The Ultimate Guide to Accounting Under the IFRS 16 Standard

Last Updated on October 13, 2022 by Morgan Beard

IFRS 16 is a new standard for lease accounting issued by the International Financial Reporting Standards (IFRS) foundation along with its International Accounting Standards Board (IASB). The goal of IFRS 16 is to offer a comprehensive model for lessee and lessor accounting, covering new, existing, and future leases.

IFRS 16 affects any organization with an international lease and represents an update to an earlier lease accounting standard – IAS 17. IFRS 16 was intended to “provide much-needed transparency on companies’ lease assets and liabilities, meaning that off-balance sheet lease financing is no longer lurking in the shadows.”

What is IFRS 16?

Similar to ASC 842 in the US context, the goal of IFRS 16 was to bring financial visibility into all lease liabilities onto the balance sheet. The critical difference between ASC 842 is that IFRS 16 is the international accounting standard, whereas ASC 842 is the US-only standard for lease accounting.

The significant changes with IFRS 16 are greater financial reporting visibility to non-financial assets such as plant, property, and equipment (PP&E) and outlining financial liabilities. The standard does this by mandating the following rules:

- Balance sheets – lessees must show their right-of-use asset as an asset and their obligation to make lease payments as a liability.

- P&L accounts – lessees must show depreciation as a straight-line basis of the asset and interest expense on the lease liability.

The IFRS 16 effective date was 1 January 2019. This means any annual reporting periods beginning then, as well as any subsequent reporting periods after that date, must adopt IFRS 16. In this article, we’ll cover some key concepts associated with IFRS 16 and how to approach accounting around them – namely lease liability, the right-of-use asset, amortization of both, and how to identify key facts around contracts and leases.

How to Account for IFRS 16?

Under IFRS 16, leases are accounted for based on a single-prong model, as all leases should be treated as financial leases, not operating leases. IFRS 16’s model places a financial obligation on a lessee to make lease payments for the right to use the underlying asset from the commencement date and throughout the lease term.

To recognize the right-of-use asset and the lease liability under IFRS 16, the lessee must acknowledge at the lease commencement date with subsequent accounting for a finance lease to be calculated similarly to IAS 17. These are determined on a lease-by-lease basis.

Deciding Whether a Contract Contains a Lease

The first step in identifying where a contract contains a lease is determining whether an arrangement qualifies as a lease under IFRS 16. The IFRS defines a lease as “a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.”

Lease Term

Now that you know your contract is a lease or contains a lease, the next step is determining the lease term. Accurately determining the lease term is a challenge in adequately applying IFRS 16. Two lease options are important to consider:

Extension Option and Termination Option

When the lessee has the option to extend a lease, it must be determined if there is reasonable certainty they will exercise that option. This judgment impacts the lease term and how today’s accounts accurately represent the lease liabilities in the lease payments.

When the lessee has the option to terminate the lease, the lessee must consider factors associated with that option. These include negotiation costs, relocation costs, the costs of identifying another suitable asset, or the costs of integrating a new asset into the lessee’s operations.

Lease Payments and Lease Liability

According to IFRS 16, lease payments are “payments made by a lessee to a lessor relating to the right to use an underlying asset during the lease term,” comprising the following:

- Fixed payments

- Variable lease payments

- The exercise price of a purchase option

- The termination price of a termination option

- Residual Value Guarantee

The lease liability is measured at the present value of the lease payments. Certain lease payments are reassessed over the lease term, and the lease liability is adjusted accordingly. For example, non-lease components like payment for services are not included in the lease liability, nor are variable lease payments that depend on sales or usage of the underlying asset. As a result, lessees must identify the lease and non-lease components of the costs associated with borrowing an asset.

Separating Lease and Non-Lease Components

For a contract that is a lease or contains a lease, an entity shall account for each lease component within the contract separately from non-lease parts of the agreement unless applying the practical expedients. For example, separate the right-of-use asset and any provision that includes services like equipment maintenance, janitorial work, repairs of building utilities, etc.

