Lease Amortization Schedule

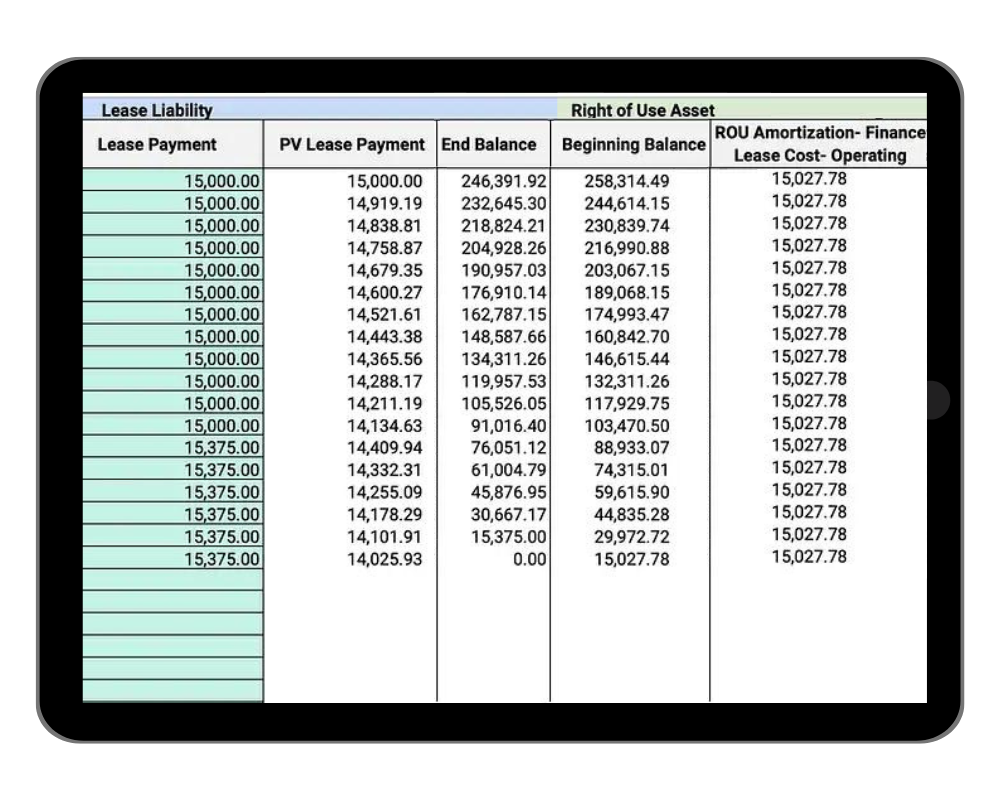

Calculate your ROU Asset and Lease Liability with our Lease Amortization Schedule – Excel Spreadsheet.

Lease Amortization Schedule – Excel Template

Occupier’s lease amortization schedule is crafted to streamline your lease accounting processes, from creating journal entries to measuring leases. Effortlessly calculate lease liabilities, interest expenses, and right-of-use assets—all within a user-friendly Excel template. This template isn’t just a tool; it’s your go-to resource for ensuring compliance and staying organized. Whether you’re managing a single lease or an entire portfolio, our template adapts to your needs. Managing a large lease portfolio? We’ve got software that scales with you, making lease measurements a breeze.

Frequently Asked Questions:

A lease amortization schedule is a detailed plan that outlines the payment schedule for lease liabilities, including principal and interest components, over the life of the lease. It’s essential for accurate lease accounting and compliance with accounting standards like ASC 842 and IFRS 16.

Our Excel template is designed to be user-friendly. Simply input your lease details—such as lease term, interest rate, and payment schedule—into the designated fields. The template will automatically calculate lease liabilities, interest expenses, and right-of-use assets for each period.

A lease amortization schedule is crucial for ensuring compliance with accounting standards like ASC 842 and IFRS 16. It helps you accurately track lease liabilities and expenses over time, ensuring that your journal entries and financial statements reflect the true cost of your leases.

Yes! Our lease amortization schedule Excel template is flexible enough to handle multiple leases. You can manage individual leases within the same template or create separate schedules for each lease, depending on your preference. If you have 10 or more leases, we recommend exploring lease accounting software tools for this.