How to Streamline Lease Accounting Policies & Controls

Last Updated on July 24, 2025 by

Why You Need Policies & Controls for Your Lease Accounting Process

The Financial Accounting Standards Board (FASB) outlines lease accounting policies and controls to ease the transition to ASC 842. While most public companies and nonpublic entities have already adopted the new requirements, the post-audit phase is the ideal time to reassess and refine your lease accounting policies.

This is especially important for commercial tenants managing long-term lease obligations. Implementing effective controls ensures all leases—including operating lease assets and embedded leases—are correctly tracked and reported under generally accepted accounting principles (GAAP). Clear policies also improve your ability to comply with debt covenants and disclosure requirements while safeguarding financial institutions’ trust in your data.

ASC 842 and Policy Elections

ASC 842 provides several accounting policy elections, allowing companies to align lease management with business operations. These elections impact how you classify leases, apply discount rates, and handle lease components. For instance, a business entity may choose a single discount rate or risk-free rate based on asset class.

On February 15, 2023, FASB issued tentative decisions regarding Common Control Arrangements. These updates provide additional clarity for implementing the leasing standard. Stakeholder feedback emphasized the need for consistent accounting entries and documentation when selecting practical expedients or classifying capital leases and operating lease ROU assets.

Documenting each policy—such as excluding short-term leases from capitalization or how to recognize variable lease payments—is critical. Your auditors and Certified Public Accountant will expect to see rationale and references to the Accounting Standards Codification in your ASC 842 policy memo.

Building Your Lease Accounting Process Team

Implementing the new accounting standards requires cross-functional collaboration. As you review original leases and existing leases, identify all departments with leasing authority. These may include IT, operations, procurement, or any team involved with verbal or implicit terms.

Establish a lease accounting task force. This team is responsible for ensuring required accounting entries are applied correctly, whether dealing with production equipment, software contracts, or right-of-use (ROU) assets. Their collaboration ensures compliance with GAAP and internal audit objectives.