Initial and Subsequent Measurement

A lessee may elect to account for lease payments as an expense on a straight-line basis over the lease term. The initial (and subsequent) measurement includes the fixed and variable costs that are measured using the actual index or a rate at the commencement date. A lessee cannot use forward rates or forecasting techniques to calculate variable lease payments.

Subsequent Measurement of the ROU Asset

There are two models that the lessee can apply to the subsequent measurement of the ROU asset. First, a lessee shall measure the right-of-use asset by using the depreciation requirements after the commencement date. The most common way of approaching depreciation is by using the cost model.

The Cost Model

Under the cost model, the value of the right-of-use of the asset is then measured at cost, including the relevant initial direct costs such as prepayments or lease incentives, and then subtracting the accumulated depreciation and impairment losses. The depreciation of the right-of-use asset is recognized by following existing standards for PP&E.

If a transfer of ownership of the underlying leased asset will occur by the end of the lease term, or if the lessee will exercise the purchase option, then the lessee depreciates the ROU asset from the commencement date to the end of the useful life of the asset.

Subsequent Measurement of the Lease Liability

After the commencement date, IFRS 16 requires lessees to re-measure lease liabilities when there is a lease modification. This can include a change in a lease’s scope or the consideration for a lease that was not part of the original conditions of the lease contract.

Interest on Lease Liability

Lease liabilities are measured on an amortized cost basis using an effective interest method, similar to other financial liabilities. Interest on the lease liability in each period during the lease term shall be the amount that produces a constant periodic rate of interest on the remaining lease liability balance.

Amortization of the

ROU Asset

In most cases, a right-of-use asset is amortized by applying a straight-line expense method. At the end of a period within the lease, the value of the right-of-use asset reduces to reflect the time remaining in the lease – with all periods valued at the same amount. This results in a predictable amortization rate under IFRS 16 that is relatively easy to report and easy to understand by stakeholders across an organization.

