A FRS 102 Overview: Key Sections and Their Applications

Last Updated on May 22, 2025 by Morgan Beard

What is FRS 102?

The Financial Reporting Standard (FRS) 102 has introduced significant changes to lease accounting, requiring businesses to adopt more sophisticated methods for lease classification, measurement, and disclosure. For CFOs, Controllers, Accountants, and CPAs, understanding what FRS 102 is and how it affects lease portfolios is crucial for compliance and financial efficiency.

This comprehensive guide breaks down the key sections of FRS 102 most relevant to commercial tenants, translating technical requirements into practical applications that will help you optimize your financial reporting and lease management strategies.

The Structure of FRS 102

Understanding the Section-Based Approach

Unlike its predecessor, UK GAAP, FRS 102 is structured into 35 sections, each covering a specific financial reporting area. This modular design simplifies access and allows for targeted updates. For commercial tenants, this means focusing on sections most relevant to leasing, property, and financial instruments.

The standard builds on core principles before addressing specialized topics, balancing international standards with UK-specific considerations. Understanding this structure helps navigate FRS 102 efficiently and prioritize relevant sections.

The Conceptual Framework and Underlying Principles

Sections 1-8 of FRS 102 establish the conceptual foundation for financial reporting under the standard. These sections outline:

- The scope and application of the standard

- Core concepts and pervasive principles

- Financial statement presentation requirements

- Balance sheet and income statement structures

- Statement of changes in equity and cash flow statement requirements

- Notes to the financial statements

These sections define how lease transactions appear in financial statements, ensuring information is relevant, reliable, comparable, and understandable for stakeholders.

Key Sections Impacting Commercial Tenants

Section 20: Leases

Section 20 of FRS 102 provides guidance on lease accounting, but under IFRS 16 or ASC 842, almost all leases are now treated as finance leases. This means that both finance and operating leases must be recognized on the balance sheet as right-of-use assets, with corresponding lease liabilities for future payments.

Finance Leases: Under these standards, all leases are treated similarly to finance leases, with the lease asset and liability recognized on the balance sheet.

Operating Leases: Previously kept off-balance sheet, operating leases are now treated in the same way as finance leases under IFRS 16 and ASC 842, meaning the right-of-use asset and liability are recognized on the balance sheet, impacting financial statements and ratios.

For finance teams managing large lease portfolios, correctly classifying each lease and adhering to these standards is essential for compliance and financial accuracy.

Section 21: Provisions and Contingencies

Commercial tenants often face obligations related to property restoration, dilapidations, or other end-of-lease requirements. Section 21 guides the recognition and measurement of these provisions, specifying when to recognize a liability and how to measure it.

Key considerations include:

- Identifying when a provision should be recognized

- Measuring provisions at the best estimate of the expenditure required

- Discounting provisions to present value when the time value of money is material

- Distinguishing between provisions and contingent liabilities

For tenants with significant dilapidations or restoration obligations, Section 21 helps ensure these future costs are properly reflected in your financial statements from the outset of the lease.

Section 11 & 12: Basic and Other Financial Instruments

Sections 11 and 12 address financial instruments, which include any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity. For commercial tenants, these sections become relevant when dealing with:

- Lease deposits and guarantees

- Complex lease arrangements with embedded derivatives

- Hedging arrangements related to property finance

- Financial covenants in lease agreements

Understanding these sections helps you properly classify and measure financial assets and liabilities arising from your lease arrangements, ensuring accurate presentation in your financial statements.

Section 17: Property, Plant, and Equipment (PPE)

Leasehold improvements and other long-term leased assets fall under Section 17, which governs how these expenditures should be capitalized and depreciated. Costs related to property modifications, build-outs, and renovations must be recorded appropriately over the lease term, ensuring compliance with asset recognition and depreciation rules.

Section 7: Statement of Cash Flows

Lease payments significantly impact cash flow reporting. Under Section 7, businesses must distinguish between lease-related cash flows:

- Finance lease payments appear under financing activities since they represent debt repayments.

