Know Your Commercial Lease Types

Last Updated on July 28, 2025 by

What is a Commercial Lease?

A commercial real estate lease (CRE lease) is a legally binding agreement that defines the lease structure and rental terms between a property owner and a commercial tenant for leased space. These agreements outline the rental rate, monthly rent payments, lease obligations, and any property-related expenses.

Understanding the right type of lease is crucial for effective financial planning, especially for small businesses managing cash flow, long-term commitments, and operating costs. Whether your leased space is an office, retail location, or industrial facility, choosing the correct lease category impacts your bottom line and business operations.

Types of Commercial Real Estate Leases

Full-Service Lease

In a full-service lease, tenants pay a flat monthly rent that includes all building operational costs—property taxes, property insurance, electricity costs, janitorial services, and common area maintenance costs (CAM). These gross leases reduce financial uncertainty by bundling all expenses into a single payment. Full-service leases are commonly found in multi-tenant buildings like office complexes and offer distinct advantages for tenants who want predictable monthly payments without variable expenses.

Single Net Lease

Under a single net lease, tenants pay a lower base rent along with one operating expense—usually property taxes. The landlord covers other property costs such as insurance and building maintenance. This lease structure can simplify expense categories, though tenants should consult a real estate lawyer to review their financial responsibilities and cash flow implications.

Double Net Lease

A double net lease requires tenants to cover property taxes and building insurance in addition to rent. These leases are common in commercial real estate investments such as industrial properties or commercial spaces in multi-tenant buildings. While offering lower rental fees upfront, tenants assume more expense-related risk and should conduct a yearly rent review to manage rising costs.

Triple Net Lease (NNN Lease)

A triple net lease—or NNN lease—passes on nearly all property-related expenses to the tenant, including taxes, insurance, and CAM costs. While tenants benefit from a lower rental rate, they must also budget for variable lease costs like maintenance fees, area charges, and property management expenses. This type of lease is typically used in single-tenant industrial properties, freestanding retail buildings, or restaurants, where tenants have full control of the space.

Absolute Net Lease (Absolute NNN Lease)

This lease type—also called an absolute NNN lease or absolute lease—makes the tenant responsible for all property expenses, including building insurance, maintenance, and even structural repairs. The landlord’s responsibility is minimal. These leases are most often used in long-term commercial real estate transactions involving national retailers or high-credit tenants leasing standalone buildings.

Gross Lease

A gross lease, often used in office or small retail spaces, charges a flat fee that includes all expenses. Tenants pay one predictable rent payment per month covering CAM, insurance, taxes, and maintenance. Gross leases simplify budgeting and reduce administrative complexity, making them ideal for renters seeking cost transparency.

Modified Gross Lease

Modified gross leases are hybrids that split financial responsibility. For instance, the landlord may cover property taxes and insurance, while tenants handle maintenance and utility costs. Modified Net Leases (a subset of this category) provide flexibility for both parties and are useful when tenants require clarity on operating costs while maintaining partial control over expense categories.

Percentage Lease

This variable lease model combines a base rent with a percentage of the tenant’s gross business sales. Popular in retail and restaurant leases, the tenant’s success is directly tied to rent hikes for the landlord. These leases often include rent review provisions and allow landlords to benefit from the tenant’s performance while offering tenants a lower base rent upfront.

Ground Lease

With a ground lease, the tenant leases the land but assumes full responsibility for the building’s construction, property costs, and maintenance. This type of lease is common in high-value real estate markets where tenants prefer not to purchase land but still want to develop commercial properties. These leases often span decades and should be reviewed with a commercial real estate lawyer due to their long-term commitment and financial impact.

Factors to Consider When Choosing a Commercial Lease Type

Type of Business and Space Requirements

Evaluate your business operations and leased space needs. The right type of lease should align with your operational goals, whether you’re a startup or an established business expanding into new commercial spaces. Consider if your model benefits from fixed payments or can absorb variable expenses over time.

Location and Accessibility

Prime locations often come with higher rental rates and different lease structures. For example, urban retail stores may enter into a percentage lease, while suburban office tenants may prefer a modified gross lease. Accessibility affects not just customer traffic, but also your lease obligations and potential rent increases.

Lease Term

Consider how long you’re willing to commit. A long-term lease may offer a lower rental rate, but also limits flexibility. Conversely, a short-term lease allows for business agility but may come with higher rent or annual adjustments through graduated leases or index leases.

Rent and Additional Expenses

Rent is more than just a flat monthly fee. Tenants must account for building costs, maintenance fees, and common area charges. Understanding how your lease allocates property-related expenses can help avoid surprises. Index leases, which adjust rent based on inflation or market indexes, should be reviewed for long-term budgeting.

Maintenance and Repairs

Who handles what? In gross and net leases, responsibility for repairs varies widely. Tenants should assess whether building maintenance and repairs fall under the landlord’s responsibility or if they must budget for these as part of monthly rent payments. Clarify obligations for HVAC, plumbing, and janitorial services.

Tenant Improvements

Leasehold improvements—such as layout changes or utility upgrades—should be negotiated upfront. Some lease types allow tenants to make improvements and recoup costs through rent deductions. Others may require approval and full payment by the tenant. Real estate leasing agreements should clearly define improvement responsibilities.