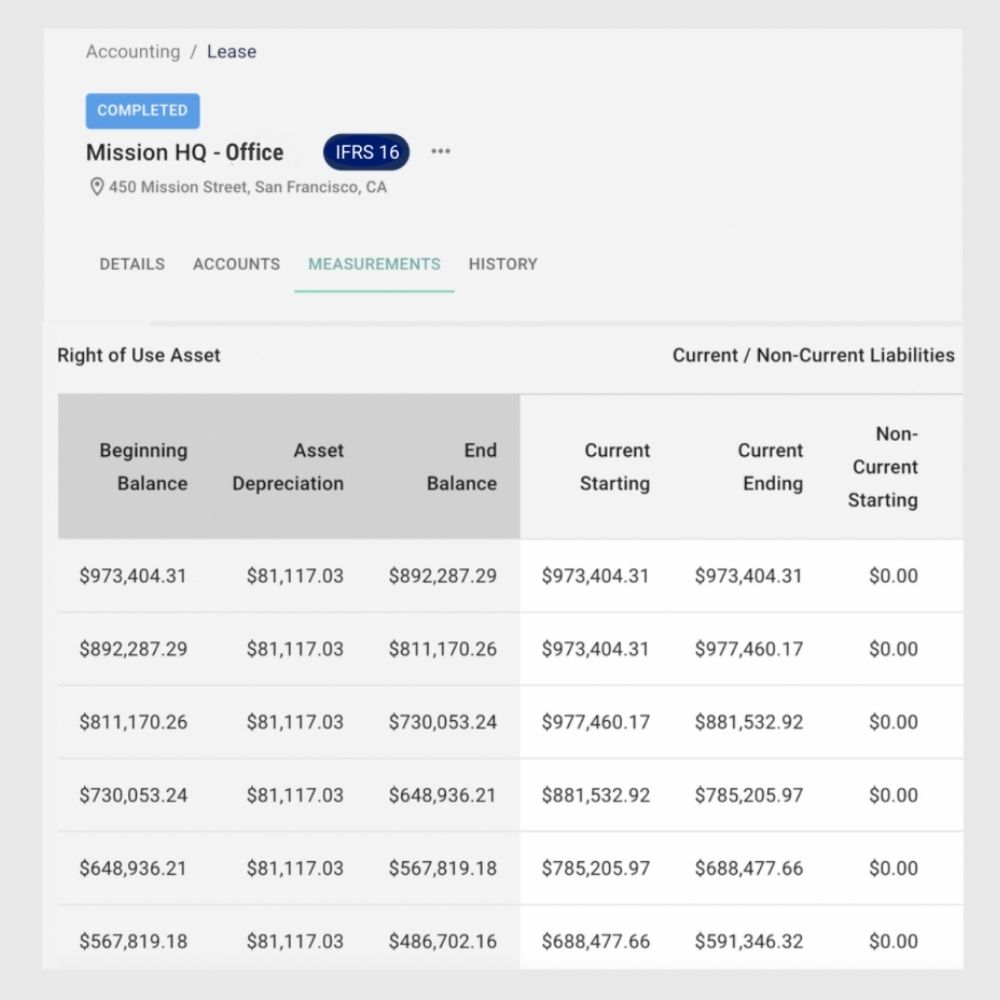

Above is an example of a dual-accounting approach that includes the ROU asset and lease liabilities on Occupier’s UI. In this example, we can see how ROU asset depreciation is handled on a straight-line basis, even when the outstanding lease liability varies period-to-period. This can lead to cases where the outstanding lease liability is markedly higher or lower than the ROU asset, which are handy flags for accounting teams and stakeholders across a lessee organization.

When calculating ROU asset amortization and lease liability reduction, it’s also important to consider variables that often complicate the picture for leases: such as commencement dates, variable payments, re-measurements of liability, and foreign currency exchange.

Commencement date

The commencement date is when the lessee gains possession of the underlying asset and measures the lease liability.

Next, the lessee will take the carrying amount of the right-of-use asset after these entries and add the annual depreciation charge. Once this is done, the lessee has the ending balance of the ROU Asset.

Lease payments

Every payment that was included in consideration of the lease liability will reduce the outstanding lease liability balance.

Different rules apply for variable lease payments that are not included in the measurement of the lease liability, regardless of whether or not these are a high or a low value relative to a comparable fixed payment. Instead, variable lease payments are recognized in financial statements via the income statements and disclosures in the period in which the event or condition that triggers those payments occurs.

Re-measurements reflecting modifications

A lessee shall recognize the amount of the re-measurement of the lease liability as an adjustment to the right-of-use asset. For example, suppose the carrying amount of the right-of-use asset falls to zero, and there is a further reduction in the measurement of the lease liability. In that case, that reduction will be recognized in the income statement.

If any of the following change, then lessees must re-measure the lease liability:

- Change in the lease term

- Change in the assessment of an option to purchase the underlying asset

- Change in the amounts expected to be payable under a residual value guarantee

- Change in future lease payments as a result of index or a rate change

- Change in in-substance fixed lease payments

The lessee will use a revised discount rate when lease payments are updated for a change in the lease term or the option to purchase is reassessed. On the other hand, the lessees will use the actual discount rate when lease payments are either updated for a change in expected amounts for residual value guarantees or payments dependent on an index or rate.

Foreign currency exchange

In essence, foreign currency lease liabilities are foreign currency financing arrangements. These liabilities can present economic benefits by serving as hedging instruments against foreign currency risks, such as through hedging against the foreign currency risk of net investments in foreign operations. For example, a conglomerate based in Europe that accounts via Euros can designate a USD lease liability as a hedge of its investment in a US-based company that accounts via USD.

Read more about how foreign currency leases can serve as useful financial instruments in our Lease Accounting for Foreign Exchange Rates blog. However, it’s also worth remembering that foreign exchange can represent a risk as much as a hedging opportunity – as 2022’s depreciation of the Euro and Pound Sterling relative to the US Dollar has shown.

