Due Diligence During Lease Acquisitions

Last Updated on July 23, 2025 by

Due diligence during lease acquisitions involves a comprehensive process of investigation and evaluation of lease agreements during the merger & acquisition stage. This crucial step ensures that all parties involved thoroughly examine current leases, financial obligations, property conditions, and legal aspects to determine the ownership rights, risks, and opportunities within an acquired lease portfolio.

By conducting a detailed examination, stakeholders can mitigate risks, uncover hidden liabilities, and potentially re-negotiate favorable terms. This leads to more informed investment decisions and helps ensure timely completion of the acquisition process. The ultimate goal is to safeguard against unexpected costs or post-transaction surprises and to maximize the benefits of the acquired real estate asset.

In this article, we will explore the importance of due diligence in commercial real estate transactions and outline the critical components that need to be evaluated.

What is a Commercial Lease Acquisition?

A commercial lease acquisition, in the context of purchasing a business, involves assuming control of the target property’s existing leases. This process entails acquiring the legal ownership, rental income, and responsibilities tied to the leased properties as part of the broader purchase agreement.

The terms of the purchase contract may include negotiations with the property owner to assign or novate the leases, ensuring operational continuity for the new owner or parent company. This transition may also involve reviewing site plans, understanding restrictive covenants, and confirming compliance with the Americans with Disabilities Act and zoning laws.

During the acquisition, conducting property due diligence—including environmental site assessment, legal due diligence, and financial due diligence—is essential for a sound investment.

Understanding the Lease Agreement

One of the first steps in lease acquisition due diligence is a thorough review of the lease agreement. This involves understanding the full scope of the lease terms, including the lease period, rent amount, renewal options, purchase options, and any other relevant clauses or covenants. Evaluating required payments like CAM charges, security deposits, and rental data provides clarity on the financial commitments and rights being acquired.

Analyzing financial documents related to the lease, such as operating statements or rent rolls, helps establish the property’s income stability and potential return. In addition, checking for missing documents, inconsistencies in rental rates, or vague terms can reveal hidden risks. This type of detailed review is critical to ensure that the lease aligns with the buyer’s intended use and overall investment objectives.

Examining Property Conditions

A core part of the due diligence checklist involves a complete property condition assessment. This means physically inspecting the property to evaluate its structural integrity, building systems, and deferred maintenance needs. It’s also essential to verify property boundaries through a comprehensive title search and confirm the property’s physical condition aligns with its reported market value and purchase price.

Environmental due diligence should not be overlooked. Conducting environmental site assessments can uncover potential environmental hazards, such as contamination or zoning violations, which may limit future use of the property or introduce costly remediation efforts. By examining these various aspects of the property’s condition, investors and tenants can avoid unexpected issues and ensure the asset supports their investment goals.

Legal Considerations

Legal reviews are a critical component of the due diligence phase. This includes confirming legal ownership through title insurance and identifying any legal risks such as unresolved disputes, unclear lease clauses, or non-compliance with zoning laws and regulatory requirements. Legal due diligence should also cover restrictive covenants, subleases, estoppel certificates, and adherence to the Americans with Disabilities Act.

Partnering with a real estate attorney ensures that the lease complies with local zoning laws and all relevant compliance requirements. Their guidance provides crucial insights that protect against legal issues post-acquisition and ensures that the lease is enforceable and beneficial to the acquiring party.

Financial Assessment

Assessing the financial health of the property owner or landlord is just as important as evaluating the property itself. Reviewing their financial documents and operating income can reveal their ability to fulfill ongoing obligations outlined in the lease. Understanding rental income streams, cash security, and comparable properties also supports smarter negotiation of the final purchase price.

Beyond the landlord’s financial position, market research into local market dynamics helps assess the long-term value and rental rates of the property. This step provides a foundation for investment decisions and ensures the acquisition aligns with broader financial due diligence efforts and capital market strategies.

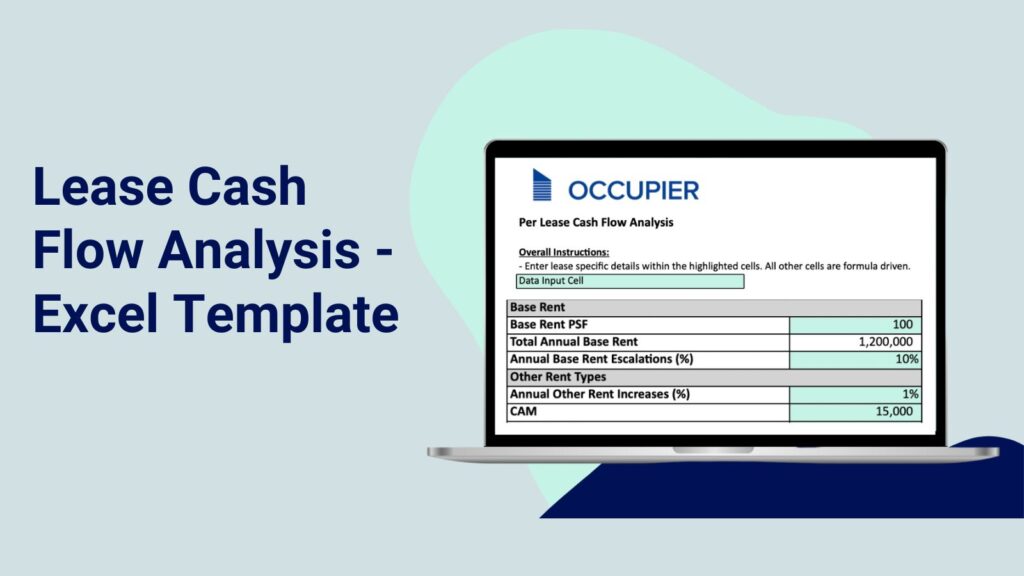

Lease Cash Flow Analysis

Whether you’re a small business owner or a growing enterprise, cash flow is king. And if your brick & mortar real estate strategy is both a revenue center and a cost center, then understanding cash flow analysis is important. When undergoing due diligence during lease acquisition, gaining an accurate cash flow analysis can help you make informed decisions about any given lease portfolio, and its bottom line impacts the success of your business and acquisition costs.

