Navigating the Transition to FRS 102: Tips for a Smooth Adoption

Last Updated on April 16, 2025 by Amanda Lee

Transitioning to FRS 102 brings significant changes to financial reporting, especially in lease accounting. As a financial leader, you know the complexities involved. The good news? With proper planning and the right tools, you can navigate this shift smoothly. This guide covers key considerations, challenges, and strategies to help commercial tenants manage multiple leases under FRS 102.

Understanding the Fundamentals of FRS 102

What Is FRS 102 and Who Does It Affect?

FRS 102 is the principal accounting standard in the UK and the Republic of Ireland’s financial reporting framework. It applies to most entities that aren’t applying EU-adopted IFRS, FRS 101, or FRS 105. For commercial tenants, particularly those with significant lease portfolios, understanding how FRS 102 differs from previous standards is crucial for compliance and accurate financial reporting.

Key Changes in Lease Accounting Under FRS 102

Under FRS 102, lease accounting undergoes several important modifications. The standard introduces a more substance-over-form approach, requiring more detailed disclosures and potentially changing how lease classifications are determined. For commercial tenants, this means:

- Almost all leases are now recognized on the balance sheet

- Enhanced disclosure requirements for lease commitments

- Potential recognition of lease incentives on a different basis

- New considerations for lease modifications and reassessments

Understanding these changes is the first step toward successful implementation. The Financial Reporting Council’s website offers detailed guidance documents that clarify these requirements.

Preparing Your Organization for FRS 102 Implementation

- Conduct a Comprehensive Lease Inventory

The foundation of successful FRS 102 implementation begins with a thorough understanding of your lease portfolio. Start by cataloging all existing leases, including:

- Property leases for all your commercial locations

- Equipment leases

- Vehicle leases

- Embedded leases within service contracts

For each lease, document key terms including commencement dates, lease terms, payment schedules, renewal options, and any incentives or unusual clauses. This inventory will serve as your roadmap for identifying which leases require different treatment under FRS 102.

- Build a Cross-Functional Implementation Team

FRS 102 adoption isn’t just an accounting exercise—it requires input from multiple departments. Consider assembling a team that includes:

- Accounting and finance professionals who understand the technical requirements

- Real estate managers who oversee lease negotiations and management

- IT personnel who can assist with systems changes or integrations

- Legal counsel to interpret lease terms and compliance requirements

By bringing these perspectives together, you’ll identify potential challenges earlier and develop more comprehensive solutions.

- Establish a Realistic Timeline for Implementation

Rushing FRS 102 implementation often leads to errors and compliance issues. Develop a practical timeline that includes:

- Initial education and training phase

- Lease inventory and analysis period

- Accounting policy development and documentation

- Systems updates or implementations

- Dry runs and testing

- Go-live preparations

- Post-implementation review

Remember to build in buffer time for unexpected challenges and to allow for proper stakeholder communication throughout the process.

Overcoming Common Challenges in FRS 102 Adoption

Data Collection and Management Hurdles

One of the biggest challenges commercial tenants face is gathering complete, accurate data from leases that may span multiple years and locations. Common obstacles include:

- Incomplete lease documentation

- Inconsistent tracking of amendments or modifications

- Difficulty extracting key financial terms from legal documents

- Reconciling historical accounting treatments with new requirements

To address these challenges, consider:

