How Van Leeuwen Attained ASC 842 Compliance with Occupier

Last Updated on June 5, 2024 by Amanda Lee

Van Leeuwen’s prior lease accounting process involved the maintenance of a massive Excel Spreadsheet.

So, they implemented Occupier as a means to automate their ASC 842 compliance transition and make their day-to-day lease accounting easier.

Van Leeuwen is a pioneer in the artisan ice cream movement. They serve up delicious scoops of innovative flavors like Earl Gray Tea, Honeycomb, and Sicilian Pistachio to consumers across the country. Founded in 2008, with a yellow truck on the streets of New York City, and on a mission to serve great ice cream with great ingredients. Fast forward 15 years and Van Leeuwen has expanded to more than 40 retail locations across the United States.

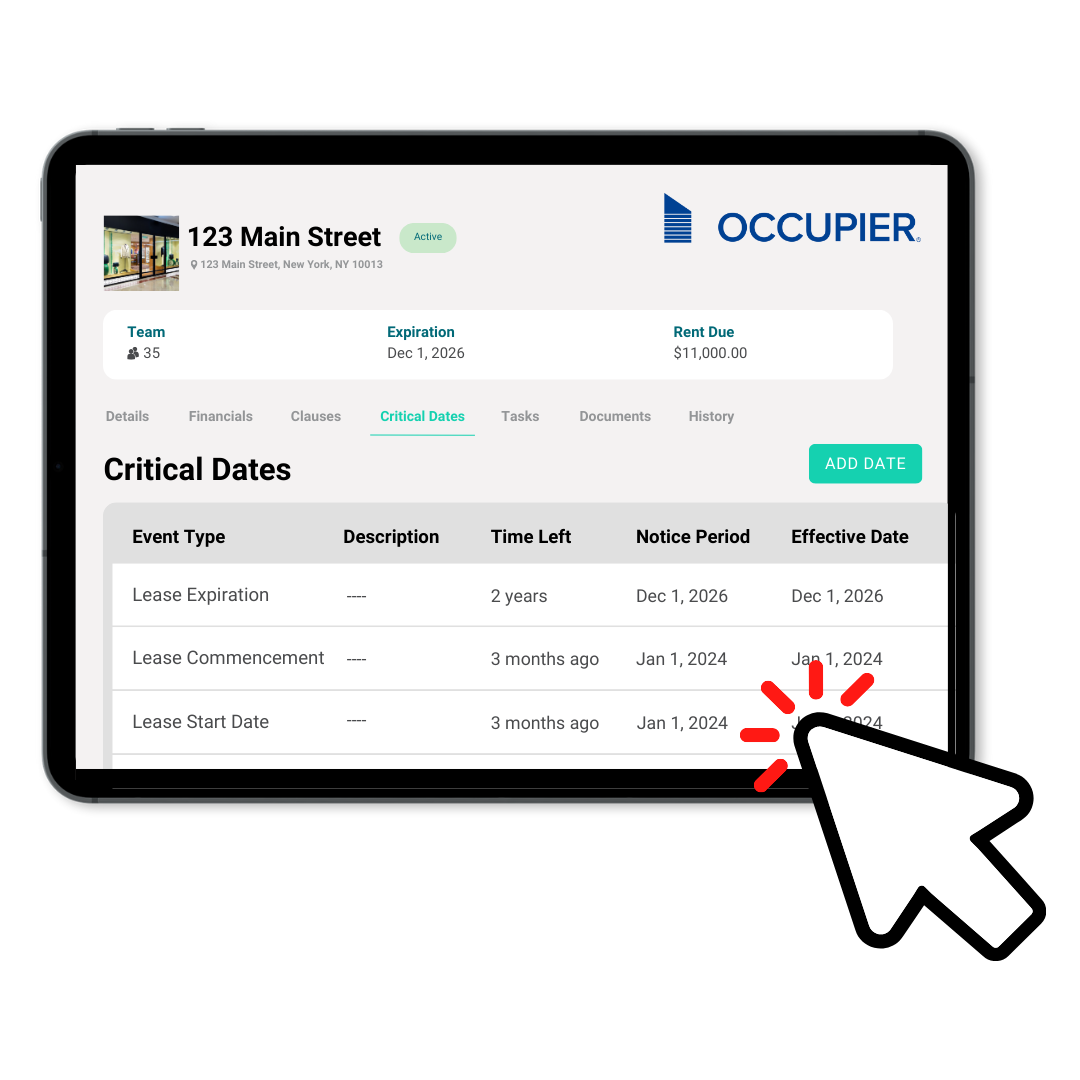

Their robust real estate lease portfolio ranges from retail store leases to production facility leases. All of which require close collaboration between the real estate team and accounting team to manage the entire lease life cycle. Kai Lu, the Controller at Van Leeuwen, and his team implemented Occupier as a means to automate their ASC 842 compliance transition and make their day-to-day lease accounting easier.

Challenge: Lease Accounting Inaccuracies Using Excel Spreadsheets

Van Leeuwen’s prior lease accounting process involved the maintenance of a massive Excel Spreadsheet. “I used to go through each tab, one by one — with 40 locations it became incredibly tedious. My time was spent making sure that every spreadsheet cell was linked to the correct formula each month. Then when we brought on a new lease, I’d manually input that lease data into a new tab on the spreadsheet.” recalls Lu.

The first and most time-consuming step in attaining ASC 842 compliance is organizing (and locating) all of your lease data. “If you are using Excel Spreadsheets to transition, then you are risking data inaccuracies and making it hard to track historical changes, errors, or outline policy decisions in preparation for your audit.”

Solution: ASC 842 Compliance Made Easy

According to Lu, “The new rules can be confusing and complicated for most accountants, but Occupier makes it easier. After you enter the data, the Occupier software calculates your journal entries for you. And, with our leases stored in the lease administration module, monthly rent increases are automatically calculated per lease within the lease accounting module.”

“Now, with Occupier, we export one journal entry each month. As long as our accounts are linked correctly in Occupier and NetSuite, it is an easy export and import process. It’s a smooth lease accounting process each month. This software saves you time, and it is a nice clean interface to hold your lease data. Occupier gives us peace of mind.”

“Switching to Occupier saved us tons of time and it’s much easier to run reports compared to Excel. Our real estate, accounting, and C-suite teams can log in and pull the reports or data sets that they need within a few clicks.”

Benefits of Occupier

Van Leeuwen identified several key benefits of implementing Occupier’s lease management software:

- Save time with automatically calculated journal entries

- Changes in lease administration update in real-time in lease accounting

- At the month’s end, the Accounting Team easily exports Occupier journal entries and imports them into NetSuite’s ERP

- Keep auditors happy with easy access to accurate measurements and operational policies

- Lease abstraction services to import every data point

- Diligent customer success team to quality check all lease data

“My advice to anyone working towards ASC 842 compliance is to start at least 3 months before your audit,” says Lu. “Especially, if a company has multiple locations, and they are not familiar with the new lease accounting rules, Occupier helps make the transition easy.”

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.