Understanding Letters of Credit: A Commercial Leasing Guide

Last Updated on July 24, 2025 by

In light of the recent Silicon Valley Bank collapse, we want to highlight an important lease covenant that could pose a hidden risk for many commercial tenants: Letters of Credit for Commercial Leasing.

If your leases include a letter of credit (LOC) as a security instrument—and that LOC is backed by a vulnerable financial institution—you may unknowingly be at risk of default. Commercial real estate tenants must proactively evaluate their issuing banks, especially in a shifting financial climate.

Many tenants operate across multiple markets with complex portfolios. While your lease likely specifies the credit amount or states whether a standby letter is required, it may not identify the issuing bank or explain the potential impact of bankruptcy. That missing context can affect your lease position—especially if a tenant-debtor situation arises.

If you’re an Occupier user, we’ve created a video showing how to find your security deposit clause inside Occupier.

Let’s break down what you need to know about LOCs, how they work, and why they matter in commercial real estate.

What is a security deposit?

A security deposit is a lump sum provided by the commercial tenant at lease execution. Its purpose is to protect the landlord’s interest in the event of default—covering unpaid commercial lease payments, property damage, or other losses tied to the lease.

The deposit amount is often based on the type of space, deal size, buildout costs, and the tenant’s creditworthiness. For many companies, locking up working capital in a cash deposit is not ideal—hence the use of LOCs or other instruments like personal guarantees or Revolving letters.

These clauses are highly negotiable and serve as remedies if the tenant defaults. However, it’s not just about the clause itself—it’s also about the financial vehicle behind it.

Example security deposit clause:

“Tenant shall deposit with Landlord, upon delivery of an executed copy of this Lease to Landlord, a security deposit (the “Security Deposit”) for the performance of all of Tenant’s obligations hereunder in the amount set forth on page 1 of this Lease, which Security Deposit shall be in the form of an unconditional and irrevocable letter of credit (the “Letter of Credit”): (i) in form and substance reasonably satisfactory to Landlord, (ii) naming Landlord as beneficiary, (iii) expressly allowing Landlord to draw upon it at any time from time to time by delivering to the issuer notice that Landlord is entitled to draw.” Source: Law Insider

What is a letter of credit?

A letter of credit (LOC) is a financial instrument issued by a bank to guarantee a tenant’s ability to fulfill lease obligations. It’s often used as an alternative to a cash security deposit. The credit amount is usually backed by a frozen portion of the tenant’s funds, allowing businesses to preserve working capital for other needs.

LOCs are often governed by the Uniform Customs and Practice for Documentary Credits, published by the International Chamber of Commerce, which outlines international standards for issuing banks. Commercial tenants benefit from these global norms, particularly in international transactions or when dealing with foreign banks.

A standby letter of credit protects the landlord’s intent to recover damages if the tenant fails to meet lease terms. LOCs are typically irrevocable, unconditional, and allow for credit proceeds to be drawn upon notification of a claim.

Example language may include: “Tenant shall provide a Letter of Credit naming Landlord as beneficiary… expressly allowing Landlord to draw upon it at any time, from time to time…”

How to obtain a letter of credit?

To secure an LOC, you apply through a financial institution—most often your commercial bank. You’ll provide the lease term, stated expiration date, and landlord information. The bank then evaluates your creditworthiness and collateral.

Approval depends on your financial standing. If you qualify, the bank may require a deposit, lien, or hold against your account. Those funds typically remain restricted until the LOC is no longer needed.

In some cases, replacement Letters may be required if the original issuing bank becomes unstable or loses its charter. This became a critical concern during the SVB collapse and should be evaluated regularly in your lease compliance workflows.

The advantages & disadvantages of using a letter of credit for your security deposit

Advantages for the Commercial Tenant

- Preserves liquidity: LOCs allow tenants to retain control of their working capital, freeing up cash for business operations while still meeting lease security requirements.

- Preferred by landlords: Unlike cash deposits, LOCs are considered bankruptcy remote. In a bankruptcy case, the landlord can often access LOC funds outside the debtor’s estate or the tenant’s bankruptcy estate, avoiding the automatic stay provisions under the Bankruptcy Code.

- Speeds negotiation: LOCs can streamline leasing deals by offering landlords a secure, third-party backed instrument—reducing hesitation over tenant credit risk.

- Credit-building potential: Proper use and renewal of an LOC can improve your corporate credit profile and facilitate future leasing agreements or financing.

Disadvantages for the Commercial Tenant

- Costs and fees: Annual issuance and renewal fees can add to the overall cost of the lease. Some banks charge up-front processing fees in addition to recurring charges.

- Requires strong credit: Tenants must meet bank underwriting criteria, which may include financial disclosures or submitting to lien filings. ASC 842 compliance and lease accounting visibility can impact these evaluations.

- Tied-up funds: If collateral is required, those funds become unavailable. In some cases, this could affect cash forecasting or restrict your flexibility in the event of emergencies.

- Complexity: LOCs include precise Notice Requirements, document formatting, and legal review. They are subject to specific enforcement rules, including the independence principle, which separates LOC enforcement from the underlying lease.

