Understanding the ROU Asset Journal Entry

Last Updated on May 3, 2023 by Morgan Beard

ASC 842 fundamentally changed how accounting departments build their organization’s balance sheet, income statement, and cash flow analysis. In this blog post, we will dive specifically into ROU Asset Journal Entry considerations and how your lease amortization schedules, monthly journal entries, and monthly rental expenses will need to be accounted for under the new standard. The income statement and balance-sheet impact from you lessee journal entries under the FASB standards new rules is steep.

Refresher on ASC 842

The lease accounting standards under ASC 842 became effective for all non-public organizations in January 2022. These updated standards (replacing ASC 840) change how private organizations, businesses, and non-profits evaluate and report leases, the information that must be included, and how they should appear on company financial reports, such as the balance sheet.

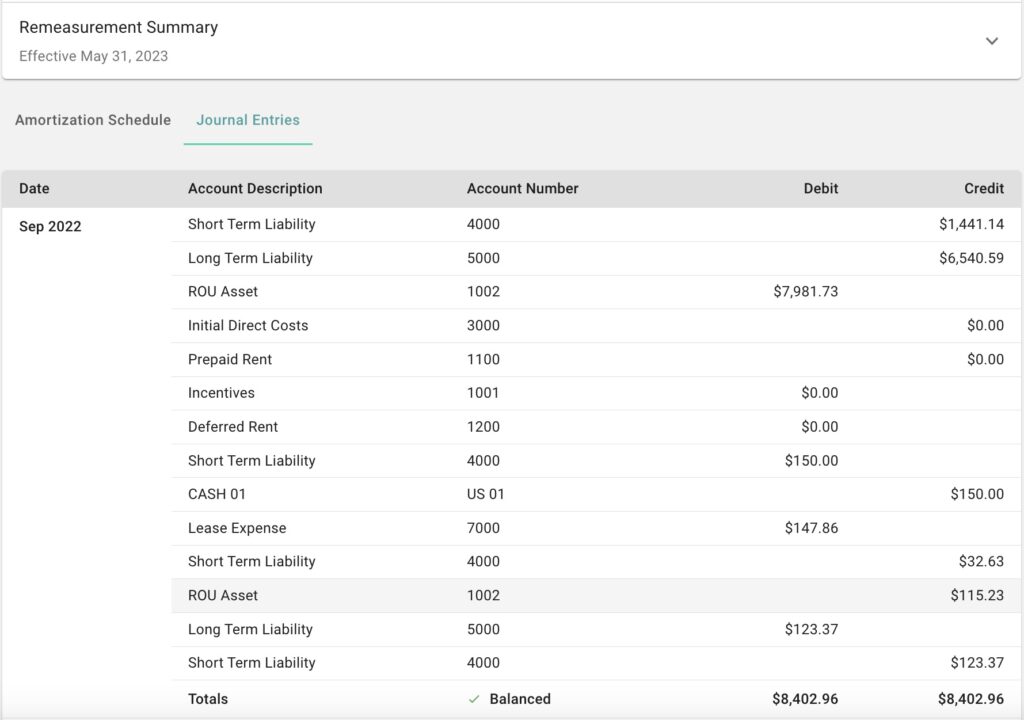

At the time, while most private organizations had begun making the transition, many businesses didn’t feel adequately prepared to entirely meet the new standard’s criteria. New policies and processes had to be chosen and understood as to how they’d impact monthly lease accounting journal entries and end-of-month balance sheets. From the first day of implementation, ASC 842 impacts your approach to operating lease accounting, so it’s important to correctly understand how ASC 842’s principles apply so you don’t run into compliance snags down the road. Below is an example of how lease liabilities and right-of-use (ROU) assets work under ASC 842.

What Is an ROU Asset?

In the United States, under generally accepted accounting principles (GAAP) and guidelines from the Financial Accounting Standards Board (FASB), an ROU asset is an asset that represents a lessee’s right to use an underlying asset over a lease term. Assets that fall into this category include real estate, warehouses, or a fleet of vehicles, but can include any asset that the company typically can use for many years.

