Lease to Rent Revenue Ratio: A Quick Guide Tenants

Last Updated on July 28, 2025 by

Lease portfolio optimization is essential for evaluating the performance and ROI of your commercial properties. Among the many metrics available to business owners and operators, the Lease to Rent Revenue Ratio stands out as a key financial metric that can significantly shape your leasing strategy—especially for retailers, restaurant operators, and multi-unit tenants managing multiple locations.

This comprehensive guide walks through what the Lease to Rent Revenue Ratio is, why it matters, how to calculate it, and how to optimize it based on your company’s financial situation, growth goals, and current market conditions.

What is the Lease to Rent Revenue Ratio?

The Lease to Rent Revenue Ratio compares your total rent expense to the total revenue generated from a leased location. It helps assess whether your rental costs are proportionate to the income your space generates. For prospective tenants evaluating new commercial lease agreements or primary leaseholders overseeing a broader real estate strategy, this ratio offers visibility into performance and sustainability across locations.

Unlike static lease clauses or initial rental applications, this ongoing metric combines actual gross rent, percentage rent, and property taxes to assess how much of your gross income is dedicated to rent. A high ratio may signal a misalignment between your rent payment and revenue potential, prompting a need for reevaluation.

Why the Lease to Rent Revenue Ratio Matters

Tracking your Lease to Rent Revenue Ratio is essential for making informed real estate decisions and protecting your business’s financial health. Whether you’re managing a single unit or overseeing a portfolio of commercial properties, this metric provides visibility into how effectively your leased space contributes to your bottom line.

Evaluating Profitability

A low ratio typically signals that your business is generating strong revenue relative to rent, allowing you to cover other operating expenses—such as common area maintenance, labor costs, and housing expenses—while maintaining healthy margins. In contrast, a high ratio—especially in expensive locations with rising rental rates or a higher base rent—can reduce cash flow and hinder profitability.

Understanding your income ratio in the context of industry standards helps you identify underperforming leases and ensures you’re not allocating too much revenue to space that isn’t delivering a return. If your rent payment consumes 15% of your revenue while peers are closer to 8%, it may be time to re-evaluate that location.

Informing Strategic Decisions

This ratio also supports high-level decision-making around lease renewals, relocations, or closures. It helps determine:

- Whether a lease should be renewed or terminated

- How your lease terms compare to peer benchmarks

- If an applicant’s income aligns with the lease income requirements

- Which locations might benefit from subleasing or layout optimization

It also plays a role in evaluating performance thresholds under percentage rent clauses, especially for tenants in retail settings with variable gross sales. By comparing your Sales Ratio to the percentage rate outlined in your lease, you gain clarity around rent obligations and risk exposure.

Financial Risk and Portfolio Health

The Lease to Rent Revenue Ratio doesn’t just reflect today’s performance—it forecasts potential risks. High ratios may lead to financial strain, missed bank account buffers, or late fees, all of which can impact your credit score and long-term growth. These signals can also discourage future lenders, investors, or prospective landlords from working with your business.

For real estate teams, property managers, and investment property owners, this ratio—often used alongside the Capitalization Rate—helps identify assets at risk of tenant churn, vacancy, or declining rental income. Monitoring it regularly provides an early warning system that supports both tactical adjustments and long-term strategy.

How to Calculate the Lease to Rent Revenue Ratio

Calculating this ratio is straightforward. Follow these steps:

- Determine Total Rent Expense: Sum up all rental costs for the period in question.

- Calculate Total Revenue: Tally the revenue generated from the leased properties during the same period.

- Apply the Formula: Divide the total rent expense by the total revenue.

Formula: Lease to Rent Revenue Ratio = Total Rent Expense / Total Revenue

For example, if your annual rent expense is $500,000 and the revenue generated from that space is $5,000,000, your ratio would be:

$500,000 / $5,000,000 = 0.1 or 10%

This means you’re spending 10% of your revenue on rent.

Industry Benchmarks: What’s Considered Healthy?

While optimal ratios can vary significantly across industries, here are some general benchmarks to consider:

- Retail: 5-10%

- Office: 4-7%

- Industrial: 3-5%

- Restaurants: 6-10%

These figures reflect average industry financial ratios, but your own applicant’s ability to operate efficiently in that space—and generate sufficient income—will determine whether a given ratio is sustainable. Keep in mind that mixed-use buildings, apartments with retail, and unique layouts may impact shared costs.

