Lease Cash Flow Analysis

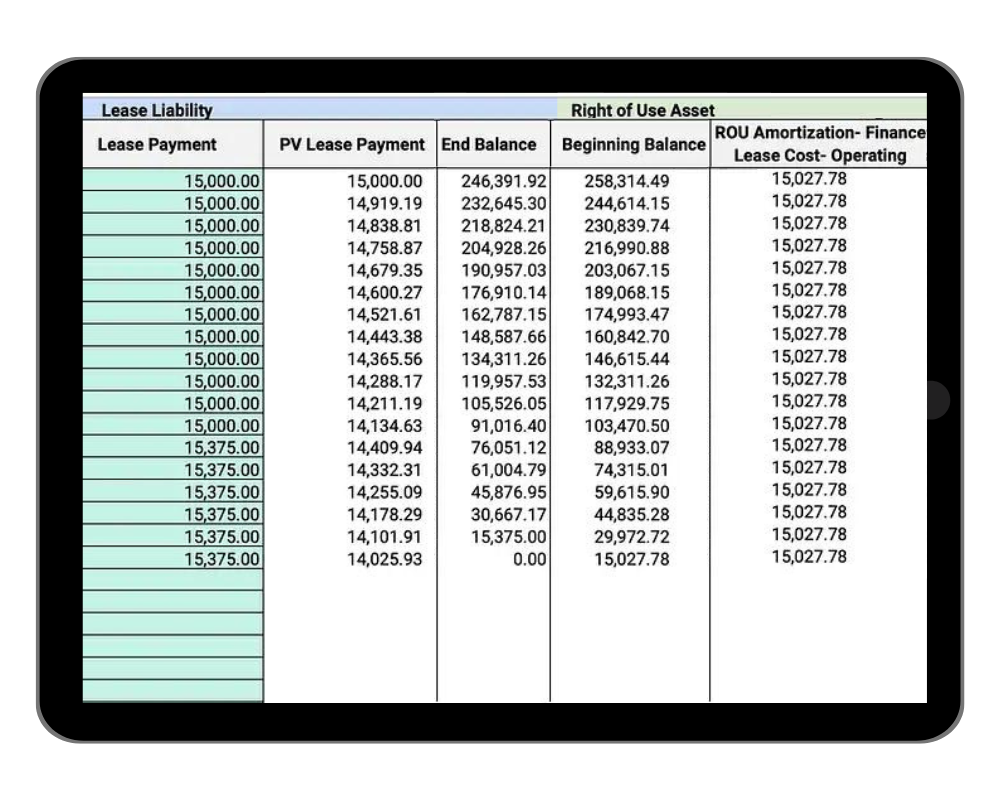

Our Cash Flow Analysis – Excel Template will help you determine whether a lease is financially viable.

Stop overpaying your Landlord and optimize your CAM + OPEX charges

Occupier Co-founder Matt Giffune and lease administration expert, Denise Hinkle sit down in this two-part series to discuss how to audit your lease portfolio CAM, OPEX, and Taxes. And ultimately how to make sure you are not overpaying your Landlord.

Frequently Asked Questions:

Lease cash flow analysis is a financial tool that estimates the cash inflows and outflows associated with a commercial lease. It helps tenants assess the financial viability of a lease, making informed decisions that can impact their business success.

The three primary components are net cash flow, cash inflows (like revenue from sales), and cash outflows (including lease payments and operating expenses). These components allow tenants to track the movement of money and evaluate potential cash flow issues.

To prepare an operating cash flow statement, you can use either the direct method, which lists cash collections and disbursements, or the indirect method, which starts with net income and adjusts for non-cash items. Both methods aim to provide a clear picture of your operating cash flow

Tenants should consider standard deductions for operating expenses like maintenance and property management fees, as well as tenant improvements made to the leased space. Understanding these deductions helps in budgeting and lease negotiations.

An Excel template streamlines the cash flow analysis process by allowing tenants to input necessary data, automatically calculating net cash flow, cash inflows, and cash outflows. This efficiency makes it easier to evaluate the financial viability of a commercial lease.