Why Spreadsheets Fall Short in Lease Management

Last Updated on June 10, 2025 by

If you’re still managing your lease portfolio in Excel, you are definitely not alone. In fact, 65% of real estate teams still rely on spreadsheets for lease management, according to a study by RETI.

Here’s the uncomfortable truth: research has repeatedly shown that 90% of spreadsheets contain errors with 50% of processes enabled through those spreadsheets having “material defects”. When you’re managing critical lease obligations, these aren’t just numbers on a page, they’re the foundation of your business operations.

The Realities of Lease Management Today

Commercial real estate has evolved into a high-stakes arena where precision isn’t just preferred… It’s essential. Today’s lease administrators and real estate executives navigate an increasingly complex landscape that includes:

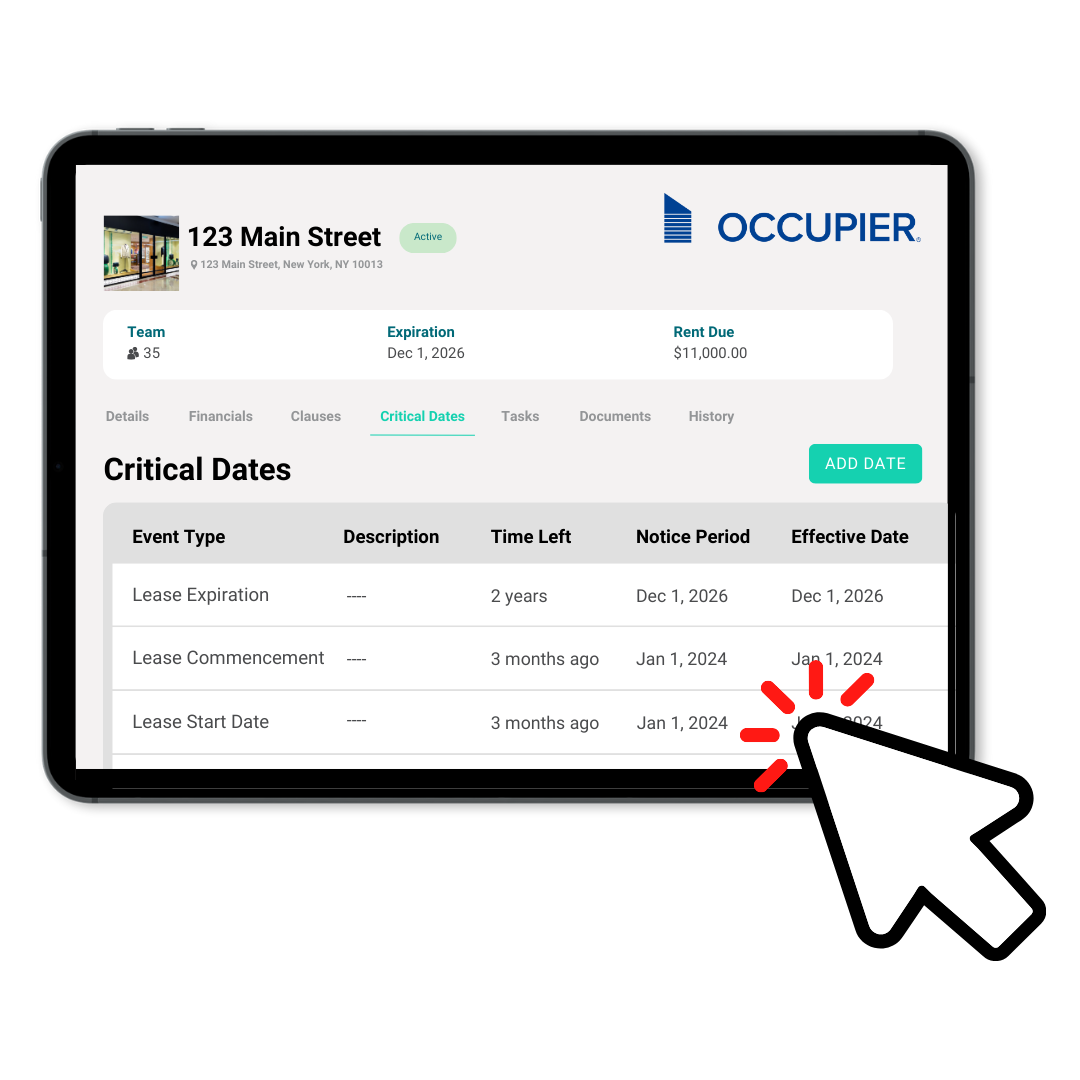

Critical Date Management: Missing a renewal deadline or failing to exercise an option can cost organizations hundreds of thousands of dollars. With lease portfolios often spanning dozens or hundreds of properties, tracking critical dates manually becomes a game of Russian roulette.

Multi-Layered Complexity: Modern commercial leases aren’t simple rent agreements. They involve intricate clauses covering everything from co-tenancy requirements and exclusivity provisions to percentage rent calculations and CAM reconciliations. Each amendment, renewal, or modification adds another layer of complexity that spreadsheets struggle to accommodate.

Cross-Functional Collaboration: Effective lease management requires seamless coordination between real estate, legal, finance, and operations teams. When critical lease data lives in isolated spreadsheets, it creates information silos that can derail strategic decision-making.

Regulatory Compliance: ASC 842 requires lease obligations to be captured on the balance sheet, with calculations that are extremely susceptible to error – particularly if done without automation. The stakes for compliance have never been higher.

The Spreadsheet Trap: Where Good Intentions Go Wrong

Spreadsheets feel comfortable and familiar. They’re the tool many of us learned, and they seem cost-effective on the surface. But this comfort comes at a hidden cost that becomes more apparent as lease portfolios grow in size and complexity.

Version Control Nightmares

Anyone who’s worked with shared spreadsheets knows the frustration of version control issues. Multiple stakeholders making changes in different versions creates a perfect storm for confusion.