Centralize Your Lease Information

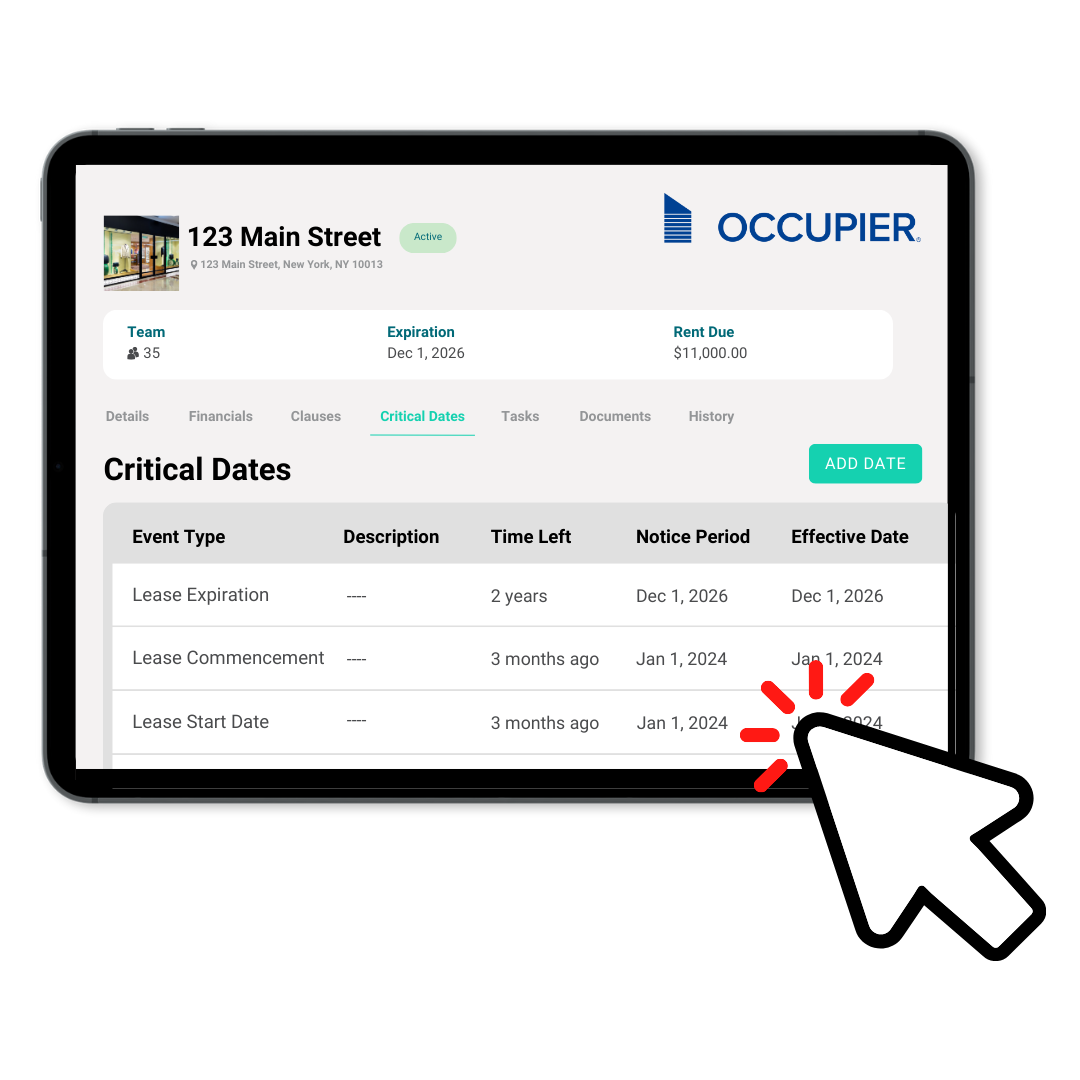

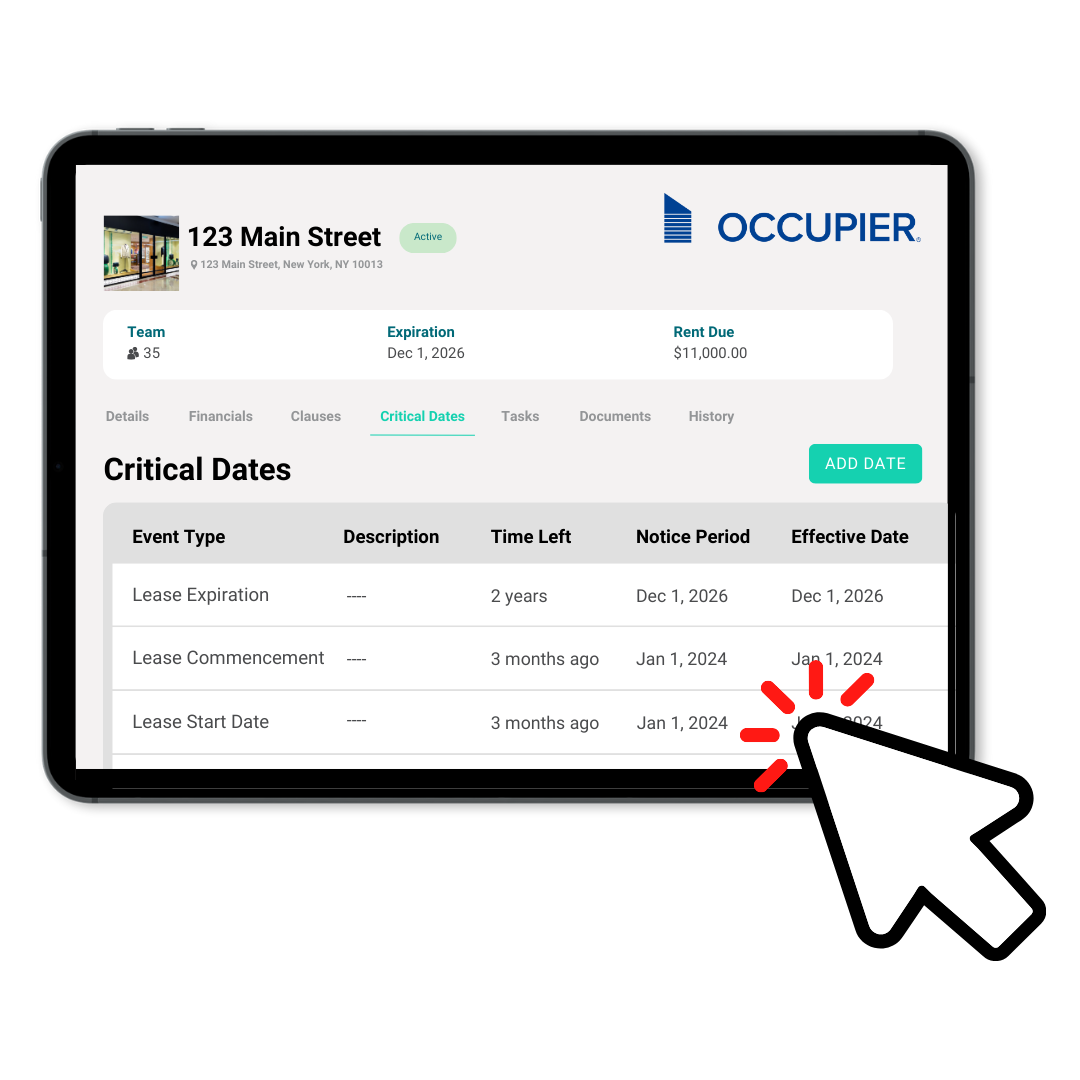

Centralized lease accounting software is essential to managing your lease portfolio. Tools like Occupier Lease Accounting Software allow tenants to centralize and organize data from operating leases, capital leases, and related-party leases.

This improves accuracy in calculating present value, future lease payments, and lease amortization. You’ll also simplify Revenue Recognition tracking and reduce the risk of duplicate or missing entries across statement line items.

A centralized system helps reconcile total lease liabilities with payment schedules and ensures visibility during fiscal year-end and interim periods. It also ensures all lease commencement dates, remaining lease terms, and leasehold improvement assets are properly documented and accessible.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.

Develop Your Policies

The transition to ASC 842 is an ideal time to take a look at your existing policies around lease management. If you’ve been through a transition or are in the process right now, there is policy guidance built into the standards, starting with transition methods.

ASC 842 requires companies to transition following one of two different transition methods because it requires an equity adjustment that reflects the impact of adopting the standard.

Your transition method options under ASC 842 include:

- The Effective Method: Applies the new standard as of the effective data, with any comparative periods still following ASC 840 standards.

- The Comparative Method: Applies the new standard as of the earliest comparative period.

ASC 842 also allows some practical expedients to reduce the burden of adopting the new standard. The options include:

- By lease

- By asset class

- By accounting policy elections

Adequately document the policy choice(s) and their application.

The accounting rules outline that lessees have the option to make an accounting policy election not to recognize the right-of-use (ROU) asset and lease liabilities on short term leases. A short lease term is defined as a lease that has a term of 12 months or fewer at the time of commencement, without an option to purchase the leased asset that the lessee reasonably expects to exercise. If you were to make this election, it must be done at the asset class level.

Set a Materiality Threshold

ASC 842 allows lessees to establish a lease materiality threshold to exclude low-dollar leases from the balance sheet. This can reduce complexity but must align with your capitalization policy.

