Lease Incentives: Accounting Best Practices Under ASC 842

Last Updated on February 21, 2024 by Morgan Beard

Accounting for lease incentives under ASC 842 and IFRS 16, the new lease standards, requires a methodical strategy by finance teams. During the leasing process, it’s common for lessors and lessees to negotiate terms into the lease contract, and these negotiated terms are also known as lease incentives.

Lessors (landlords) are always looking for ways to make their leased space more suitable and competitive in the eyes of lessees (tenants). And the lessee is always searching for the best deal for a desired leased space. This negotiation process creates lease incentives within ASC 842 and IFRS 16.

What Is a Lease Incentive?

A lease incentive is a payment, reimbursement, or discount from the landlord to the tenant. These incentives might be considered “lease specials” to entice the tenant to enter into the contract. Many features can be negotiated into a lease agreement—however, to be classified as a lease incentive, there needs to be cash flows remitted by the lessor to the lessee (or a payment made by the lessor on behalf of the lessee).

Lease incentives are often exchanged at the inception of a leasing arrangement. However, it’s not uncommon for incentives to be exchanged after the lease commencement date.

A few common examples of lease incentives include:

- A cash payment from the lessor to the lessee

- An allowance given to the lessee by the lessor to be used to improve the leased space and make it suitable for their needs (often referred to as a Tenant Improvement Allowance, or TIA)

- The lessor “buying out” or “taking over” the lessee’s previous lease

- Moving expense reimbursements

Note:a period of free or subsidized rent (no monthly payment) would not be considered a lease incentive under ASC 842/IFRS 16 since there is no exchange of cash flows from the lessor to the lessee.

ASC 842 defines a lease incentive as:

- Reimbursement of or payments made to or on behalf of the lessee

- Losses incurred by the lessor as a result of assuming a lessee’s pre-existing lease with a third party

IFRS 16 defines a lease incentive as payments or reimbursement made by a lessor to a lessee associated with a lease.

Accounting for Lease Incentives Under ASC 842 & IFRS 16:

Lease incentives are crucial in the context of successfully implementing (and maintaining compliance with) ASC 842 and IFRS 16.

When incentives are mentioned in ASC 842/IFRS 16, they are often described as “paid or payable.” In referring to incentives as “paid or payable,” the standard is categorizing these payments into two buckets as follows:

1. Incentives paid at or before commencement

This type would result in a reduction in the ROU Asset at the initial recognition based on the following chart:

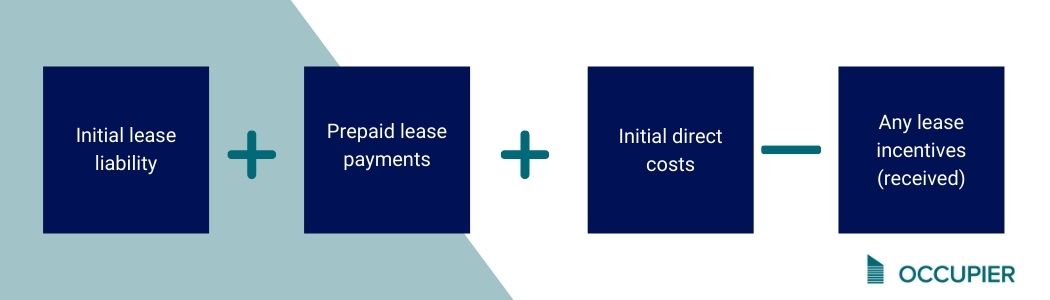

The Right-of-Use Asset is calculated as follows:

2. Incentives payable at commencement but not paid until after commencement.

This type of incentive would result in a reduction of a lease’s monthly payment in the period the incentive payable is due.

A third type of incentive exists that is contingent on a future event (not paid or payable).

In summary, any lease incentives received affects all of the resulting journal entries that follow. Tenant improvements are amortized as a depreciation on your financial reporting.

Reporting Tenant Allowance as a Leasehold Improvement Under ASC 842

The most common lease incentive in commercial real estate is a tenant improvement allowance (after that, a rent-free period), which indicates improvements made to the space.

In lease accounting, we refer to a tenant improvement allowance as a leasehold improvement. Essentially, a leasehold improvement is a reimbursement payment from the lessor to the lessee to cover commercial real estate space renovations. This reimbursement requires the proper lease accounting treatment under ASC 842.

Under ASC 840, lease incentives like moving expenses, reduced rent, or TI allowance were accounted for as a separate liability. And that liability would have been reduced on a straight-line basis. With the ASC 842 standard, when the TI allowance is reimbursed to be paid to the lessee, it then reduces the ROU asset. And it adds a leasehold improvement asset that totals to the reimbursement amount. Both the components and non-lease components will need to be considered in the lease incentives calculation (unless the practical expedients package is elected). Ultimately, the leasehold improvement allowance (i.e., lease incentive) created a separate monthly expense and result in a reduction of the rent expense over the lifetime of the lease.