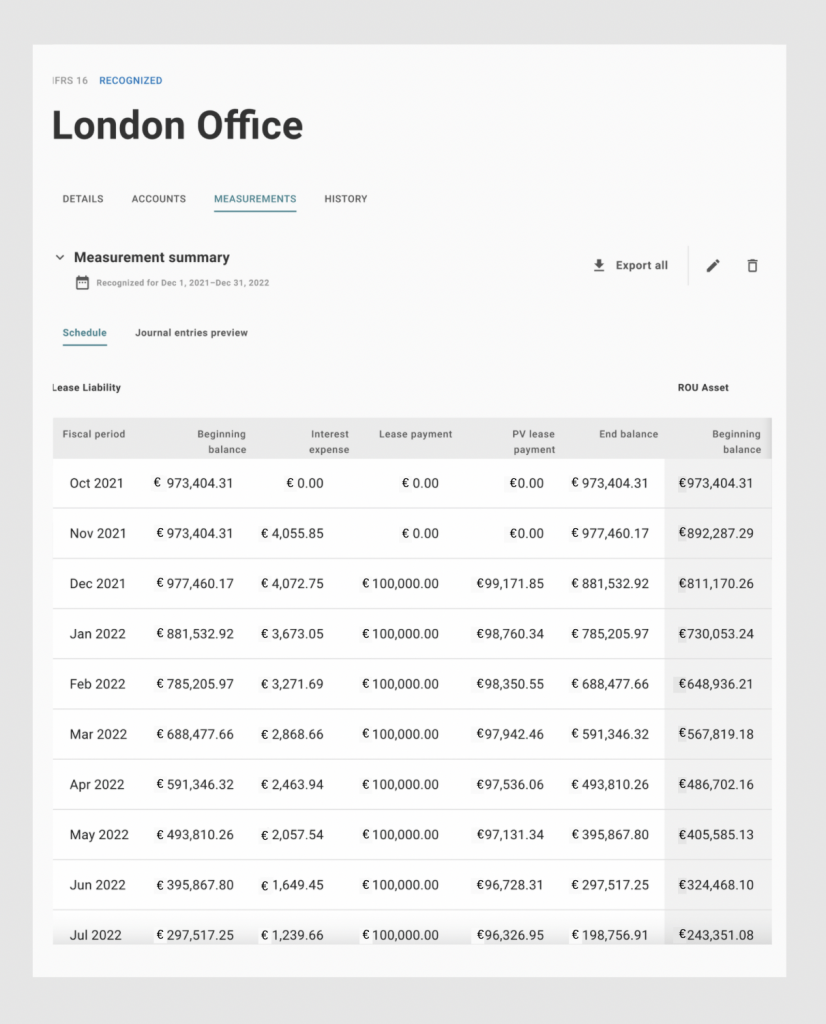

An IFRS 16 Lease Amortization Schedule Example

For overall lease amortization, a typical schedule produced by Occupier typically looks like the one below. In this case, we show the amortization of lease liability for an office in London. To ensure compliance with IFRS 16, this schedule covers the initial balance, interest expense, regular lease payments, and end balance associated with the lease.

What new regulations mean for accounting teams

The lease accounting world is transforming globally and domestically. IFRS 16 and ASC 842, while promising greater transparency to stakeholders, do add layers of complexity and room for miscalculations. The new leasing standards have a similar way of impacting both implementation process and ongoing accounting treatment. Certain types of major changes like these only happen every few decades.

Lease accounting software solutions are here to ease these transitions. And, allow businesses to automate and collaborate across the whole lease lifecycle, allowing them to understand their cash flows better and lease contracts. As a result, teams can reduce their risk exposure, establish efficient processes, and achieve complete transparency into accounting decisions and liabilities. If you’d like to learn more, take a tour of Occupier’s Lease Accounting software suite.