Retail Real Estate Expansion Strategy

Last Updated on August 13, 2024 by Morgan Beard

Retail real estate expansion strategies are top of mind for a number of DTC brands and specialty stores. Household names like Bonobos, Warby Parker, and Casper Mattress have proven that the brick & mortar game is alive and thriving.

After weathering the pandemic and inflation, retailers have good reason to approach expansion opportunities thoughtfully. Retailers need a strong real estate growth strategy that provides the foundation to make the best decisions in today’s business environment. More specifically, having access to their lease data, rent financials and market comps in a single-source-of-truth is the first step to elevating a retail real estate strategy into 2023 and beyond.

Retail Real Estate Investment Is Performing Strongly

Retail has been a bright spot in commercial real estate. As distributed work continues and COVID-19 subsides, consumers are looking for ways to reconnect. Shopping, dining, and other experiences with friends and family in local neighborhoods are clear outlets for this need. Retailers who understand this have shifted their real estate management strategy to accommodate this change in consumer behavior. Retailers should strongly consider modeling this approach and expanding into this domain, as it is proving to be resilient and profitable.

This success is playing out on the national stage. Retailers offering personalized, high-value experiences are succeeding; seven consecutive quarters showed positive retail real estate demand, according to an October 2022 analysis. So, retailers should feel confident that if they can provide the right value, they are making strong bets for their futures. However, enacting this shift requires strong organizational practices and disciplined project management.

The State of Retail Real Estate Expansion Strategy in 2023

Karly Iacono, Senior Vice President CBRE Capital Markets, and retail real estate expert sat down with our Co-founder, Matt Giffune to chat about the retail real estate landscape. According to Iacono, “I truly believe retail is one of the hidden gems right now. The retail fundamentals are strong, the tenant health is there, and I’m personally very bullish on this sector moving forward. So from the tenant-side, we have the lowest vacancy level since 2005. In Q4 of 2022, retail vacancy was sitting at 4.9%, that is 9 consecutive quarters of positive absorption in the market. And, a lot of tenants are still trying to expand.”

Why is retail thriving in 2023?

“Retailers have done a really good job managing their real estate portfolio during the pandemic. The stores that needed to close have closed. Retailers are now starting to pay closer attention to their lease portfolio than they have in the past. And the conclusion they are drawing is the importance of bricks & mortar even over ecommerce. Store are more profitable and they are a more important part of retailers consumer engagement strategy post-pandemic.”

Where are retail tenants meeting their customers?

According to Iacono, “retailers are deploying smaller format stores. A great example is Walgreens going from 13,000 square feet to their ‘mini cooper’ format which is closer to 2,000 square feet. Retailers are coming out of the mall and going closer to the consumer in smaller more nimble formats.” Mix-used properties are being built in the suburbs and bringing everything the consumer could want within walking distance.

In a recent Forbes article titled How Can Brands Emerge Triumphant In A Post-Pandemic World, Occupier co-founder Matt Giffune was quoted stating “with decentralized offices and remote work becoming the new standard, people are replacing lunches with colleagues in favor of activities closer to home,” he says. “Spin classes in the morning, lunch with old friends, and shopping downtown at hip specialty retailers are making comebacks.”

What new consumer-centric experiences are retailers creating?

Shoppers want to have an amazing experience. And retail brands are in a unique position to deliver incredible shopping journeys to their customers. According to Karly Iacono, “we are starting to see a weaving in of technology in the customer experience. For example, there are now digital dressing room mirrors that takes 20,000 points of data then recommends outfits for you.” DTC brands are re-writing their ecommmerce script for their brick & mortar strategy. And using their real estate storefronts as a brand awareness and customer rentention channel.

A Single Source of Truth Is Critical for Retail Real Estate Expansion

Personalized experiences and retailtainment are the future of a sound retail real estate expansion strategy. People want to invest their time in places that provide exceptional experiences. Expansion into brick-and-mortar locations are all about your brand and your customer. So, designing an incredible experiential space needs to be a first-order priority. Because of the complexities in this expanding and shifting field, excellent lease and project management software is vital from start to finish on the project.

Commercial real estate automation has never been more important. In the shifting marketplace, retailers need to be nimble to succeed. This means having critical information such as move-in dates, tenant improvement allowances, utility payment responsibilities, option rights, and rent escalation clauses available within a few clicks if an opportunity quickly presents itself. Once a lease is signed, it’s critical to keep the project moving on the proper timeline to get the store constructed to the exact specifications necessary to give the right customer experience. Having all the critical dates, lease data, clauses, and build-out timelines stored in a central, stable access point will keep all project stakeholders aligned and moving forward. It’s important everyone works from the same understanding to avoid delays and twin detriments of construction costs and lost profits.

Having a centralized, dependable data source will provide reliable information for lease needs quickly while also keeping internal parties on a good track for project management. Additionally, there are several other key ways a lease management system can help with business flexibility to take advantage of the current market

1. Financial forecasting

Business leaders first review their profit and loss statements to look for areas to optimize. Real estate leases are usually an organization’s second-largest expense beyond payroll, so this is a particularly important area to track. With rent escalation clauses and expense adjustments tied to the consumer price index posing increasing threats in a high-interest rate and high-expense environment, your real estate leases could have ticking time bombs that are not being tracked. Lease management software that allows for commercial real estate automation is a key defense to make sure expenses are tracked accurately.