- Operating lease payments are reported under operating activities, reflecting the ongoing cost of renting properties.

Clear distinction between these payment types ensures accurate cash flow reporting and financial transparency.

Section 29: Income Taxes (Deferred Tax Implications)

Changes in lease classification and recognition can impact deferred tax liabilities and the timing of tax deductions. Adjustments resulting from FRS 102 may influence tax reporting, requiring careful consideration of financial implications to maintain compliance and optimize tax strategy.

Practical Applications for Commercial Tenants

Lease Classification and Balance Sheet Impact

Under FRS 102, lease classification plays a critical role in how leases are recorded. While many commercial leases were traditionally classified as operating leases, the classification has changed, and most leases are now treated as finance leases. A lease is likely a finance lease if:

- The lease term covers most of the asset’s economic life.

- The present value of minimum lease payments approximates the asset’s fair value.

- The lease contains a bargain purchase option.

- The leased asset is specialized in nature.

With this shift, almost all leases now bring both assets and liabilities onto the balance sheet, impacting financial statements and ratios.

Accounting for Lease Incentives

Commercial property negotiations often involve incentives such as rent-free periods, reduced rent, or contributions to fit-out costs. Section 20 requires these incentives to be recognized as an integral part of the net lease consideration and spread over the lease term.

In practice:

- A rent-free period reduces total rent expense evenly across the lease term.

- Landlord contributions to fit-out costs are treated as lease incentives and recognized over the lease term.

- Stepped or escalating rents require careful calculation to determine the average rent expense.

Managing Lease Modifications

Leases often change during their term. Section 20 provides guidance on accounting for modifications, including:

- Extending or shortening the lease term

- Increasing or decreasing leased space

- Changing significant lease terms

Lease modifications require reassessment, potentially impacting financial statements and key financial metrics.

Disclosures and Financial Statement Presentation

FRS 102 requires extensive disclosures about lease arrangements, demanding robust lease management systems that can provide the necessary information. For commercial tenants, key disclosures include:

- Future minimum lease payments under non-cancellable operating leases, analyzed by period

- Total contingent rents are recognized as an expense

- General description of significant leasing arrangements

- Restrictions imposed by lease arrangements, such as dividends, additional debt, or further leasing

These disclosures provide stakeholders with transparency about your lease commitments and their impact on your financial flexibility. The Financial Reporting Council’s FRS 102 guidance offers further details on these disclosure requirements.

Implementing FRS 102 Sections Effectively

Systematic Approach to Lease Review

To effectively implement the relevant sections of FRS 102, commercial tenants should adopt a systematic approach to reviewing their lease portfolio:

- Compile a comprehensive lease inventory: Gather all lease agreements, modifications, and related documents in a centralized repository.

- Identify key lease terms: Extract critical information such as lease term, payment schedules, renewal options, and termination clauses.

- Apply classification criteria: Assess each lease against the Section 20 criteria to determine proper classification.

- Calculate required accounting entries: Develop templates for calculating straight-line rent expense, amortization schedules, and present value calculations.

- Implement appropriate systems: Invest in lease management software that can handle the complexities of FRS 102 accounting.