Legal updates lease terms in one file, finance adjusts payment schedules in another, and real estate tracks renewal options in a third. The result? Three different “versions of truth” that can lead to costly miscommunications and missed opportunities.

The problem compounds when team members work remotely or across different time zones. By the time everyone syncs up, critical decisions may have been made based on outdated information.

The Human Error Factor

Manual data entry is inherently prone to mistakes and in lease management, even small errors can have massive consequences. A mistyped rent escalation percentage, an incorrect lease term, or a wrongly entered critical date can cascade into significant financial and operational problems.

Consider this scenario: A lease administrator accidentally enters a renewal deadline as December 31st instead of December 1st. That 30-day error could result in losing favorable lease terms or facing an unwanted automatic renewal with unfavorable escalations. When you multiply this risk across dozens or hundreds of leases, the potential for error becomes staggering.

Limited Automation Capabilities

Spreadsheets excel at calculations, but they fall short when it comes to automated alerts and process management. Critical dates pass without warning, rent escalations go unnoticed, and renewal opportunities slip through the cracks.

Manual data entry is not only time-consuming but also susceptible to errors, and the effort required to create meaningful reports often means that insights arrive too late to be actionable. By the time you’ve manually consolidated data from multiple spreadsheets, the moment for strategic decision-making may have passed.

Compliance Challenges in a Regulated Environment

The introduction of ASC 842 has fundamentally changed how organizations must approach lease accounting. Maintaining accurate and up-to-date lease records can be complex due to several factors: Volume of Leases: Organizations with extensive lease portfolios, common in sectors like higher education and healthcare, may manage hundreds or thousands of lease agreements.

Tracking complex obligations like exclusivity clauses, co-tenancy requirements, or sublease rights becomes exponentially more difficult in spreadsheets. When audit time arrives, the manual effort required to validate data accuracy and demonstrate compliance can be overwhelming.

Scalability: The Breaking Point

Perhaps the most telling limitation of spreadsheets becomes apparent as organizations grow. Managing 30 leases in Excel might be manageable, but what happens when that number reaches 300? The linear increase in leases creates an exponential increase in complexity, cross-references, and potential failure points.

