Monitoring Lease Critical Dates for Real Estate Leases: A Strategic Imperative

Last Updated on May 22, 2025 by Morgan Beard

The Strategic Imperative of Critical Date Management

Missing a critical lease date isn’t merely an administrative oversight, it represents a material business risk with direct P&L impact. For real estate leaders managing large portfolios, commercial lease critical date management is imperative to keeping your portfolio in compliance and maintaining strategic lease visibility. When your team misses notification deadlines, your company can face hundreds of thousands in penalties, get stuck in leases you wanted to end, and lose your power to negotiate better terms when it matters most.

If you’re leading a real estate department, good critical date tracking isn’t optional – it’s essential for running an efficient operation and keeping your portfolio financially healthy. As leases get more complicated, accounting rules like ASC 842 create more requirements, and there’s constant pressure to optimize your real estate footprint. Having a solid system to manage critical dates has become the foundation of smart lease administration.

What Are Critical Dates in a Commercial Lease?

Critical dates in commercial leases are specific deadlines that trigger important rights, obligations, or decision points for tenants and landlords. These dates require action and planning across multiple departments in your organization.

Common Critical Dates to Track

- Lease start and end dates: When your lease officially begins and ends, also known as lease commencement and lease expiration dates, which are often different from when you actually move in or start paying rent.

- Renewal and termination options: Deadlines to extend your lease or end it early. These typically require notice 6-12 months before the lease ends, with some requiring up to 18-24 months advance notice.

- Rent escalation dates: When your rent goes up through percentage increases, CPI adjustments, or market resets. These directly impact your budget and financial planning.

- Commencement and possession dates: The difference between when you can access the space and when you start paying rent, these are often different dates during buildouts.

- Notice periods for options: The specific window when you must notify your landlord about lease renewals, expansions, or terminations. Missing these means losing valuable options.

- Dates for special provisions: Deadlines for improvement allowances, expense reconciliations, and other financial terms that impact your costs.

The Real Risks of Missing Deadlines

- Loss of negotiation power: Missing option deadlines means you lose leverage when you need it most, often leading to rushed decisions and worse terms.

- Unwanted lease renewal or termination: Many leases automatically renew if you don’t give notice, potentially locking you into years of unwanted space. Or you might lose a location you wanted to keep.

- Overpaying: Without good tracking systems, companies typically overpay by 2-5% annually on rent and expenses – often for years before someone catches it.

- Accounting problems: Under current lease accounting rules, missed dates can create reporting issues that affect your financial statements.

- Legal and operational issues: Missing dates tied to compliance requirements, insurance, or maintenance creates liability risks and disrupts operations.

Why Spreadsheets Put Your Lease Portfolio at Risk

Spreadsheets might work for small portfolios, but they create serious risks for companies with significant real estate lease assets. Commercial lease critical date management is key to keeping your lease portfolio on track, avoiding costly oversights, and staying ahead of renewals, expirations, and key decision points that impact your bottom line.

The Risk Management Problem

- Too many errors: Studies show 88% of spreadsheets contain material errors. For a large lease portfolio, this means thousands of potential mistakes in critical date tracking each year.

- No governance: Unlike purpose-built systems, spreadsheets lack the validation, approval workflows, and audit trails needed for proper management of major lease commitments.

- Knowledge loss: When lease administrators leave (average tenure is under 3 years), critical knowledge often leaves with them, creating dangerous gaps in your critical date tracking.

The Cross-Department Challenge

- Scattered information: Most organizations have lease data spread across 7 different systems on average, making it nearly impossible to track critical dates effectively.

- Disconnected teams: Real estate, operations, facilities, finance, and accounting often track the same leases in different systems, increasing the risk of missed critical dates.

- Inconsistent workflow management: While companies use sophisticated systems for most business processes, many still rely on basic tools like email and calendar reminders for critical lease notifications that represent significant financial commitments.

How Smart Organizations Manage Lease Dates

For real estate leaders, good critical date management isn’t just about avoiding problems, it’s about creating competitive advantage. Companies that excel at critical date management consistently outperform their peers in several key areas:

- Cost savings: By proactively managing critical dates, companies can renegotiate terms before they’re in a time crunch, typically securing 10-15% better terms than those negotiating under deadline pressure.

- Portfolio flexibility: Strategic critical date management gives organizations the runway to make thoughtful decisions about their space needs, allowing them to right-size their footprint as business needs change.

- Financial predictability: When critical dates are properly tracked, finance teams can forecast real estate costs with greater accuracy, reducing budget surprises and improving capital allocation.

- Operational resilience: Companies with robust critical date systems can respond faster to market disruptions because they have clear visibility into upcoming decision points across their portfolio.

- Strategic alignment: Proper critical date management helps ensure real estate decisions support broader business strategies rather than being driven by lease deadlines.

Most importantly, transforming critical date management from reactive to proactive gives real estate leaders more control over one of their company’s largest expense categories, directly impacting the bottom line.

