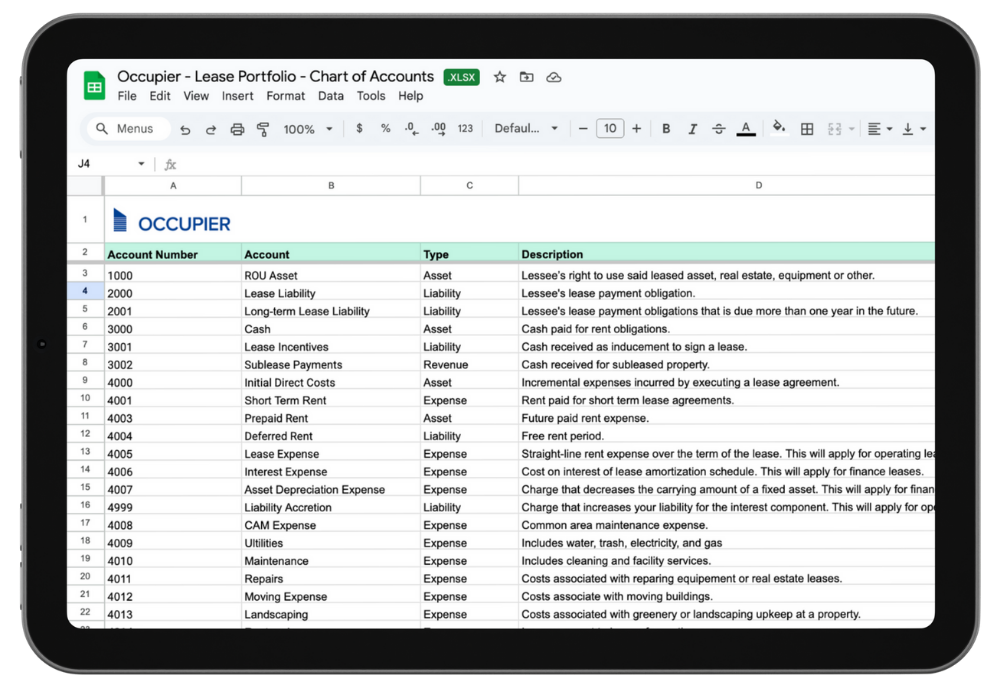

Lease Accounting Chart of Accounts

Our Chart of Accounts for lease accounting purposes sets your team up for compliance and management of your journal entries.

Learn how to set up a Chart of Accounts for your Lease Portfolio

Frequently Asked Questions:

A chart of accounts represents all the accounts at a given business. It’s made up of a list of account codes. Each individual code is made up of several segments, each representing a different aspect or department of the business.

The chart of accounts is at the center of all bookkeeping, accounting, and financial reporting activities. Creating a thoughtful chart of accounts for your lease portfolio is important — a mistake can have severe repercussions down the road. A well-organized chart of accounts simplifies record keeping, ensures accuracy, identifies metrics and analytics, and helps ensure compliance with policies and regulations.

For ASC 842, you’ll need accounts for the Right-of-Use (ROU) asset, Lease Liability, Lease Expense, and any Variable Lease Payments to track and report lease transactions accurately.