Leveraging FRS 102 Lease Accounting Software for Compliance

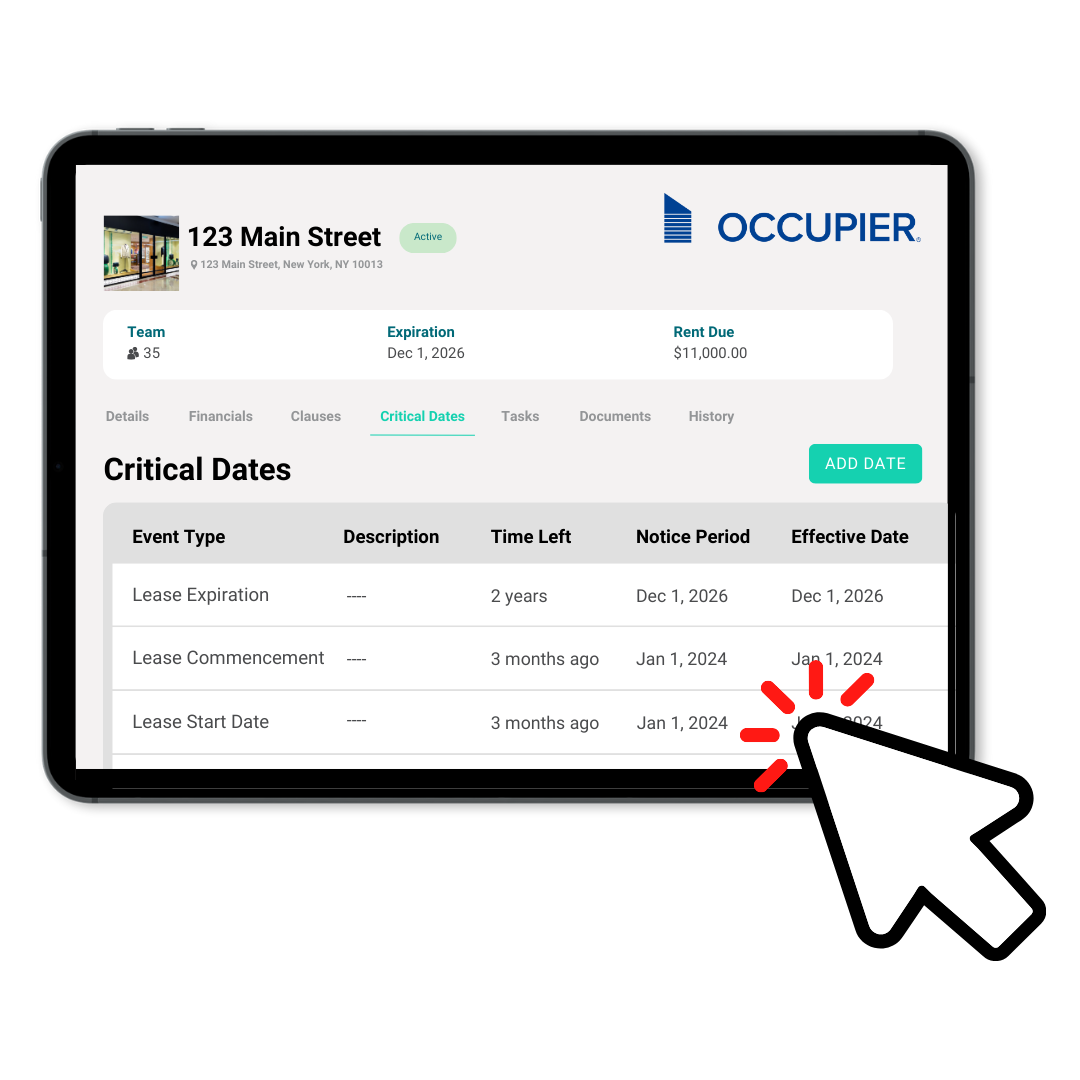

The detailed requirements of FRS 102’s various sections demand sophisticated tracking and reporting capabilities. Purpose-built lease management platforms like Occupier can help commercial tenants:

- Centralize lease data and documents

- Automate complex calculations required for compliance

- Generate required disclosures for financial statements

- Track lease modifications and reassess classification when needed

- Model the financial impact of proposed lease changes

By leveraging technology specifically designed for lease accounting, commercial tenants can ensure compliance with all relevant sections of FRS 102 while gaining strategic insights into their property portfolio.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.

Resources for Further Reading

Disclaimer: This article is for informational purposes and should not be considered legal or financial advice. Always consult with a qualified professional for specific guidance.