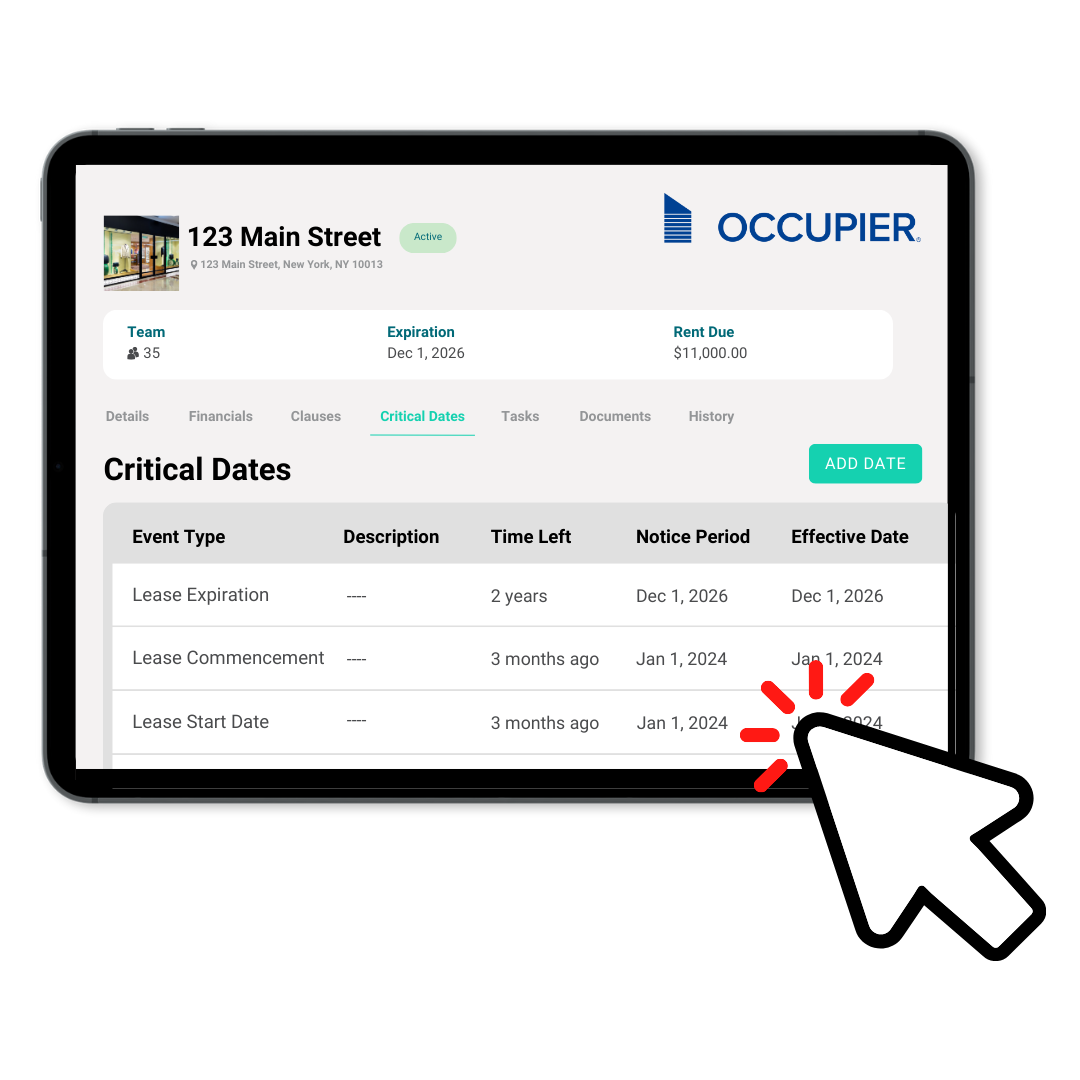

2. Critical date management

A strong real estate management strategy requires surgical precision in tracking critical dates. Every lease has dozens of essential dates. Multiply that by a lease portfolio of 50, and your team is easily tracking hundreds of critical dates. There are enormous financial and operational implications if you miss those dates. For example, if your lease auto-renews, then you might be locked into another five-year lease that doesn’t serve your business. Having a single automated source of truth that notifies you of upcoming and vital dates is critical to navigating a retail real estate expansion strategy amidst economic uncertainty.

3. Lease accounting compliance

The Financial Accounting Standards Board (or FASB) instituted a new lease accounting guideline called ASC 842. With ASC 842 impacting every private, public, and nonprofit organization, complying with these new lease accounting standards is top of mind for every accounting team.

Retailers who move quickly to capitalize on the strong retail real estate market will be rewarded. However, that aggression must be channeled through disciplined underwriting and project management to succeed. Using lease management software from the beginning to the end of the business cycle will help retailers drive their businesses forward and position themselves for success.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.