As portfolios expand across multiple markets, property types, and legal jurisdictions, spreadsheets become less of a solution and more of a bottleneck to efficient operations.

Real-World Consequences: When Spreadsheets Fail

The limitations of spreadsheet-based lease management aren’t just theoretical. They have real, measurable impacts on business operations:

Financial Penalties: Overlooked rent escalations, missed renewal deadlines, or failure to properly exercise options can result in significant financial losses. One missed deadline could cost more than a comprehensive lease management solution’s annual fee.

Operational Inefficiency: Teams spend valuable time hunting down information, reconciling conflicting data, and manually generating reports instead of focusing on strategic initiatives that drive business value.

Risk Exposure: Failing to comply with ASC 842 can have serious consequences for organizations, including: Financial Penalties: Non-compliance can result in fines and penalties, depending on regulatory requirements and the severity of the discrepancies.

Strategic Limitations: When lease data is trapped in spreadsheets, it’s difficult to conduct meaningful portfolio analysis, identify optimization opportunities, or make data-driven decisions about future real estate strategy.

The Smarter Solution: Intelligent Lease Management Software

Modern lease management technology addresses these challenges head-on, providing organizations with the tools they need to manage complex portfolios efficiently and accurately.

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.

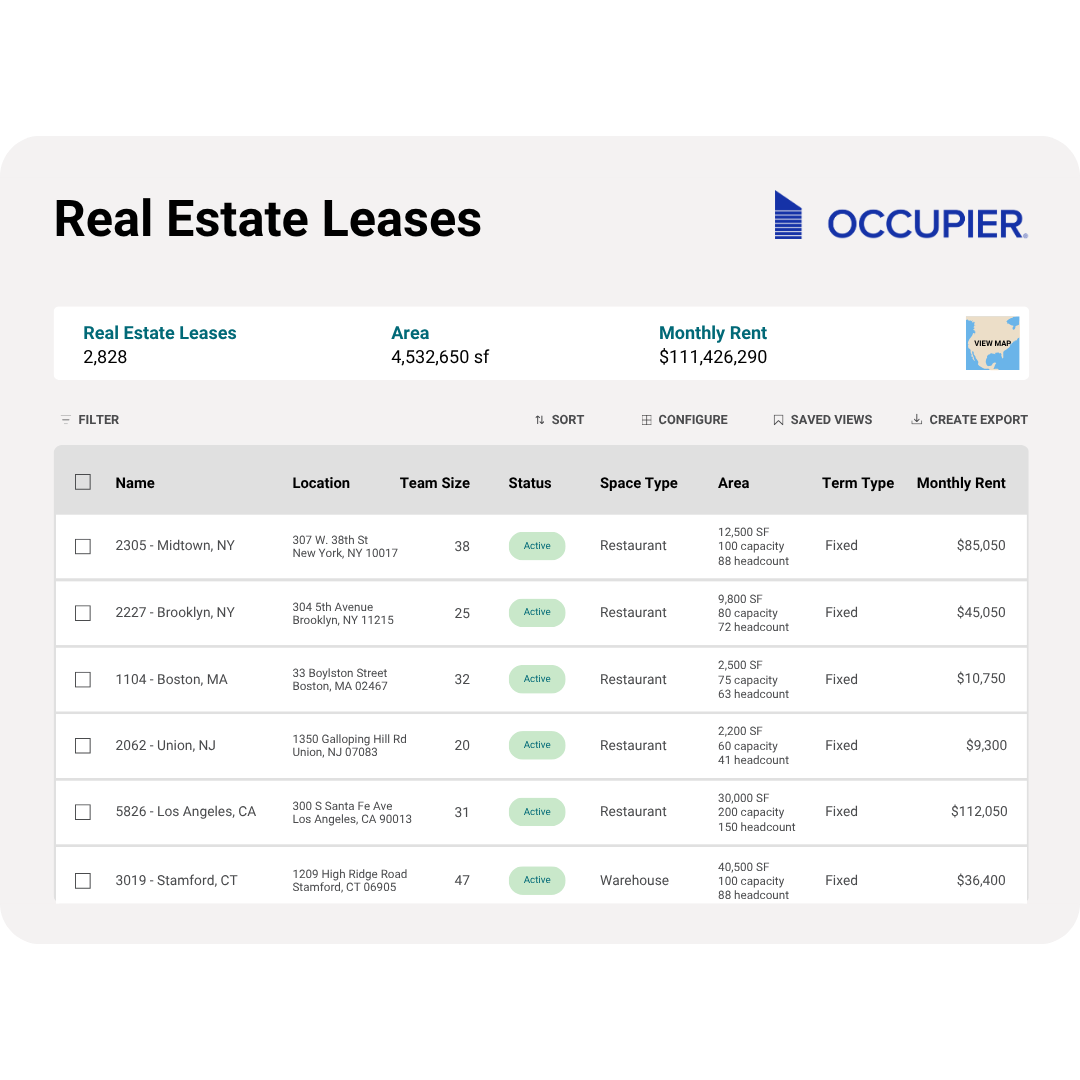

Centralized Data Management

A centralized platform eliminates version control issues by providing a single source of truth for all lease information. When legal updates lease terms, finance sees the changes in real-time. When real estate tracks renewal options, operations can immediately understand the implications for their planning.

Automated Alerts and Workflow Management

Intelligent lease management software proactively monitors critical dates and obligations, sending automated alerts well in advance of deadlines. This ensures that renewal opportunities aren’t missed and compliance requirements are met consistently.

Advanced Compliance Capabilities

Purpose-built lease management solutions automate the complex calculations required for ASC 842 compliance, reducing the risk of errors and providing audit trails that satisfy regulatory requirements. Lease accounting software assists with ASC 842 compliance by automating calculations and financial reports. It enables you to ensure reliable data – and provides transparency into the math behind the calculations.