For instance, if your asset capitalization threshold is $5,000, you might apply the same limit to leases. Document the rationale and ensure consistent application across departments, asset classes, and disclosure requirements. This simplifies compliance without compromising accuracy.

Understanding Your Lease Portfolio

As you centralize your lease data, your team should be gathering an understanding of your lease portfolio.

Although it may seem like a basic step, you’ll want to make sure everyone on the team understands the definition of a lease. A shared understanding of leases will help guide decisions like whether or not to capitalize on short-term leases and the election of practical expedients, which will impact your required accounting entries.

Create documentation of judgments and assumptions that go into creating policies for your lease portfolio. Decisions you make regarding lease renewals, purchase options, and how and when to terminate lease agreements should all be set as policy. ASC 842 guidance specifically mentions reviewing the implications of lease options. You will want to document the factors considered and the rationale for your team’s decisions. This can exclude external factors like current market conditions, the expense of choosing lease options, and other considerations.

The phrase “reasonably certain” is often used in lease standard guidance. But what qualifies as “reasonably certain” is open to interpretation. For example, are you reasonably certain to exercise your option to purchase the underlying asset? How you and your team choose to see it should also be documented as internal controls. It should be a high standard, based on factors like your company’s history and current market conditions.

If you’re already starting with some effective controls and policies in place regarding renewals and purchase options, you’ll be a step ahead. That will give you a baseline to work with, but the team should evaluate any existing policies for their impact on financial statements like your income statement, balance sheet, and P&L statement. In any case, your portfolio should have policies for renewing leases and exercising purchase options and legally enforceable terms on your lease agreements. Financial institutions, auditors, and Certified Public Accountants will use these lease accounting policies and procedures to audit your company’s balance sheet under the new requirements.

