What is a Letter of Intent in Commercial Real Estate?

Last Updated on July 25, 2025 by

In a commercial real estate transaction, a Letter of Intent (LOI) is a preliminary agreement that outlines the proposed terms between a tenant and a property owner. Typically structured as a two-page document, the LOI defines the basic business terms of a lease before the parties commit to a legally binding contract.

While LOIs are also used in acquisitions and purchase and sale agreements, this article focuses specifically on their role in lease negotiations. For commercial tenants navigating new space opportunities, the LOI helps clarify expectations, formalize intent, and guide the due diligence process before entering into a definitive agreement.

Why Letters of Intent Matter in Commercial Transactions

The main purpose of a Letter of Intent is to document the mutual agreement between parties before the creation of a formal lease agreement. It provides a structure for key terms and outlines the intentions of the tenant and property owner without triggering immediate legal obligation.

In commercial real estate, this document plays a critical role in aligning legal, real estate, and finance teams before lease negotiations intensify. For tenants, especially those evaluating multiple spaces or markets, Letters of Intent act as decision-making tools that surface deal points, potential risks, and inconsistencies early on. This enables internal approvals to move forward with confidence.

Letters of Intent are particularly valuable in fast-moving markets or complex leasing scenarios. They provide a way to engage in meaningful conversations about lease structure, cost responsibilities, and timeline expectations, without committing to a binding letter or final contract before all stakeholders are aligned.

Key Elements of a Letter of Intent

Though each LOI varies depending on the commercial space and nature of the deal, most follow a similar structure. A comprehensive letter should include the following components:

- Introductory Paragraph: States the intent of the LOI, identifies the parties involved, and outlines the potential transaction.

- Property Description: Includes the subject property’s address, legal description, and general details such as size or special features.

- Lease Term and Rent: Defines the proposed lease term, rent payments, any escalation structure, and whether rent-free periods or rent abatements apply.

- Tenant Improvement Allowance: Outlines any financial support for buildouts and specifies how much the property owner will contribute.

- Operating Expenses and CAM Fees: Clarifies how common area maintenance charges and other shared costs will be calculated and passed on to the tenant.

- Space Configuration: Details the layout, square footage, and any unique space requirements or modifications needed by the tenant.

- Lease Guarantees: Indicates whether a corporate or personal guarantee is required to secure the lease obligations.

- Early Termination and Renewal Options: Addresses flexibility in the lease, such as relocation rights, termination options, or renewal terms.

- Conditions Precedent: Lists requirements that must be met before the lease becomes binding, such as zoning approvals, mortgage clearance, or lender consent.

- Confidentiality Provisions: Establishes the parties’ obligation to keep the proposed terms and negotiations private.

- Signatures: While not always legally required, signatures help formalize the LOI and confirm mutual interest in moving forward.

These elements ensure the LOI functions as more than just a placeholder. Instead, it becomes a reference point for structuring a formal lease while allowing the parties to remain flexible during the negotiation process.

Letters of Intent vs. Final Contracts

It’s important to distinguish a Letter of Intent from a final lease or purchase agreement. A typical sales contract is fully enforceable and legally binding. By contrast, the LOI is generally considered a non-binding agreement. This means that, unless stated otherwise, neither party has a legal obligation to proceed with the transaction based on the LOI alone.

However, certain sections, such as confidentiality clauses or exclusivity periods, can carry legal consequences if violated. These should be clearly marked as binding, and tenants should seek legal advice to confirm the enforceability of any such provisions.

Carefully crafted LOIs help prevent confusion or disputes. They provide the necessary structure to move forward while protecting both sides from unintended commitments.

The LOI’s Role in Negotiation and Due Diligence

Once signed, the LOI functions as a term sheet that informs the formal lease agreement. From this point forward, the negotiation process becomes more detailed and often includes collaboration between internal stakeholders and external professionals.

Commercial real estate brokers assist in aligning market comps and validating the proposed terms. A real estate attorney helps translate business terms into legal language for the lease agreement. Financial teams may initiate conversations with a potential lender to evaluate the impact on capital planning, debt covenants, and operating budgets.

Due diligence activities also increase during this phase. The tenant might conduct property inspections, review title insurance policies, confirm zoning requirements, and assess land survey information to uncover any legal or physical barriers. The LOI serves as the anchor for these efforts, ensuring alignment throughout the lease lifecycle.

Sample Use Cases: When Tenants Rely on LOIs

Here are a few commercial real estate scenarios where LOIs prove especially valuable:

- A real estate investor considering a portfolio lease uses LOIs to outline intent and timeline before negotiating lease language across multiple assets.

- A prospective buyer or tenant evaluating a complex deal structure leverages an LOI to define ownership responsibilities and leaseback terms.

- A tenant relocating HQ uses LOIs to request tenant improvement allowances, agree on security deposit terms, and confirm landlord readiness to deliver space.

Each use case highlights how an LOI can reduce ambiguity, surface inconsistencies, and ensure parties’ interests are clearly documented before progressing to a formal contract.

