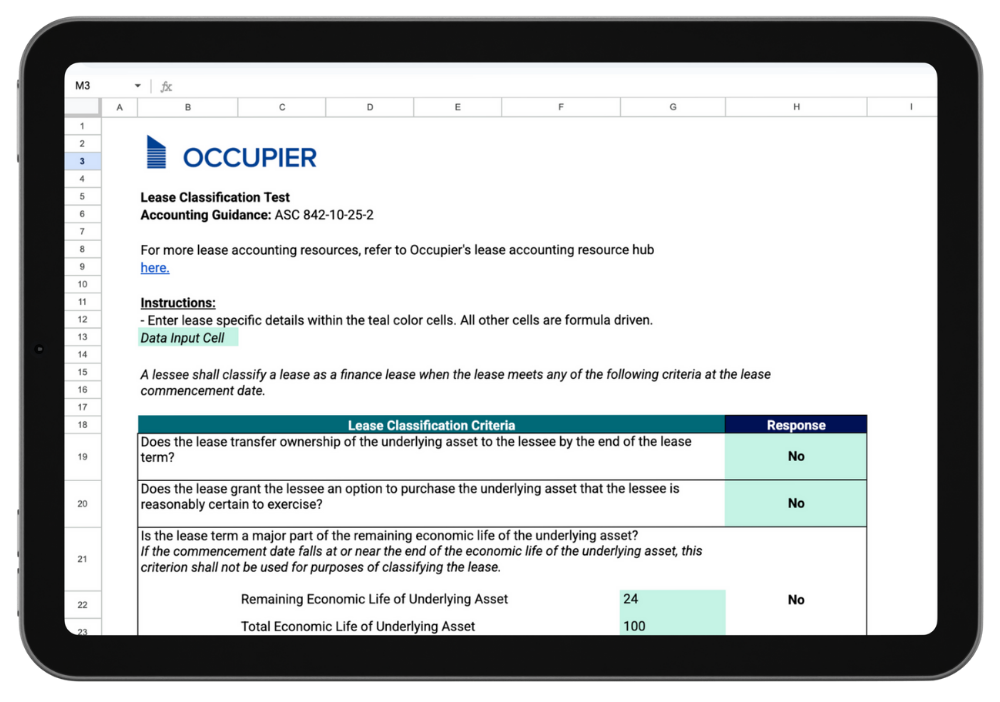

Lease Classification Test

The Lease Classification Test is an Excel tool built to help you determine whether a lease qualifies as an operating or finance lease.

Learn about Lease Classification’s Impact to the Financials

Operating and finance leases each impact the balance sheet differently. For an operating lease, there is a single lease cost on the income statement. For a finance lease, there is interest expense and ROU asset amortization The monthly journal entries for each lease classification is calculated differently. Watch the video to learn how to calculate each lease type.

Frequently Asked Questions:

A lease classification test determines whether a lease should be classified as a finance lease or an operating lease under ASC 842. The test evaluates factors such as asset ownership transfer, purchase options, the economic life of the asset, and whether the asset is specialized or has alternative uses.

A lease is considered a finance lease if it meets any of the following criteria: transferring ownership, offering a purchase option, covering the majority of the asset’s life, or if the asset is specialized. Otherwise, it is classified as an operating lease.

ASC 842 uses a dual model approach that classifies leases as either finance or operating leases, while IFRS 16 generally treats all leases as finance leases, with exceptions for short-term and low-value leases.