Best Practices for Optimizing Your Ratio

Monitor Consistently

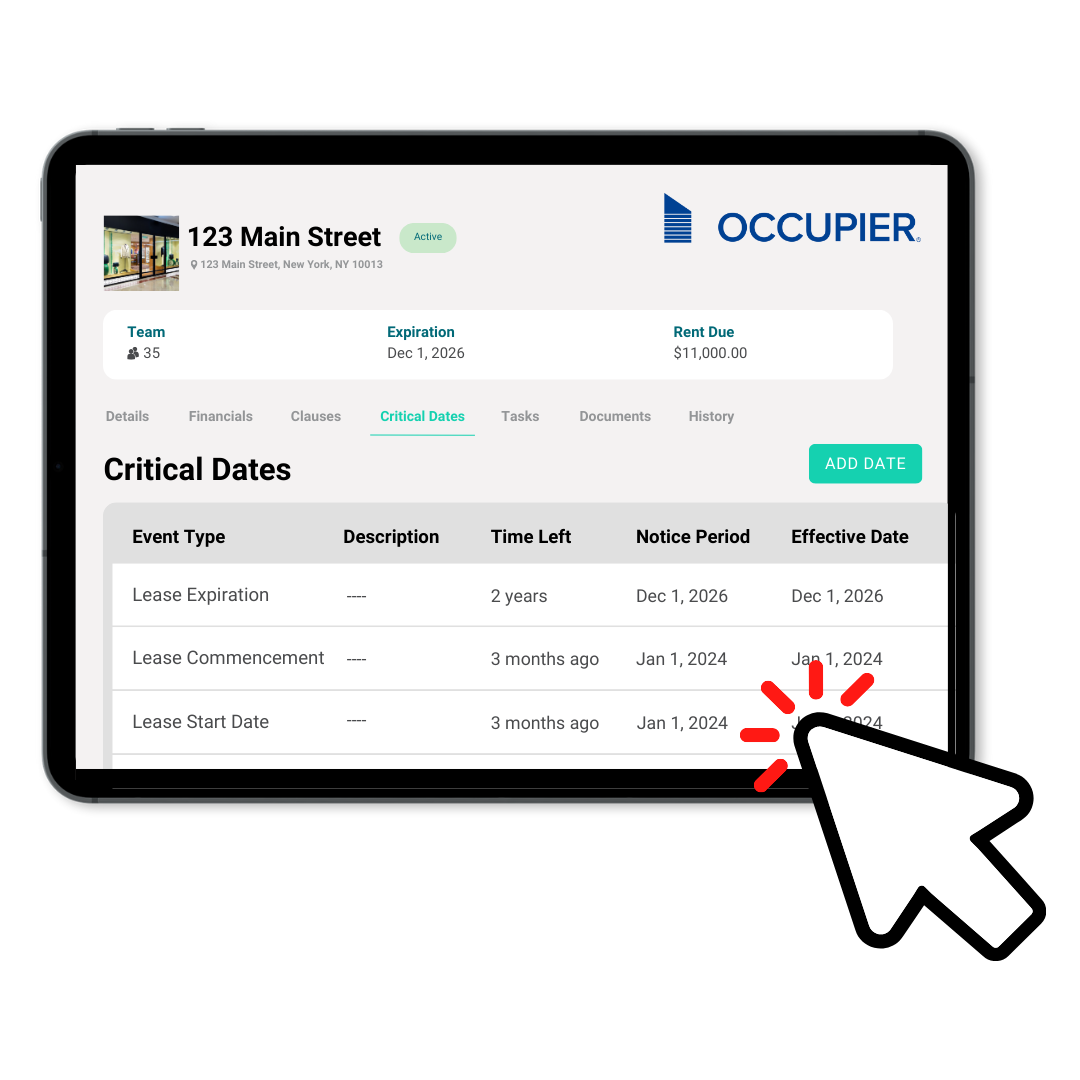

Review your Lease to Rent Revenue Ratio across locations at least quarterly. Use modern lease management platforms to track financial data, monitor gross sales, and evaluate how rental income aligns with business performance.

