How Bluestone Lane Approaches Growth and Location Management

Last Updated on May 22, 2024 by Morgan Beard

Bluestone Lane Founder & CEO, Nick Stone knew legacy real estate tools were not going to help with brick & mortar retail growth.

So, they implemented Occupier as their real estate leasing solution creating team transparency to navigate contractions during COVID, location expansions, and lease renewal negotiations.

For those who have not yet experienced Bluestone Lane coffee, they are a transcendent brand bringing an ‘Aussie’ approach to coffee and healthy bites. Their first location opened in 2013 in Midtown, NY, and they quickly expanded to 30 locations in 5 years and hit 60 locations in 2023.

Founder and CEO, Nick Stone, started Bluestone Lane with a commitment to curating a coffee culture that emphasizes a local and community-centric experience. When Dan Bodner, owner of Bodner Ventures joined the Bluestone Lane team as Head Broker in 2018, he took a strategic approach to growth that prioritized full portfolio visibility, efficiency in processes as well as thoughtful real estate expansion. “I tell all my clients, we need to use Occupier, it is the only answer for commercial real estate lease management.”

Challenge: Legacy Real Estate Tools Lack Visibility

Visibility, access to information, and transparency in your real estate leasing data are the most critical factors when it comes to managing a lease portfolio and, of course, approaching real estate growth.

Without a comprehensive and clear view of leasing data, making informed decisions becomes a daunting task, fraught with the risk of oversight and mismanagement.

As Stone and Bodner strategized the brick-and-mortar growth of their coffee shop chain, they recognized a significant gap in their existing processes. The traditional methods they relied on were not only time-consuming but also prone to errors and inefficiencies. They knew they needed to upgrade their processes and leverage an automated and collaborative single source of lease data truth.

“Commercial real estate is of the utmost importance to how our brand is perceived and whether we’ll be successful or not. At Bluestone Lane, we have a thoughtful approach to where we open locations and aim to integrate ourselves into the fabric of a given neighborhood,” said Stone. This meticulous approach to location selection underscored the necessity for accurate, real-time data to drive their decisions.

Solution: Collaborative Lease Management Software

Bluestone Lane turned to Occupier to solve their real estate challenges by providing a centralized and collaborative platform for managing their lease portfolio. “The Occupier software is our real estate nerve center. Their leasing solution enhances our team’s capabilities to cross-collaborate and keep real estate projects moving forward” says Stone. “If we are entering a new market, Occupier gives us full visibility into where we are in the build-out process, and enables us to assign tasks to team members to keep moving forward”

According to Bodner, “As soon as I enter a new site into Occupier, Nick and the team can see it. Being in a growth phase, we are making decisions quickly; so streamlined visibility creates synergy amongst our stakeholders and allows us to act quickly and strategically. From site selection, deal negotiations contract execution, and ongoing lease management, Occupier keeps our teams aligned.”

“The Occupier software is our real estate nerve center… their leasing solution enhances our team’s capabilities to cross-collaborate and keep real estate projects moving forward.”

Benefits of Occupier:

Stone recognized the value of leasing software in brick & mortar retail operations, “We as a team have to ask ourselves, what are our goals and what tools are at our disposal to ensure that we are functioning in a cohesive and effective manner? Occupier as a real estate solution enhances our team’s capabilities to cross-collaborate and keep projects moving forward.”