Using Occupier to Manage Letters of Intent and Lease Execution

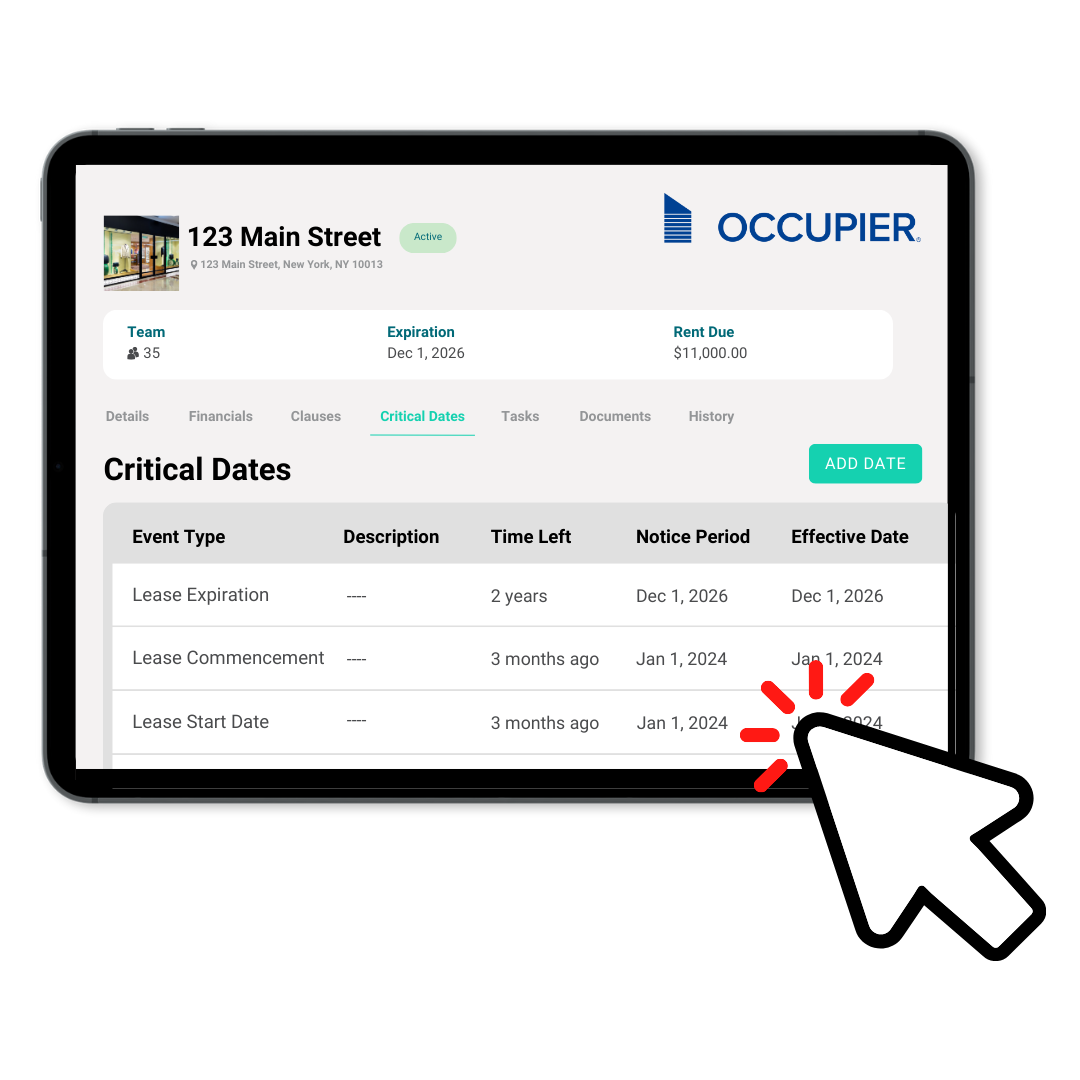

Modern lease negotiations require collaboration across multiple departments. With Occupier, commercial tenants can centralize LOI data, assign task ownership, and track the progression of preliminary documents alongside final lease agreements.

Rather than managing Letters of Intent through siloed tools or static documents, Occupier enables real-time updates, version control, and audit-ready documentation across the lease lifecycle. Tenants can store proposed terms, capture digital signatures, and move seamlessly from initial offer to signed lease with full visibility.

Occupier also helps manage internal workflows—from legal review to executive sign-off—while ensuring that contract terms, obligations, and lease structures remain transparent and traceable.

Why Letters of Intent Are Essential

Letters of Intent are essential tools for commercial tenants navigating new leases or expansion strategies. They define key terms, organize deal points, and allow both sides to confirm alignment before entering into a binding lease agreement.

By outlining the structure of a proposed real estate transaction in advance, the LOI prevents misunderstandings and accelerates the due diligence process. It also empowers tenants to engage real estate brokers, attorneys, and lenders early, improving the quality of decisions made during lease negotiations.

With the help of lease management tools like Occupier, tenants can manage everything from initial offers to final contract execution in one streamlined platform, supporting faster decisions, stronger alignment, and smarter lease outcomes.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.