First and foremost, we must determine who owns the leasehold improvement asset. Is it a lessee asset or a lessor asset?

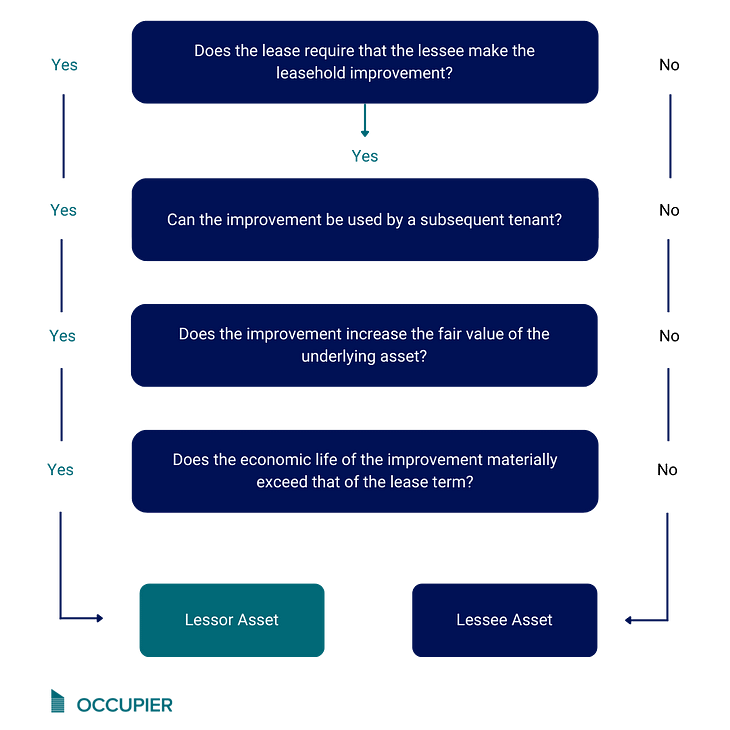

This chart outlines the methodology to make that assumption of asset ownership under the generally accepted accounting principles of ASC 842:

Now you know whether you have a lessor or lessee asset on your hands! Lessee assets are considered to be lease incentive reimbursements. At the same time, lessor assets are not lease incentives, and lessor assets would trigger lessor accounting methodologies. Follow the example below to learn about accounting for lease incentives.

Accounting For Lease Incentives Example

For leasehold improvements that represent lessee assets, then the payment or reimbursement is classified as a lease incentive. In the example below, the lessee (hypothetical retailer) is receiving $50,000 in a fit-out contribution. For this particular lease incentive, the lessor is reimbursing the lessee for building out fittings and fixtures, like dressing rooms, clothes storage, and check-out stations.

| Lessee: | Retailer |

| Lease Term: | July 1, 2023 to July 31, 2026 |

| Base Rate: | $200,000 annual payment on July 31st |

| Discount Rate: | 5% |

| Lease Classification: | Operating Lease |

| Lease Incentive: | $50,000 paid by the lessor by the lease commencement date of July 1st |