Use Performance-Based Lease Models

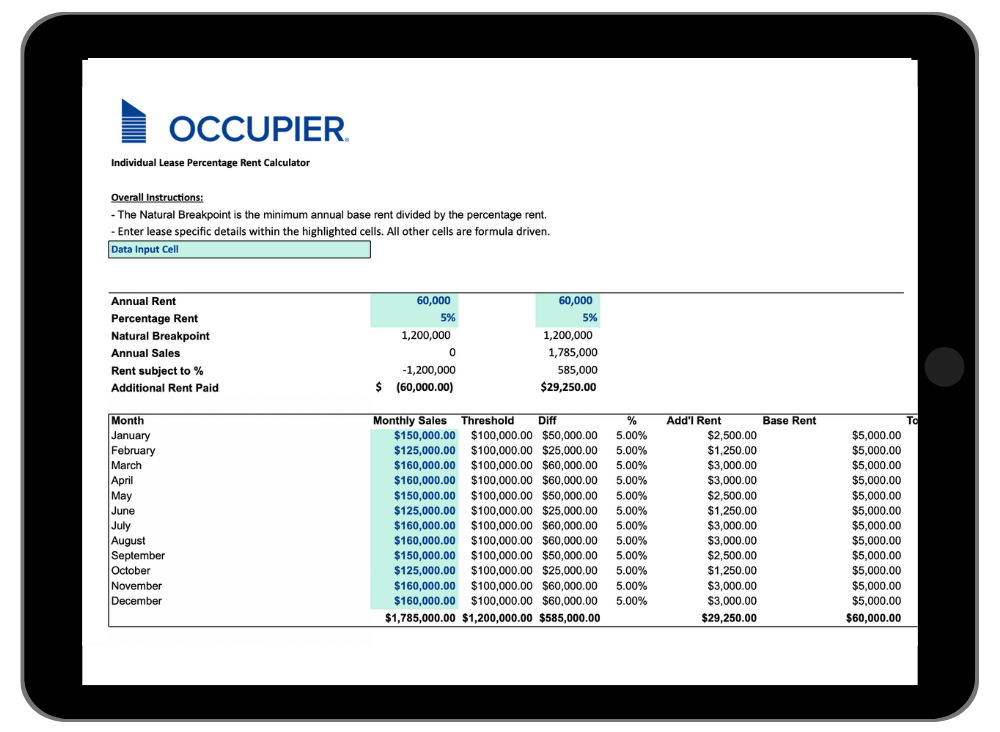

Percentage leases allow rent to scale with revenue. This provides relief during low seasons while supporting property owners through upside sharing when your gross amount exceeds targets. Review each percentage rate and minimum rent to avoid paying more than what your financial model can support.

Maximize Revenue Per Square Foot

Evaluate whether your leased space is sized properly. Sublet underused areas or reconfigure layouts to drive more rental income per square foot—especially in locations with strong foot traffic or premium commercial real estate space.

Negotiate Flexibility

Shorter leases with early exit clauses can protect against changes in the market or operations. Flexible terms reduce exposure to rent spikes, living costs, or poor-performing locations, helping renters remain nimble.

Compare and Benchmark

Use Landlord’s Guides, industry reports, or peer benchmarks to assess whether your ratio aligns with reasonable budget thresholds. If you’re paying significantly more than your peers, work with a Real Estate Agent to renegotiate terms or explore other locations.

Managing Your Lease Portfolio with Confidence

The Lease to Rent Revenue Ratio is more than a formula—it’s a forward-looking tool that allows commercial tenants to make better leasing decisions and protect long-term viability.

By tracking this metric, assessing your household income equivalents at the business level, and comparing rent spend to gross income, tenants can evaluate whether lease terms reflect strong performance or signal the need for change. It’s also essential during tenant screening processes when onboarding a new tenant or evaluating expansion.

With a lease management platform like Occupier, you can visualize these ratios across your portfolio, flag underperforming locations, and compare lease terms against your Terms & Conditions and financial benchmarks. The result? Smarter, faster decisions and a healthier real estate strategy—powered by data.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.