Tax Implications

Different lease structures impact how property taxes and rent payments are reported for tax purposes. Tenants should consult a CPA or real estate lawyer to evaluate whether expenses like property taxes, insurance, and CAM costs are deductible. This is particularly important in NNN or modified net leases where financial responsibilities are greater.

Negotiating Your Commercial Lease

Negotiating commercial lease terms is essential for aligning financial responsibilities with your business’s financial situation. Tenants should negotiate variables like rent hikes, leasehold improvements, expense caps, and rent abatement periods. Check out our Ultimate Guide to Lease Negotiations for practical tips on rent concessions, term flexibility, and legal must-knows. Legal advice from a commercial real estate lawyer can also help ensure clarity on common terms and prevent costly misunderstandings.

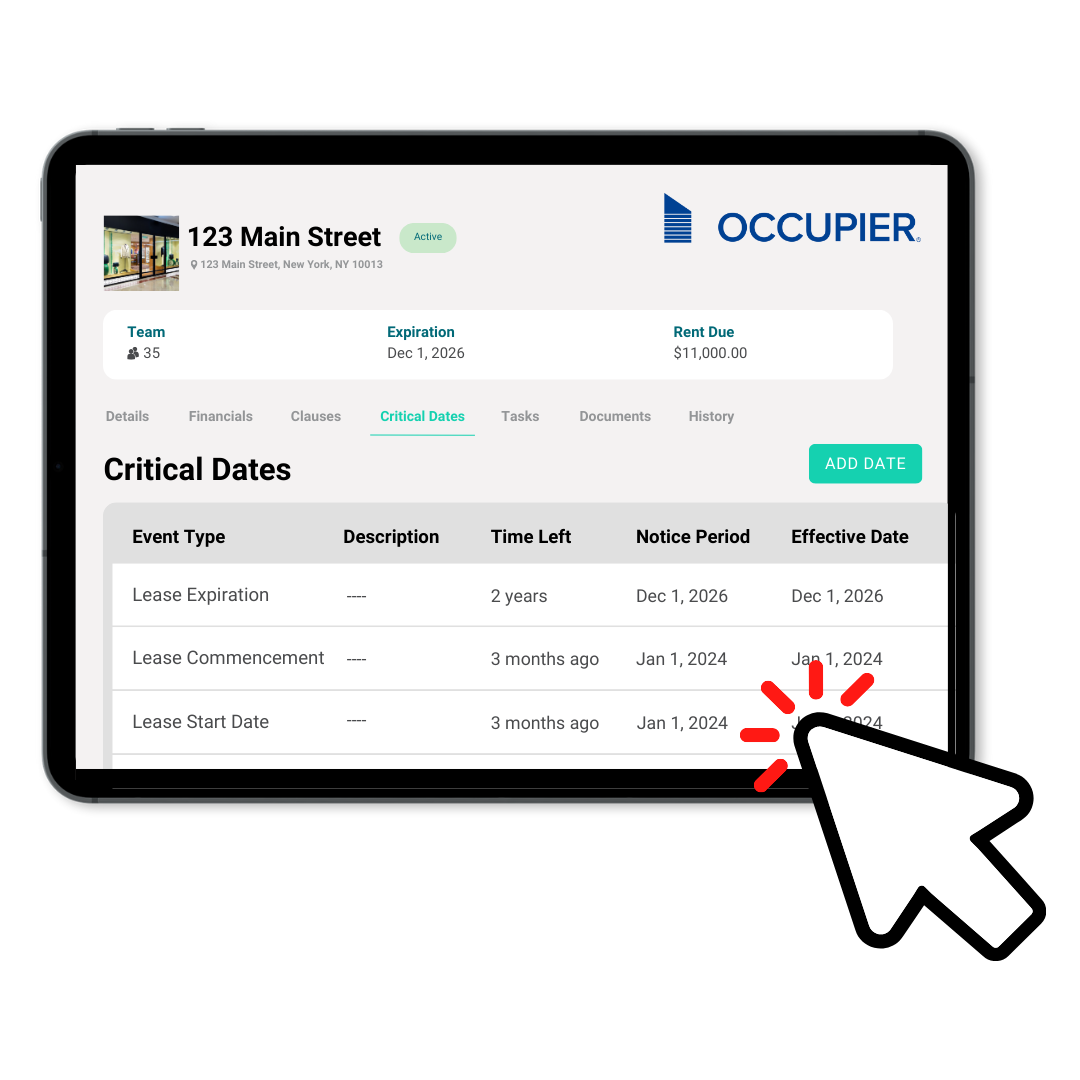

Streamline Your Commercial Lease Management with Occupier

Understanding the different types of commercial real estate leases is only the first step. Managing lease obligations, critical dates, and financial responsibilities across multiple commercial spaces can be overwhelming without the right tools.

Occupier’s commercial real estate software simplifies lease management for tenants. From tracking lease terms and area charges to monitoring rent hikes and common area maintenance costs, Occupier helps you stay compliant, organized, and in control.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.