- Implementing digital document management solutions

- Developing standardized data extraction templates

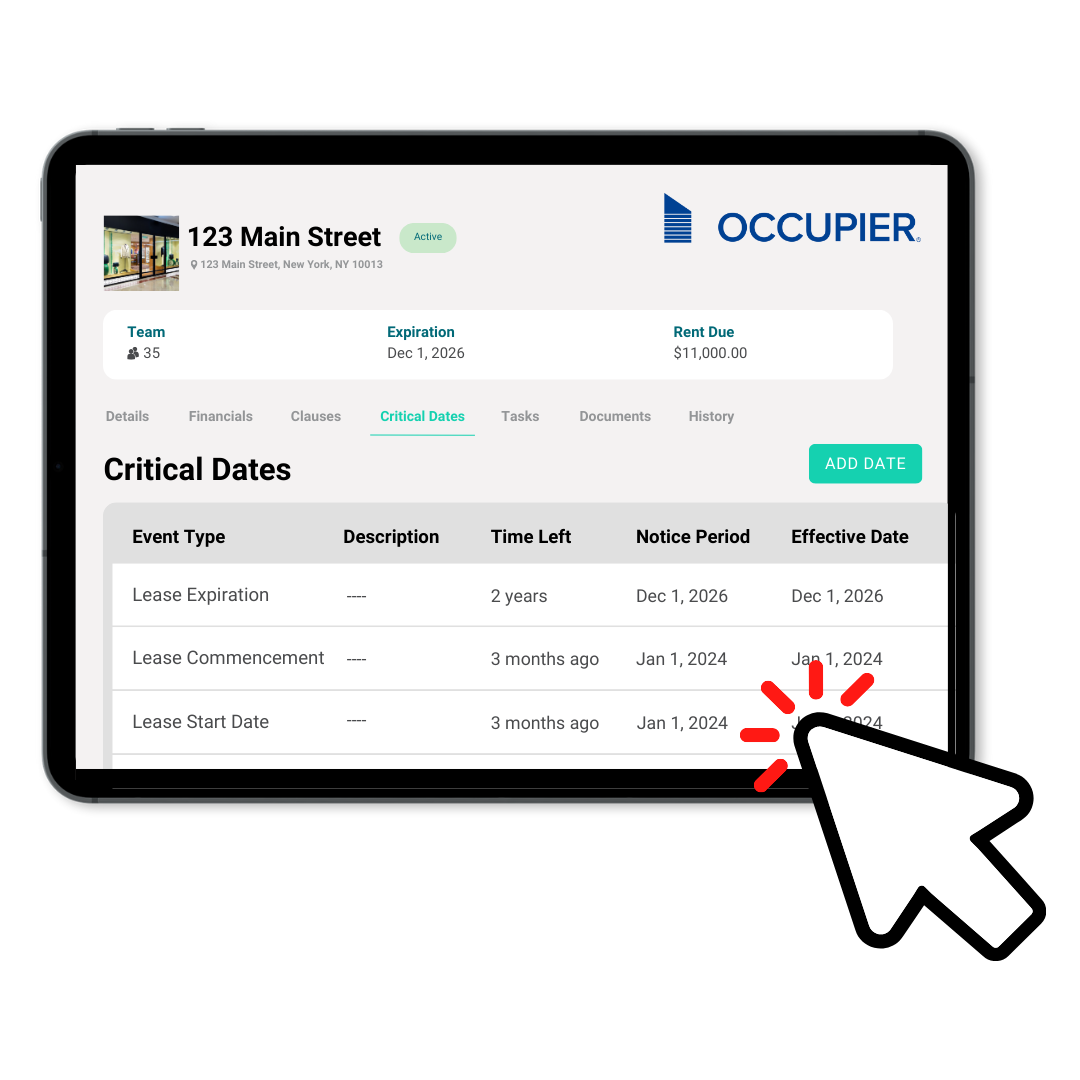

- Utilizing lease management software like Occupier that centralizes lease information

- Establishing quality control procedures for lease data

Managing the Impact on Financial Ratios and Covenants

The transition to FRS 102 may affect your financial statements in ways that impact loan covenants, performance metrics, or management KPIs. Proactively:

- Model the impact of FRS 102 adoption on key financial metrics

- Communicate with lenders early about potential covenant impacts

- Prepare adjusted reporting packages for internal stakeholders

- Review compensation structures that might be affected by accounting changes

Addressing Systems and Process Limitations

Your existing accounting systems may not be equipped to handle FRS 102’s requirements. Consider whether you need:

- Enhanced lease management software

- Updates to general ledger systems

- New procedures for lease modifications and reassessments

- Revised internal controls around lease accounting

Leveraging Lease Accounting Software for Seamless FRS 102 Compliance

How Lease Management Software Simplifies Compliance

Purpose-built lease management platforms like Occupier can dramatically simplify FRS 102 compliance by:

- Centralizing all lease data in a single, accessible location

- Automating complex calculations required by the standard

- Providing audit trails for lease modifications and accounting decisions

- Generating compliant disclosure reports

- Offering real-time visibility into your lease portfolio

The right technology foundation can transform FRS 102 from a compliance burden into an opportunity for greater lease portfolio visibility and management.

Transforming FRS 102 Compliance into Strategic Advantage

The transition to FRS 102 presents challenges for commercial tenants with complex lease portfolios, but it also provides an opportunity to gain valuable insights into lease commitments and financial impacts. With strategic preparation, the right technology, and ongoing compliance efforts, tenants can turn FRS 102 adoption into a strategic advantage. Occupier’s lease management platform helps simplify compliance, centralize data, automate calculations, and provide powerful reporting, enabling better leasing decisions.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.

Resources for Further Reading

Disclaimer: This article is for informational purposes and should not be considered legal or financial advice. Always consult with a qualified professional for specific guidance.