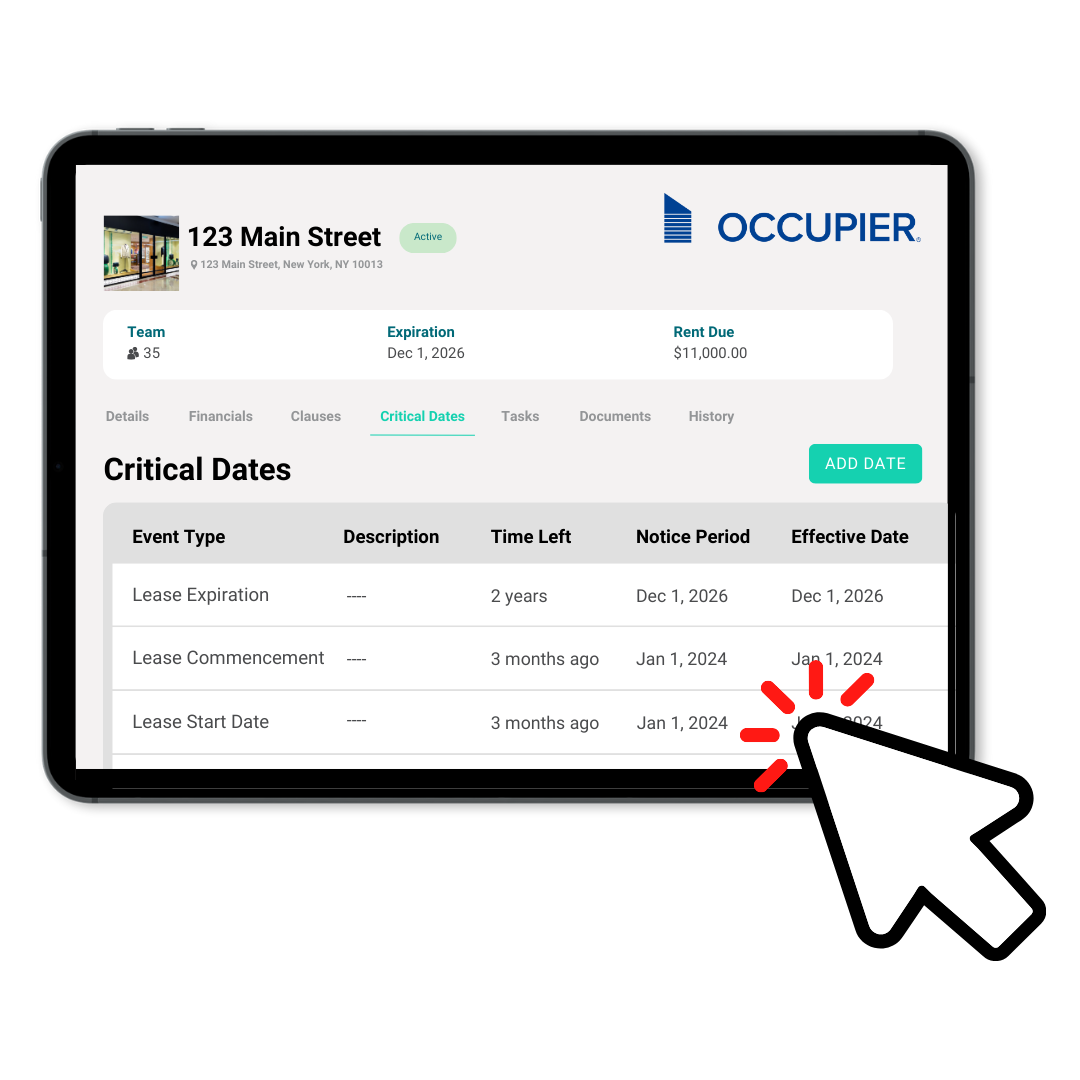

Occupier’s lease management and accounting platform is purpose-built to simplify CAM reconciliation and calculate commercial recoveries for you. Audits reconciliation statements against your lease abstracts to identify overcharges, missed exclusions, and more.

Our centralized lease repository, customizable reporting, and accounting integrations enable you to gain control and visibility over your CAM expenses like never before. Say goodbye to overpayments and massively reduce the time spent on this critical financial process.

Take control of your CAM reconciliation and lease management workflows with Occupier.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.