Real-Time Collaboration and Reporting

Modern platforms enable cross-functional teams to collaborate effectively while maintaining data integrity. Real-time dashboards and automated reporting ensure that stakeholders have access to current information when they need it.

Scalable Architecture

Unlike spreadsheets, dedicated lease management platforms are designed to scale with your organization. Whether you’re managing 50 leases or 5,000, the system adapts to your needs without compromising performance or reliability.

How Advanced Lease Management Transforms Operations

Leading lease management platforms like Occupier are specifically designed to address the challenges that spreadsheets simply cannot handle:

- Comprehensive Critical Date Tracking: Never miss another renewal deadline or option exercise date with automated alerts and workflow management.

- Intelligent Clause Management: Track complex lease provisions, from co-tenancy requirements to exclusivity clauses, with automated monitoring and reporting.

- Seamless ASC 842 Compliance: Automate the complex calculations required for lease accounting while maintaining complete audit trails.

- Real-Time Portfolio Analytics: Generate insights about your portfolio performance, identify optimization opportunities, and make data-driven decisions about your real estate strategy.

- Integrated Collaboration: Enable legal, finance, and real estate teams to work from the same accurate, up-to-date information.

The transformation is immediate and measurable. Organizations that make the switch typically see significant improvements in operational efficiency, compliance accuracy, and strategic decision-making capabilities.

Making the Leasing Transition: Your Next Steps

The evidence is clear: while spreadsheets may have served us well in the past, they’re simply not equipped to handle the demands of modern commercial lease management. The risks, financial, operational, and regulatory, are too significant to ignore.

The question isn’t whether to upgrade your lease management approach, but when. Every day spent managing leases in spreadsheets is another day exposed to preventable risks and missed opportunities.

Ready to leave spreadsheets behind and transform your lease management process? The time for change is now. Schedule a demo with Occupier and deploy a lease management software to turn your biggest operational challenge into a competitive advantage.

Your future self… and your CFO, will thank you.

Schedule a demo.

From critical date management to compliance, let Occupier handle the heavy lifting. See it in action, schedule a demo today.