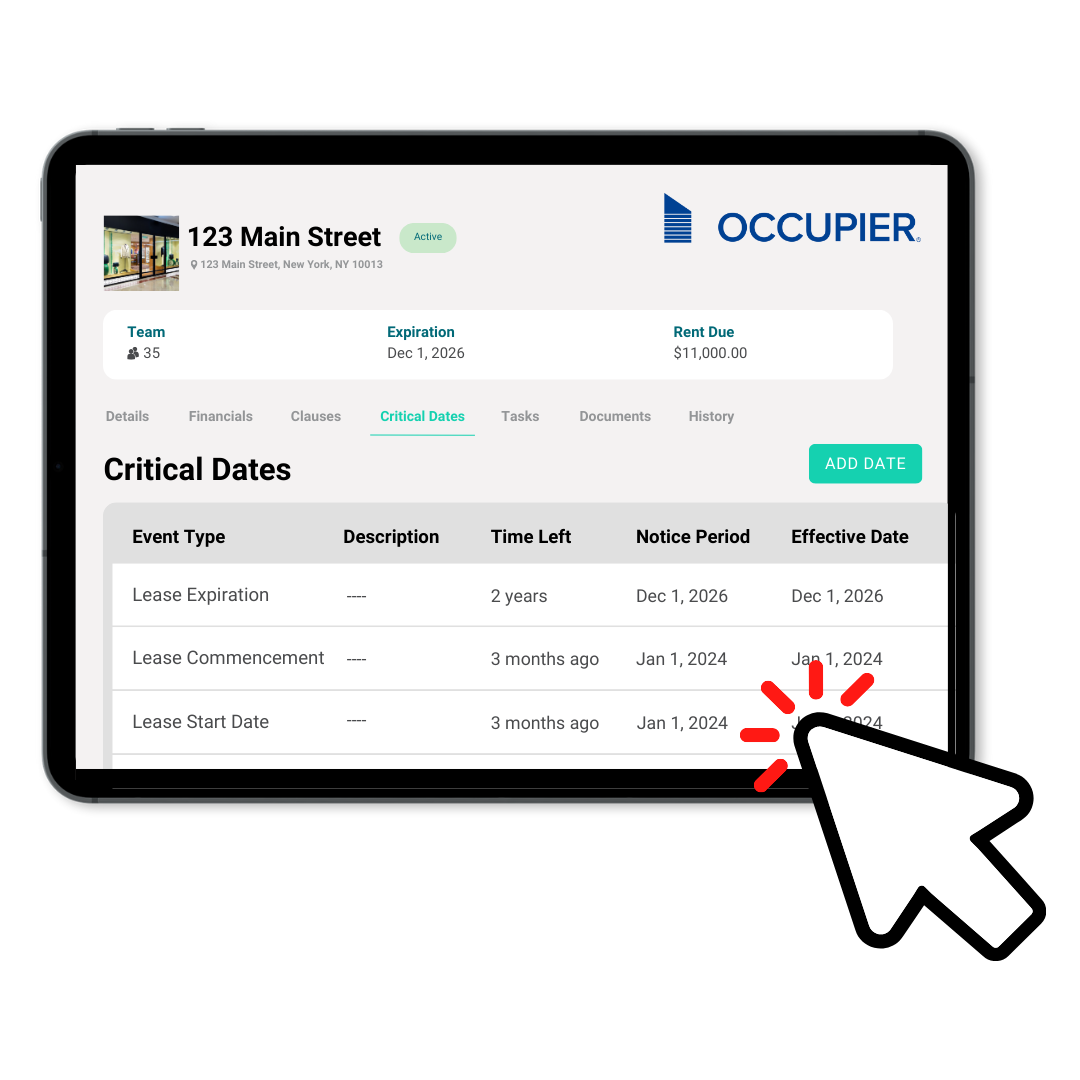

Centralize Your Lease Data

Modern companies use lease administration software from providers like Occupier that are built specifically for commercial tenants. These provide a single source of truth for all lease information and critical dates. When real estate, finance, facilities, legal, and operations teams can all see the same lease data, strategic decisions get made faster and better.

Create Early Warning Systems

Configure notifications at 180/90/60/30 days before action is needed. With multi-stage triggering alerts then your team can strategize which action to take on a given critical date notice. It is also important to establish clear ownership. Automated task assignment ensures someone is responsible for each critical date and provides tracking of all actions taken.

Make Lease Management Strategic

Modern organizations deploy lease management software as a strategic business tool. With clear visibility into critical dates and lease data, real estate teams can plan smarter, negotiate stronger, and drive down occupancy costs. The result? Lease management is a strategic lever to unlock ROI across your entire footprint.

The Bottom Line: From Reactive to Strategic

Strategic critical date management isn’t just about avoiding risk, it’s about creating options, predicting costs, and making your real estate portfolio more flexible. When your team has reliable critical date information and gets timely notifications, you make better real estate decisions that support your broader business goals.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.