Best Practices for Commercial Leasing Tenants

To reduce exposure and maintain compliance:

- Review all existing LOCs to confirm issuing banks are financially stable.

- Track expiration dates and renewal terms using lease management software.

- Prepare for a replacement Letter strategy if using at-risk institutions.

- Consult legal counsel to evaluate enforceability, especially in cross-border or bankruptcy-sensitive leases.

- Consider alternatives like synthetic bonds for greater liquidity without sacrificing security.

Companies like Otso offer solutions that mimic the security of a traditional LOC while protecting the tenant’s cash position. These options are increasingly common among credit-conscious commercial real estate tenants.

Simplify Your Lease Security Process with Occupier

As a commercial tenant, managing lease security instruments like LOCs is a critical component of protecting your business and mitigating financial risk.

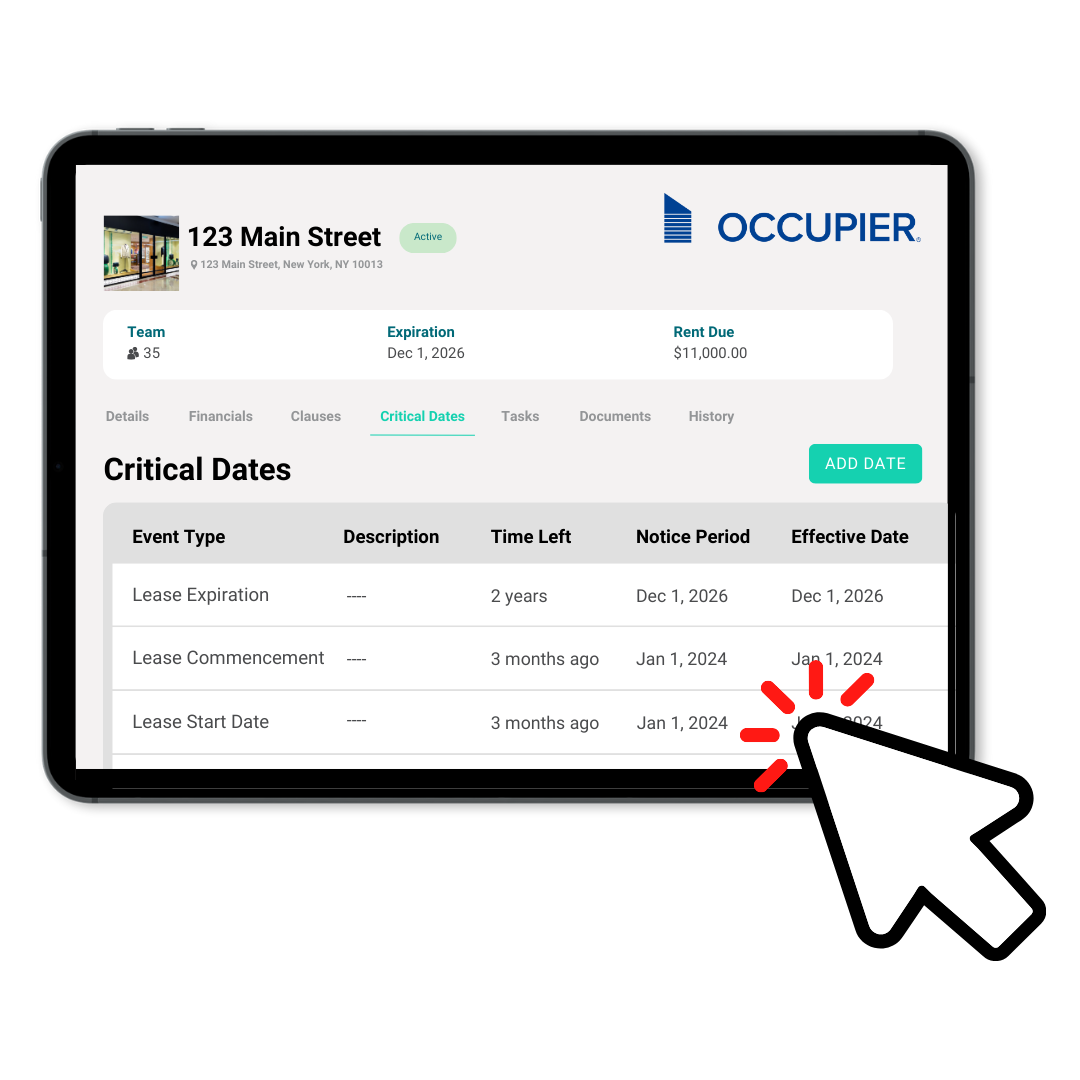

Occupier’s lease management platform enables you to track every lease term—commercial lease payments, security deposit clauses, credit amounts, and critical renewal dates—within a single, centralized system. Our team provides lease abstraction services to summarize security deposit clauses and upload them into the platform for easy access.

No more toggling between spreadsheets or legal files. From credit proceeds to Notice Requirements, Occupier ensures your team stays informed and in control—especially in volatile financial environments.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.