Accounting for Lease Incentives – Example

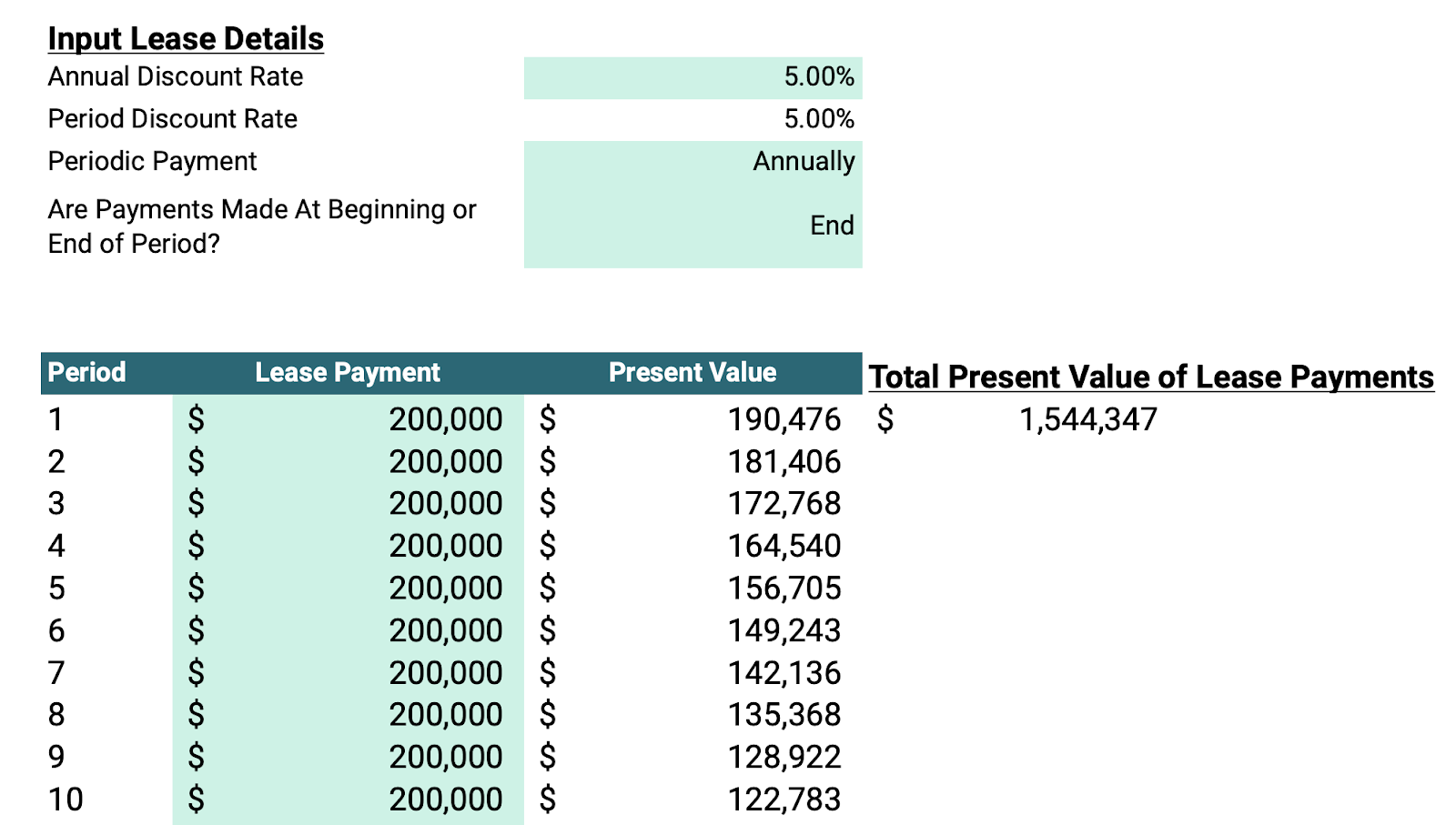

The Present Value Calculator by Occupier outlines the five $200,000 annual payments, each discounted at 3% resulting in a net present value of $1,544,347. That number represents the lessee’s lease liability at commencement. The present value calculation is the first step in accounting for lease incentives. To note, this calculation looks at the future payment of the lease asset at the lease inception.

Lease Incentives – Present Value Calculation

Now we have our opening lease liability. The next step is to calculate the ROU asset. A right-of-use asset is defined as an asset that represents a lessee’s right to use an underlying asset for the lease term. The initial measurement of the ROU Asset under the new lease accounting standard, ASC 842, consists of the following:

Lease Obligation:

- PV of lease payments at the Lease Commencement Date

ROU Asset:

- Lease Obligation + Initial Direct Costs – Lease Incentives + Prepaid Lease Payments

In our lease incentive accounting example above, the lessee was given a $50,000 reimbursement in lease incentives for fit-out renovations at the commencement date. So, the ROU Asset is calculated by subtracting the $50,000 in lease incentives from the lease liability balance of $1,544,347 (as determined by our PV calculations), and that gives us an ROU asset of $1,494,347.

Journal Entry Recorded at the Lease Commencement Date

| Account | Debit | Credit | |

| ROU Asset | 1,494,347 | ||

| Cash | 50,000 | ||

| Lease Liability | 1,544,347 |

Journal Entry Recorded at the Lease Commencement Date of July 1, 2023

Not Paid or Payable Lease Incentives

The third type of lease incentives are those not paid or payable at lease commencement. This type of incentive is contingent upon a future event taking place. For this reason, this category might also be known as “contingent incentives.”

ASC 842 doesn’t directly address this type of lease incentive. As such, there are differing interpretations on how to properly account for “not paid or payable” incentives.

A common approach is to estimate the amount of the incentive and its timing and then account for it as payable at lease commencement time. If there is a substantial difference between the estimate and the actual timing or amount of the incentive, the lease liability and ROU asset should be remeasured. In this case, the lessee would apply the most recent discount rate used.

Lease Incentives Best Practices Summary

It is common for both finance leases and operating leases to have lease incentives. Those lease incentives trigger the leasehold improvement calculation which can be done in excel. In our experience, transitioning to ASC 842 and accounting for lease incentives is infinitely easier by leveraging lease accounting software.

Here at Occupier, our comprehensive solutions streamline the entire lease accounting process. If you are ready to start collaborating with your real estate team and automating your accounting processes, then schedule a demo today.

Lease Accounting Resources

Check out our resource hub. We have the templates, spreadsheets, and calculators to help you manage entire lease lifecycle.