Under the new ASC 842 guidance, lessees now report future payments for these assets as a lease liability, but this has left a lot of stakeholders wondering what’s an ROU asset? And how do we account for it? You may be leasing the asset with the intention of the lease payments going towards eventual ownership, or you may only be leasing the asset temporarily.

An example of a lease payment going towards something you’ll eventually own might be a fleet of delivery vans. In contrast, lease payments going towards something you’re using for a certain period but won’t own at the end of the lease payments might be office or warehouse space. While the outcomes differ, you still have the right to use and control these assets during your lease period.

How to Initially Measure an ROU Asset

To create the first ROU asset journal entry, you need to measure the lease liability and calculate the present value of the lease payments you made to Landlord over each fiscal period. You then add any initial direct costs you incurred as a result of signing the lease and subtract any lease incentives you received from the Landlord.

The initial ROU asset journal entry for an asset with a purchase price of $10,000 would appear as follows:

| ACCOUNT | DEBIT | CREDIT |

| Right-of-use asset | 10,000.00 | |

| Current liability | 1,000.00 | |

| Long-term liability | 9,000.00 |

But this is a very clean entry assuming no incentives were provided and no down payment or other costs incurred. So initial journal entries for ROU assets might have other entries, such as debits to cash like deferred rent or prepaid rent. On the flip side, there could be other credits to the lease-liability balance or asset balance. Below is a peek at a more complete ROU Asset Journal Entry within the Occupier platform.

How to Recognize ROU Assets: The ROU Asset Journal Entry Difference Between Finance and Operating Leases

ASC 842 adoption requires recognizing the type of lease before the transition before you enter anything in the journal:

Finance leases: An ROU asset is considered equal to the amount remaining on the leased asset immediately prior to transitioning.

The initial entry for an operating lease is calculated differently.

Operating leases: The ROU asset is equal to the current lease liability, calculated by:

- Adding all prepaid rent to date

- Adding all direct costs to date before amortization

- Subtracting accrued rent to date

- Subtracting lease incentives to date

- Subtracting any ROU asset impairment

- Subtracting any exit or disposal liabilities

But what if your resulting ROU asset journal entry bloats the fair market value of the actual asset?

Can an ROU Asset’s Journal Entry Be Greater Than the Asset’s Fair Value?

Actually, it can. ASC 842 updated outdated guidance prohibiting asset entries from exceeding actual fair market value. But it’s still vital to make accurate lease measurements regarding:

- Discount rate

- Lease identification

- Any non-lease factors

- Contract allocation

So, ROU asset measurements should be as close to actual fair market value as possible.

How to Measure and Enter an ROU Asset Journal Entry Under ASC 842

Measuring ROU assets first brings us back to lease classification test: Finance or Operating?

Finance lease ROU measurement

Unless a solid foundation represents the asset’s usage pattern that better depicts its actual life, the ROU asset journal entry depreciates the asset using the straight-line method.

Operating lease ROU measurement

Unless you’ve modified the asset or experienced an impairment, its measurement closely follows that of its initial entry — recalculate the balance of lease liability after you’ve adjusted for paid lease payments and the cost of the lease. Unless there’s a significant impairment, leased assets falling under an Operating lease classification don’t use an ROU asset journal entry to amortize with the straight-line expense method. After an impairment occurs, however, amortize the remainder of the lease using the straight-line expense.

Maintain ASC 842 Lease Accounting Compliance with Occupier

Occupier can take the pressure of accounting standards and lease compliance off your shoulders, allowing you to focus on what matters most to you — your business. We can help you navigate this new guidance, its implications, and what it means for your bottom line going forward. The financial statement impact from ASC 842 and tracking of your ROU asset amortization expenses and corresponding lease liabilities on your lessee balance sheet are major changes for accountants.

Have a question about an ROU asset journal entry or want to learn how Occupier can help your unique case? Schedule a demo today.