Asset Classes vs. Risk and Use

Many elections must be made at the asset class level. Clearly define your asset classes—such as vehicles, equipment, or real estate. For more nuanced reporting, classify based on risk and use: for instance, distinguish between warehouse, office, and retail spaces rather than grouping all real estate together.

This categorization enhances your ability to make lease classification judgments and ensures more accurate financial reporting.

Lease and Non-Lease Components

Under ASC 842, commercial tenants may elect to treat lease and non-lease components as a single component. This practical expedient simplifies required changes to accounting entries, especially when dealing with variable payments or services bundled with the asset.

However, this election must be applied consistently and disclosed as part of your ASC 842 implementation process. Ensure this policy is supported by appropriate documentation and aligns with generally accepted accounting principles.

Forming Your Procedures

Auditors will look to understand the decisions you and your team have turned into policy to mitigate financial risks. This is where your processes and procedures come into play.

In particular, you’ll need to have procedures for capturing your operating lease liabilities, operating lease ROU assets as well as your finance lease liabilities and finance lease ROU assets. External auditors will take a magnifying glass to your lease accounting policies and controls.

Ensuring that all leases are captured is one of the main reasons your team has representatives from multiple departments. Finance teams may be disconnected from other groups like real estate, facilities and operations — groups in a company that might have equipment contracts that qualify as leases. Start by asking all departments for a list of leased equipment and other contracts, along with their ongoing payments.

The team should then compare the list of equipment against existing contracts. Make sure each has a match. If you have equipment without a contract, or vice versa, that’s a sure sign that not all leasing arrangements are captured.

Auditors will need to understand the procedures used to assess the accuracy of your lease portfolio. This is where some thorough procedures can show the due diligence you’ve done, and will continue to do going forward. Start by documenting your procedure of comparing recurring payments to the expenses detailed on your list of leases.

Match the lease information — asset name, serial number, location, vendor, original lease details as well as any lease modifications — for all contracts and look for any gaps. Once the listing is finalized, compare to your lease amortization schedule. Make sure the final listings match your commitment schedule.

Ensure all team members understand what a lease is, and how the new lease accounting standards impact your company. This will go a long way toward ensuring your lease portfolio is full and accurate. Going forward, you’ll have a process for identifying lease agreements and ensuring they’re correctly classified and accounted for.

Rent Expense Procedure

Rent expense should also be matched up to contracts to find any missing data. Expenses accounted for on operating leases will result in a straight-line expense. While expenses accounted for on a finance lease will result in the lessee recognizing the interest expense and the lease amortization expense, the expenses will be higher at the lease commencement date and decrease over time.

Extrapolate annual rent expense from a listing of leased real estate assets against the contract payment details. These amounts don’t necessarily have to reconcile exactly. As long as they’re close, you’ll have a good indication of whether rent expense was captured in the lease listing. Auditors will likely perform a similar reconciliation analysis, so making this a part of your rent expense procedure can save some surprises popping up down the road.

Documenting Your Disclosures

Financial statements have a number of required disclosures. ASC 842 and IFRS 16 each have their fair share of qualitative and quantitative disclosures that expand upon those in earlier standards.

Evaluate the completeness and accuracy of your disclosures, creating a documented procedure around your verification process. Make sure to include any new policies, procedures, and lease accounting controls that went into your disclosures so that auditors can understand your process.

Robust policies, procedures, and controls go a long way toward verifying your disclosures. Auditors will be looking for quantitative footnote disclosures as evidence for accounting purposes, so the more you can document your procedure, the better.

Occupier: The Lease Accounting Solution

When you consider the complexity of lease accounting under the new standards, it’s easy to see why it’s so important to have a full-featured lease accounting software platform. With so many critical touchpoints in the lease accounting implementation process, and ongoing compliance process, all lease data must be in a central location. Enforcing policies, procedures, and controls can be impossible to do manually, but a centralized lease management solution makes it easy to implement your controls.

Occupier offers modern solutions built on an innovative and intuitive tech stack. The entire lease accounting process is automated, ensuring compliance with the latest standards and making it easy to close the books each month. To see how Occupier can take the hassle out of lease accounting, request a demo today.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.