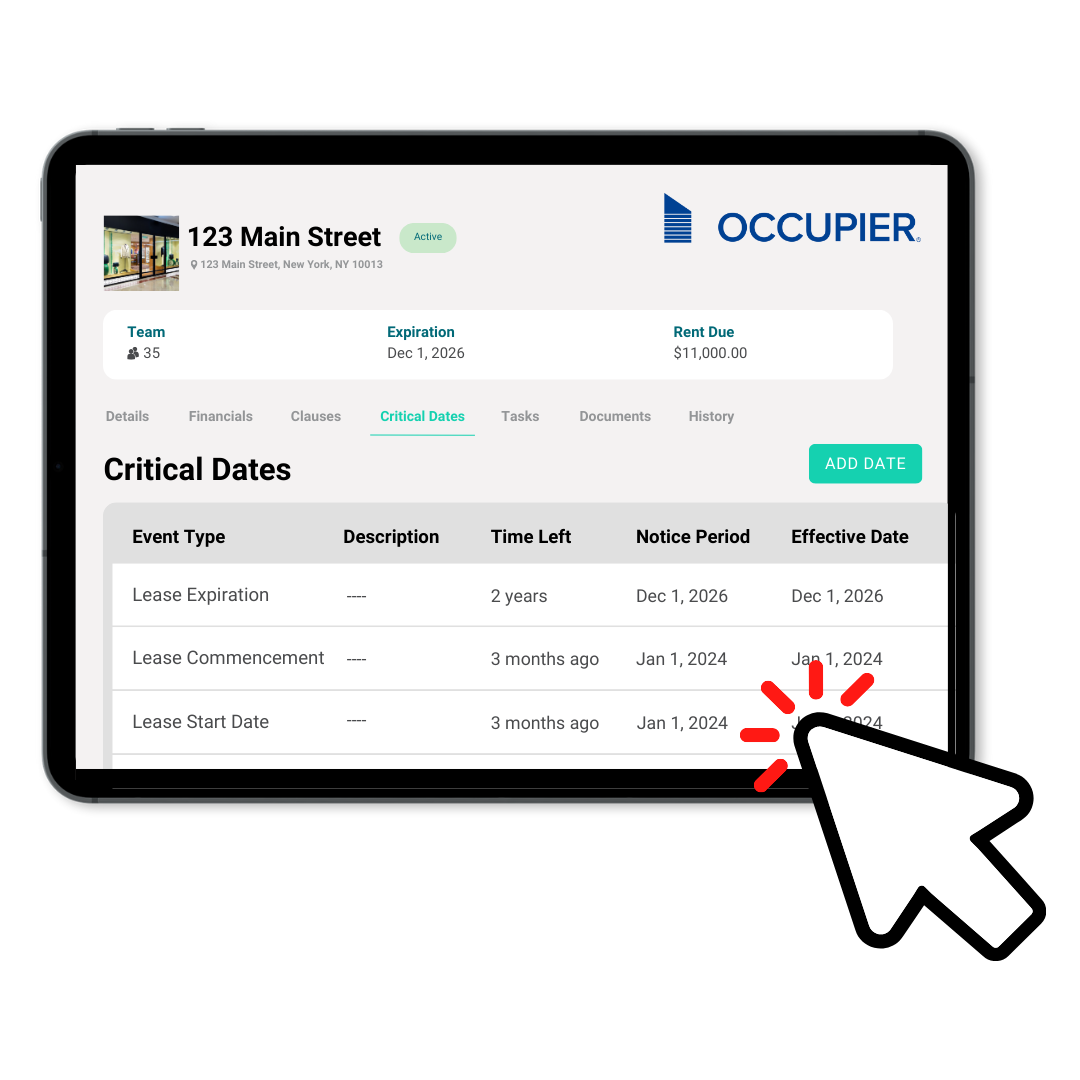

- Comprehensive Visibility: Full transparency into the build-out process and lease portfolio, enabling informed decision-making and strategic planning.

- Centralized Lease Data: A single source of truth for all lease-related information, reducing the risk of errors and miscommunication.

- Streamlined Communication: Enhanced collaboration among stakeholders with real-time updates and shared access to leasing data.

- Deal Pipeline Management: Regular reviews and updates of lease opportunities ensure the team remains aligned and focused on growth.

- Efficient Lease Administration: Detailed insights into lease clauses and conditions, facilitating better management of landlord relationships and negotiating lease terms.

- Automated Notifications: Real-time alerts of renewal options, amendments, and lease expirations keep all departments informed, aiding in timely decision-making.

With Occupier, Bluestone Lane can focus on executing their brick-and-mortar retail strategy and goal of crafting community-oriented coffee shops.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.