Streamlining Lease Management & Accounting Processes

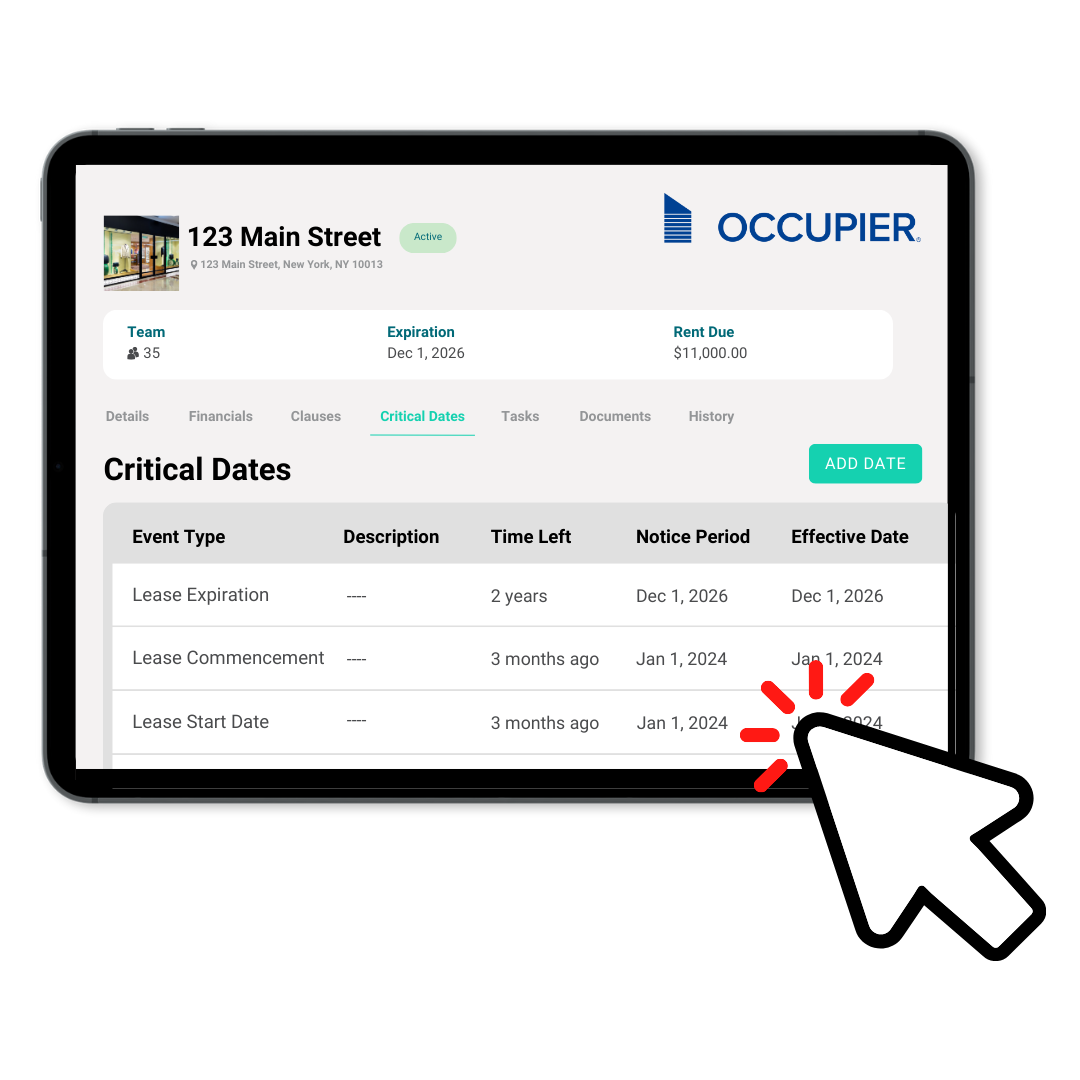

To ensure a smooth transition, it’s essential to integrate a technology-driven solution for ongoing lease management. A robust lease management software platform enables:

- Data collection and centralization of current leases

- Real-time tracking of rental data, financial obligations, and lease renewals

- Collaboration across internal teams, external industry experts, and accounting professionals

- Increased visibility into required payments, future expenses, and compliance deadlines

Using such a platform improves operational efficiency, supports market research, and enables a more comprehensive understanding of your acquisition process and post-acquisition lease obligations.

Summarizing Due Diligence During Lease Acquisitions

Due diligence during lease acquisitions is a critical component of any successful commercial property acquisition or real estate purchase. A comprehensive evaluation of lease terms, property condition, rental income, financial obligations, and legal considerations allows all parties involved to make informed investment decisions and mitigate risk.

For commercial tenants, adopting lease management software as part of this process unlocks operational clarity and reduces the burden of managing siloed data. It also enables the accurate forecasting of investment outcomes, improved insights into the lease portfolio, and aligned purchase price negotiations.

By conducting a thorough investigation of all various aspects of a lease—financial, legal, and operational—you can avoid potential issues and ensure a smooth and sound investment that supports your broader business and real estate strategies.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.